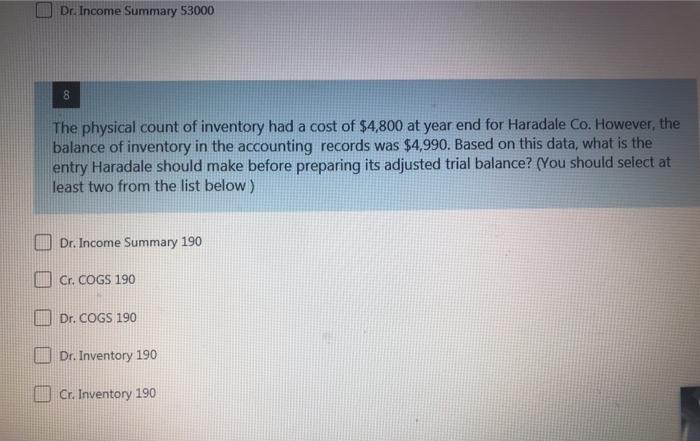

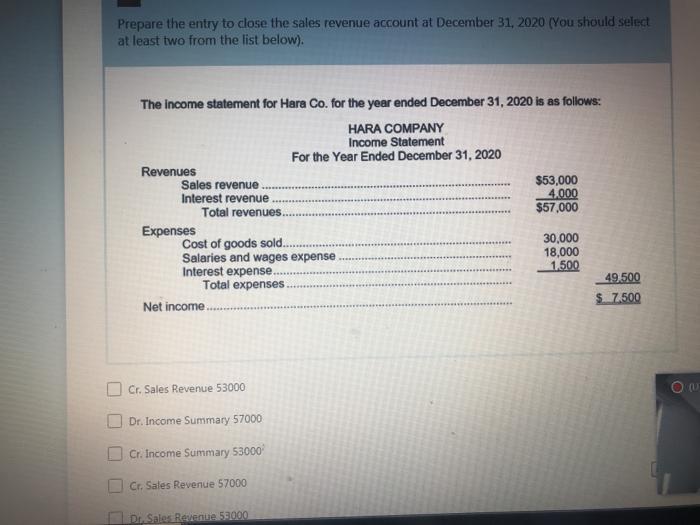

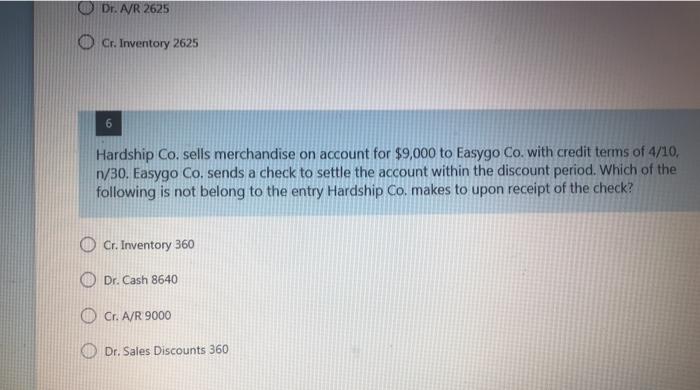

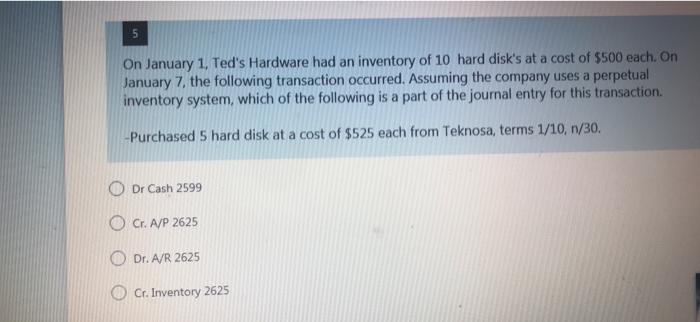

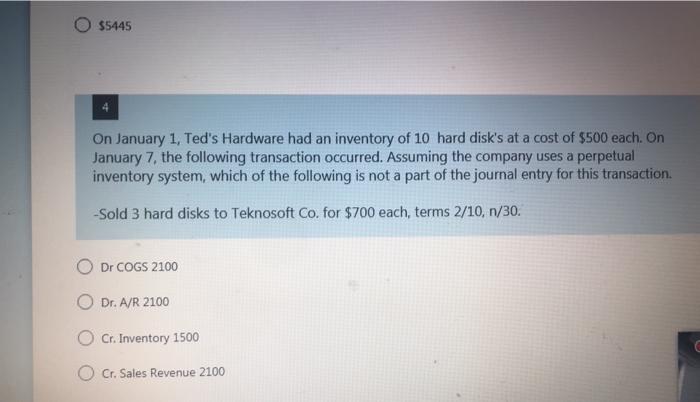

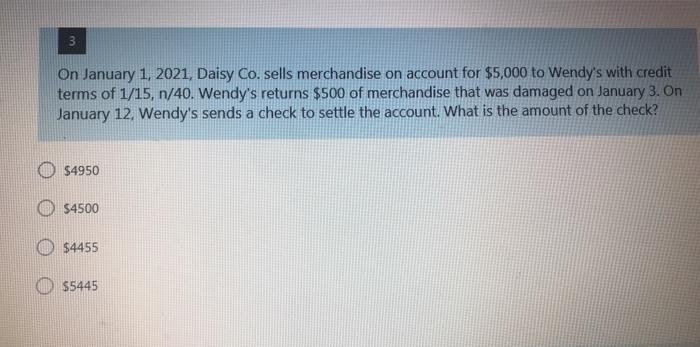

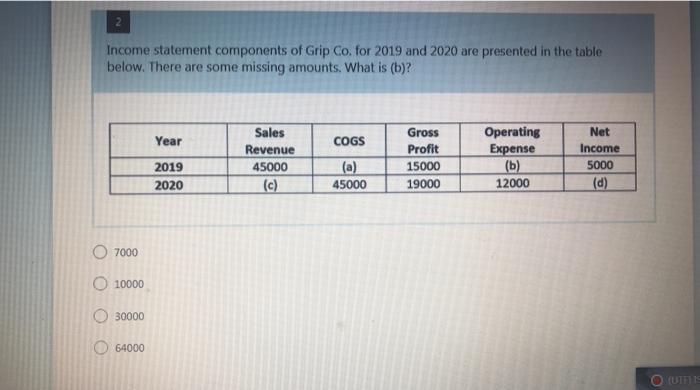

Dr. Income Summary 53000 8 The physical count of inventory had a cost of $4,800 at year end for Haradale Co. However, the balance of inventory in the accounting records was $4,990. Based on this data, what is the entry Haradale should make before preparing its adjusted trial balance? (You should select at least two from the list below) Dr. Income Summary 190 O Cr. COGS 190 Dr. COGS 190 Dr. Inventory 190 Cr. Inventory 190 Prepare the entry to close the sales revenue account at December 31, 2020 (You should select at least two from the list below). The Income statement for Hara Co. for the year ended December 31, 2020 is as follows: HARA COMPANY Income Statement For the Year Ended December 31, 2020 Revenues Sales revenue $53,000 Interest revenue 4.000 Total revenues. $57,000 Expenses Cost of goods sold. 30,000 Salaries and wages expense 18,000 Interest expense. 1.500 Total expenses 49.500 Net income $. 7.500 Cr. Sales Revenue 53000 O Dr. Income Summary 57000 Cr. Income Summary 53000 Cr. Sales Revenue 57000 Sales Revenue 55.000 Dr. A/R 2625 O Cr. Inventory 2625 6 Hardship Co. sells merchandise on account for $9,000 to Easygo Co. with credit terms of 4/10, n/30. Easygo Co. sends a check to settle the account within the discount period. Which of the following is