Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bramble Enterprises had a tough month in May, but June's sales and cash activity are looking strong. Bramble had to borrow $3,000 in May in

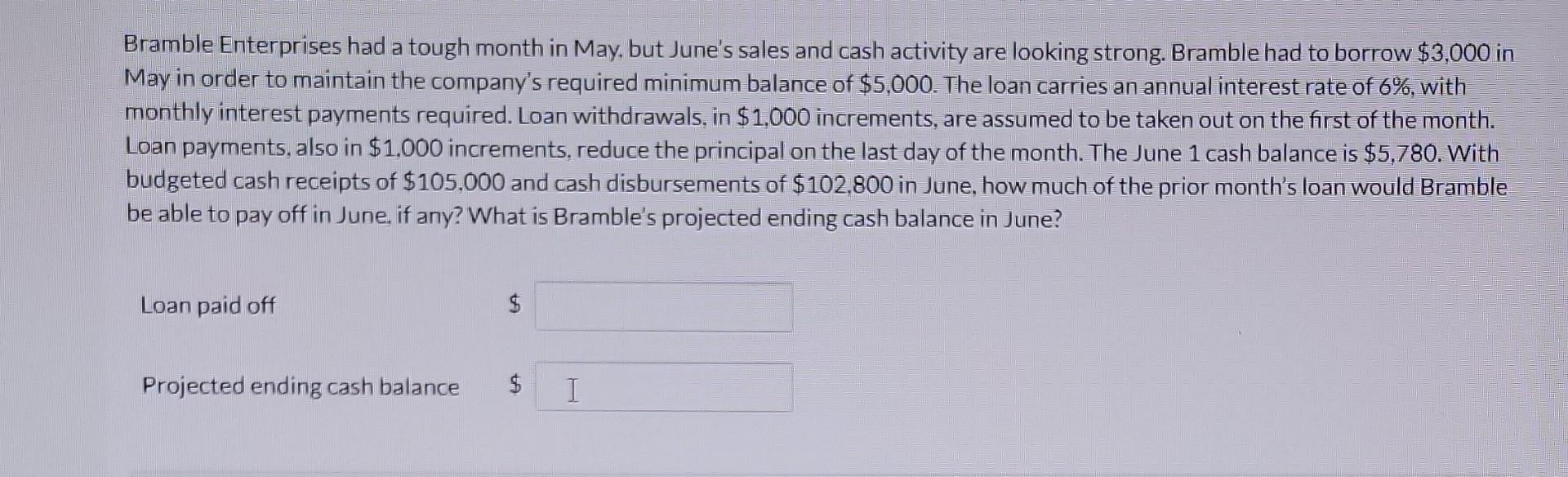

Bramble Enterprises had a tough month in May, but June's sales and cash activity are looking strong. Bramble had to borrow $3,000 in May in order to maintain the company's required minimum balance of $5,000. The loan carries an annual interest rate of 6%, with monthly interest payments required. Loan withdrawals, in $1,000 increments, are assumed to be taken out on the first of the month. Loan payments, also in $1,000 increments, reduce the principal on the last day of the month. The June 1 cash balance is $5,780. With budgeted cash receipts of $105,000 and cash disbursements of $102,800 in June, how much of the prior month's loan would Bramble be able to pay off in June, if any? What is Bramble's projected ending cash balance in June? Loan paid off Projected ending cash balance \$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started