Question

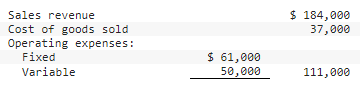

Branson Electronics Company is a small, publicly traded company preparing its first quarter interim report to be mailed to shareholders. The following information for the

Branson Electronics Company is a small, publicly traded company preparing its first quarter interim report to be mailed to shareholders. The following information for the quarter has been compiled:

Fixed operating expenses include payments of $50,800 to an advertising firm to promote Branson through various media throughout the year. The income tax rate for Bransons level of operations in the first quarter is 20%, but management estimates the effective rate for the entire year will be 25%.

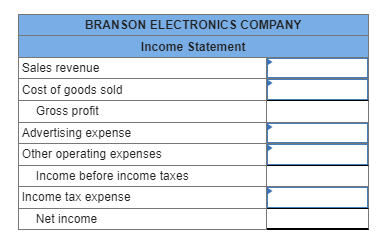

Required:

Prepare the income statement to be included in Bransons first quarter interim report.

\begin{tabular}{lrr} Sales revenue & & $184,000 \\ Cost of goods sold & & 37,000 \\ Operating expenses: & & \\ Fixed & $61,000 & \\ Variable & 50,000 & 111,000 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ BRAN InON ELECTRONICS COMPANY } \\ \hline \multicolumn{2}{|c|}{ Income Statement } \\ \hline Sales revenue & \\ \hline Cost of goods sold & \\ \hline Gross profit & \\ \hline Advertising expense & \\ \hline Other operating expenses & \\ \hline Income before income taxes & \\ \hline Income tax expense & \\ \hline Net income & \\ \hline \end{tabular}

\begin{tabular}{lrr} Sales revenue & & $184,000 \\ Cost of goods sold & & 37,000 \\ Operating expenses: & & \\ Fixed & $61,000 & \\ Variable & 50,000 & 111,000 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ BRAN InON ELECTRONICS COMPANY } \\ \hline \multicolumn{2}{|c|}{ Income Statement } \\ \hline Sales revenue & \\ \hline Cost of goods sold & \\ \hline Gross profit & \\ \hline Advertising expense & \\ \hline Other operating expenses & \\ \hline Income before income taxes & \\ \hline Income tax expense & \\ \hline Net income & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started