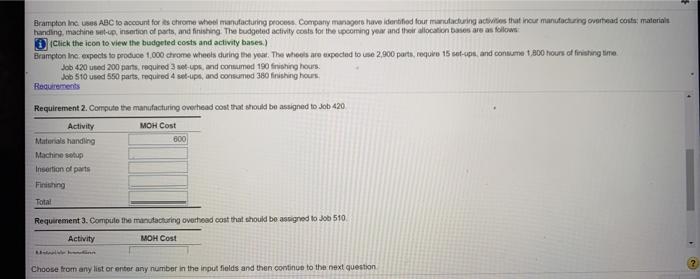

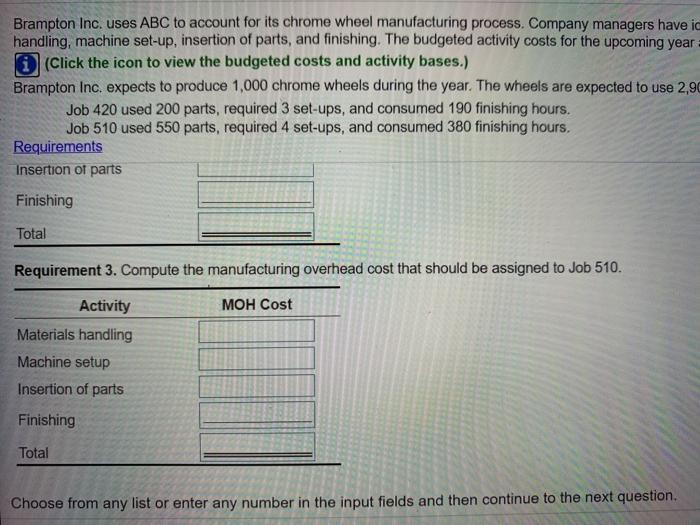

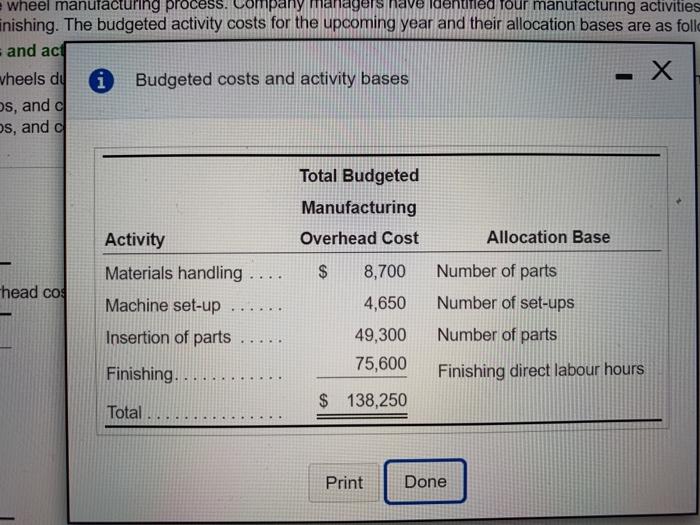

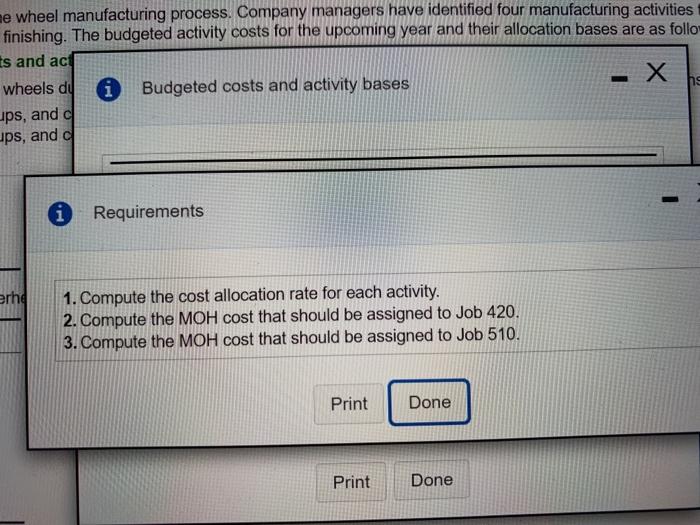

Brampton Inc US ABC to account for as chrome wheel manufacturing process. Company managers have identified fout marutacturing activities that incur manufacturing overtad con material landing, machine web, insertion of parts, and finishing. The budgeted activity costs for the upcoming you and the allocation bases are as follow 1. Click the icon to view the budgeted costs and activity bases.) Brampton Inc. expects to produce 1000 chrome whools during the year. The wheels are expected to use 2,900 parts, requvo 15 st., and consume 1 800 hours of finishing time Job 420 used 200 parts, required 3 set-ups, and consumed 150 finishing hours Job 510 used 550 parts, required 4 set-ups, and consumed 380 finishing hours Requirements Requirement 2. Compute the manufacturing overhead cost that should be assigned to Job 420 Activity MOH Cost Materials handling 600 Machines Insertion of parts Finishing Total Requirement 3. Computo the manufacturing overhead cost that should be assigned to Job 510 Activity MOH Cost Choose from any list or enter any number in the input fields and then continue to the next question Brampton Inc. uses ABC to account for its chrome wheel manufacturing process. Company managers have i handling, machine set-up, insertion of parts, and finishing. The budgeted activity costs for the upcoming year (Click the icon to view the budgeted costs and activity bases.) Brampton Inc. expects to produce 1,000 chrome wheels during the year. The wheels are expected to use 2,90 Job 420 used 200 parts, required 3 set-ups, and consumed 190 finishing hours. Job 510 used 550 parts, required 4 set-ups, and consumed 380 finishing hours. Requirements Insertion of parts Finishing Total Requirement 3. Compute the manufacturing overhead cost that should be assigned to Job 510. MOH Cost Activity Materials handling Machine setup Insertion of parts Finishing Total Choose from any list or enter any number in the input fields and then continue to the next question. wheel manufacturing process. Company managed navedenuried Tour manufacturing activities inishing. The budgeted activity costs for the upcoming year and their allocation bases are as follo and act vheels dy i Budgeted costs and activity bases s, and a Os, and a Total Budgeted Manufacturing Overhead Cost Allocation Base $ Number of parts - - head cog Activity Materials handling Machine set-up Insertion of parts Number of set-ups . . . . 8,700 4,650 49,300 75,600 Number of parts Finishing.... Finishing direct labour hours $ 138,250 Total Print Done me wheel manufacturing process. Company managers have identified four manufacturing activities finishing. The budgeted activity costs for the upcoming year and their allocation bases are as follo ts and act X wheels du i Budgeted costs and activity bases ups, and d ng ups, and d i Requirements erhe 1. Compute the cost allocation rate for each activity. 2. Compute the MOH cost that should be assigned to Job 420. 3. Compute the MOH cost that should be assigned to Job 510. Print Done Print Done