not belong to the entry Hardship Co. makes to upon receipt of the check? O Cr. Inventory 360 Dr. Cash 8640 O Cr. A/R 9000 O Dr. Sales Discounts 360 5 On January 1, Ted's Hardware had an inventory of 10 hard disk's at a cost of $500 each. On January 7, the following transaction occurred. Assuming the company uses a perpetual inventory system, which of the following is a part of the journal entry for this transaction. -Purchased 5 hard disk at a cost of $525 each from Teknosa, terms 1/10, 1/30. O Dr Cash 2599 O Cr. A/P 2625 Dr. A/R 2625 O Cr. Inventory 2625 $5445 On January 1, Ted's Hardware had an inventory of 10 hard disk's at a cost of $500 each. On January 7, the following transaction occurred. Assuming the company uses a perpetual inventory system, which of the following is not a part of the journal entry for this transaction. -Sold 3 hard disks to Teknosoft Co. for $700 each, terms 2/10, 1/30. O Dr COGS 2100 Dr. A/R 2100 O Cr. Inventory 1500 O Cr. Sales Revenue 2100 3 On January 1, 2021, Daisy Co. sells merchandise on account for $5,000 to Wendy's with credit terms of 1/15, n/40. Wendy's returns $500 of merchandise that was damaged on January 3. On January 12, Wendy's sends a check to settle the account. What is the amount of the check? $4950 $4500 $4455 $5445 2 Income statement components of Grip Co. for 2019 and 2020 are presented in the table below. There are some missing amounts. What is (b)? Year COGS Sales Revenue 45000 (c) Gross Profit 15000 19000 Operating Expense (b) 12000 Net Income 5000 (d) 2019 2020 45000 O 7000 O 10000 O 30000 64000