Answered step by step

Verified Expert Solution

Question

1 Approved Answer

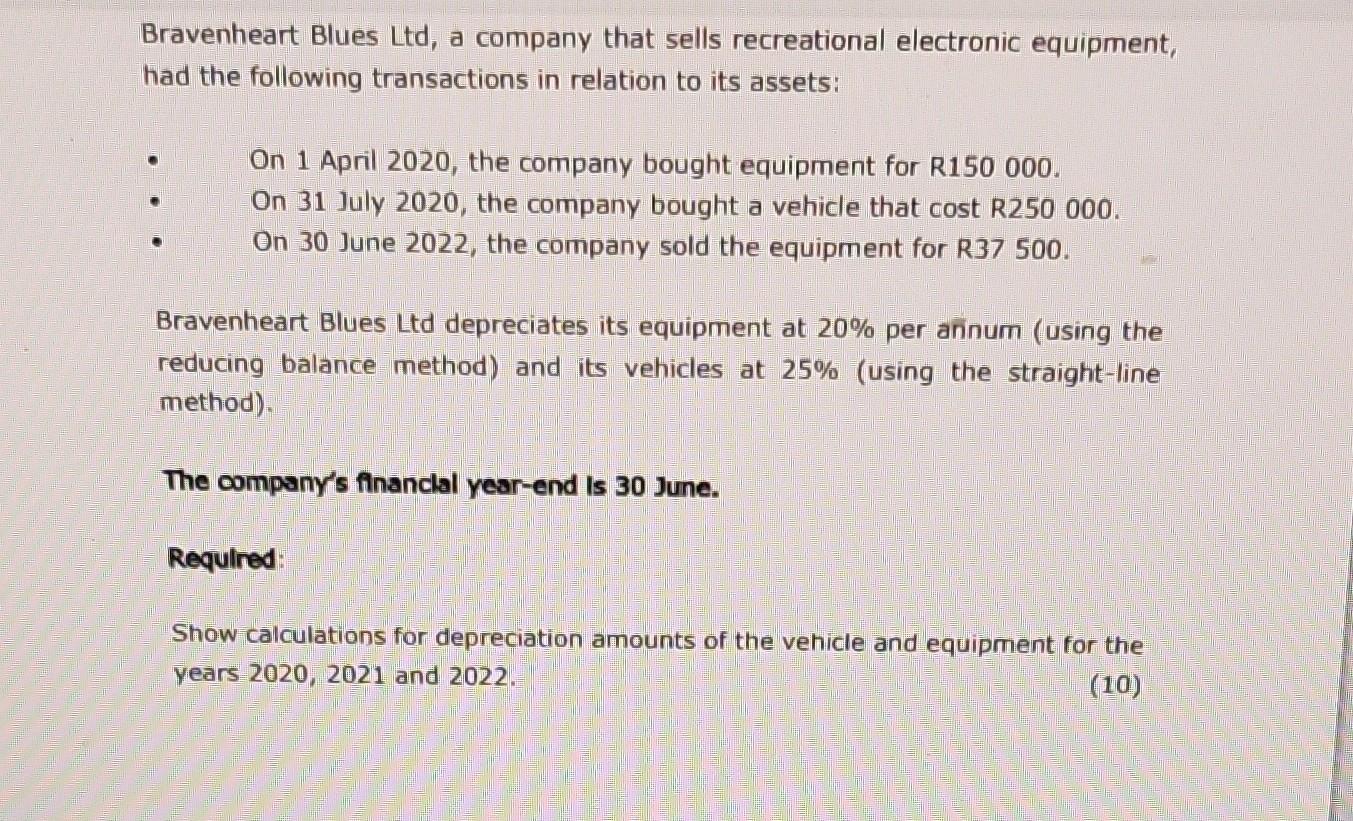

Bravenheart Blues Ltd, a company that sells recreational electronic equipment, had the following transactions in relation to its assets: - On 1 April 2020, the

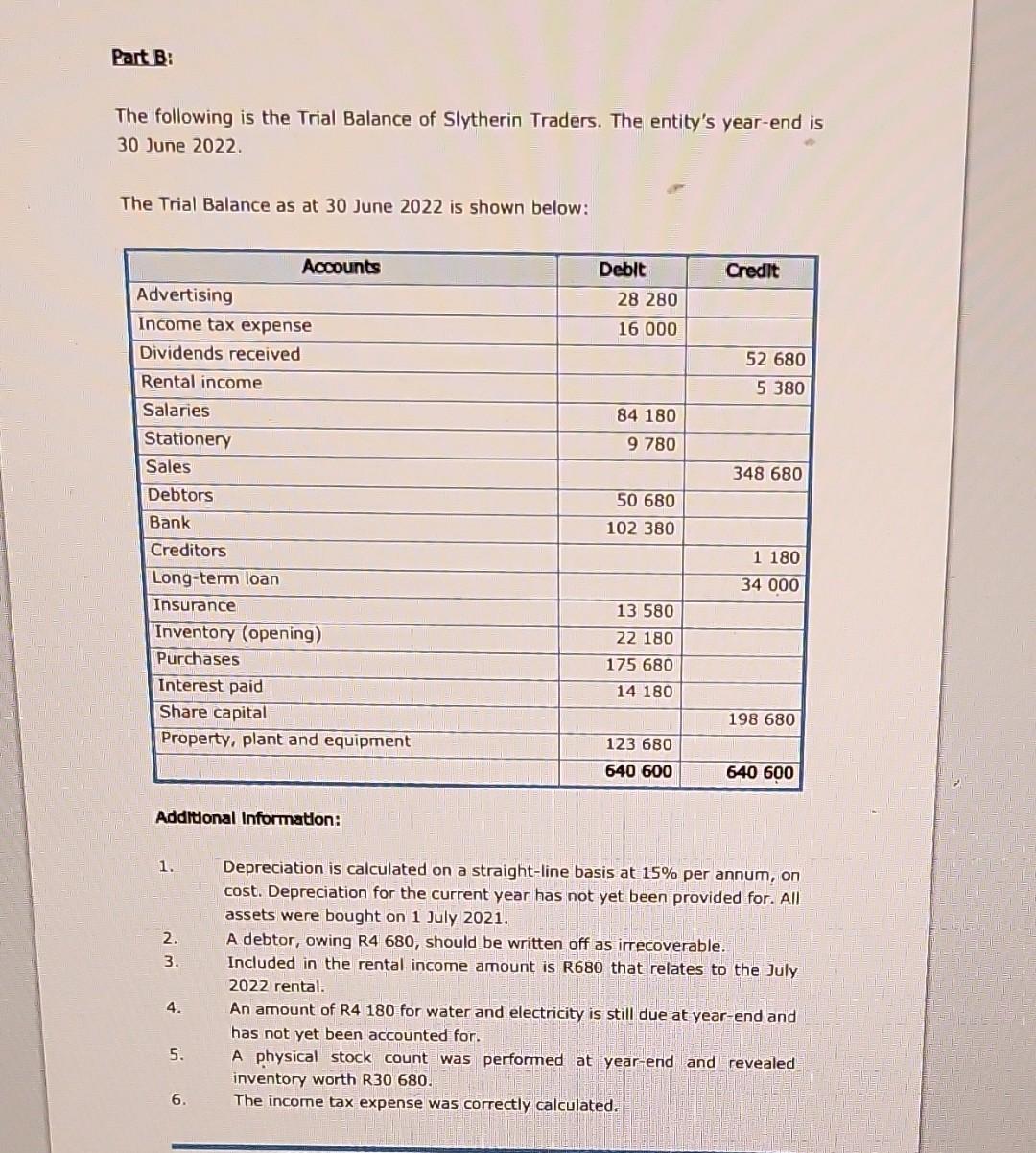

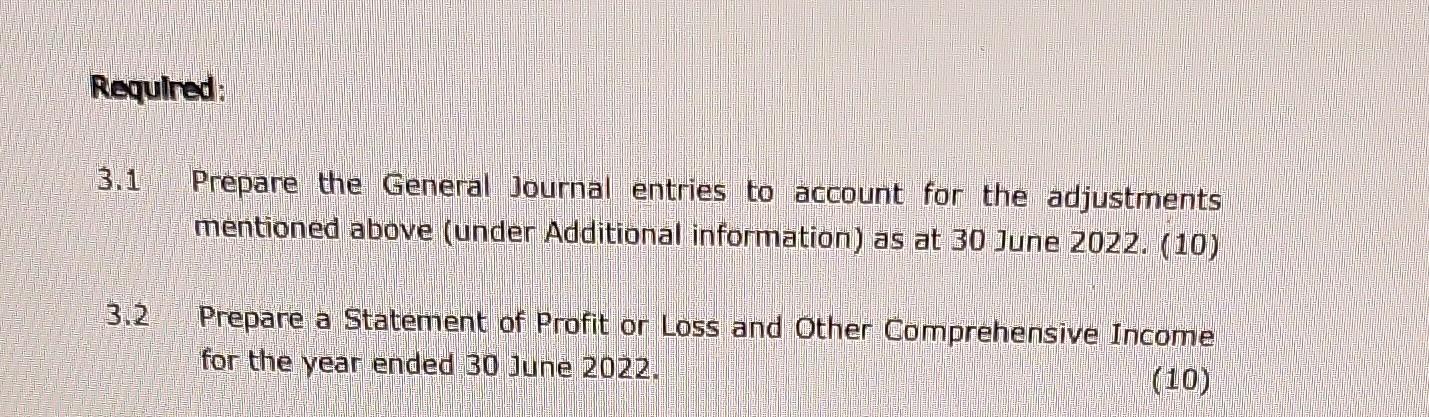

Bravenheart Blues Ltd, a company that sells recreational electronic equipment, had the following transactions in relation to its assets: - On 1 April 2020, the company bought equipment for R150 000. - On 31 July 2020, the company bought a vehicle that cost R250 000 . - On 30 June 2022, the company sold the equipment for R37 500. Bravenheart Blues Ltd depreciates its equipment at 20\% per annum (using the reducing balance method) and its vehicles at 25% (using the straight-line method). The company's financlal year-end is 30 June. Required: Show calculations for depreciation amounts of the vehicle and equipment for the years 2020,2021 and 2022. (10) Part B: The following is the Trial Balance of Slytherin Traders. The entity's year-end is 30 June 2022. The Trial Balance as at 30 June 2022 is shown below: Addittonal Information: 1. Depreciation is calculated on a straight-line basis at 15% per annum, on cost. Depreciation for the current year has not yet been provided for. All assets were bought on 1 July 2021. 2. A debtor, owing R4 680, should be written off as irrecoverable. 3. Included in the rental income amount is R680 that relates to the July 2022 rental. 4. An amount of R4 180 for water and electricity is still due at year-end and has not yet been accounted for. 5. A physical stock count was performed at year-end and revealed inventory worth R30 680 . 6. The income tax expense was correctly calculated. 3.1 Prepare the General Journal entries to account for the adjustments mentioned above (under Additional information) as at 30 June 2022. (10) 3.2 Prepare a Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2022 . (10) Bravenheart Blues Ltd, a company that sells recreational electronic equipment, had the following transactions in relation to its assets: - On 1 April 2020, the company bought equipment for R150 000. - On 31 July 2020, the company bought a vehicle that cost R250 000 . - On 30 June 2022, the company sold the equipment for R37 500. Bravenheart Blues Ltd depreciates its equipment at 20\% per annum (using the reducing balance method) and its vehicles at 25% (using the straight-line method). The company's financlal year-end is 30 June. Required: Show calculations for depreciation amounts of the vehicle and equipment for the years 2020,2021 and 2022. (10) Part B: The following is the Trial Balance of Slytherin Traders. The entity's year-end is 30 June 2022. The Trial Balance as at 30 June 2022 is shown below: Addittonal Information: 1. Depreciation is calculated on a straight-line basis at 15% per annum, on cost. Depreciation for the current year has not yet been provided for. All assets were bought on 1 July 2021. 2. A debtor, owing R4 680, should be written off as irrecoverable. 3. Included in the rental income amount is R680 that relates to the July 2022 rental. 4. An amount of R4 180 for water and electricity is still due at year-end and has not yet been accounted for. 5. A physical stock count was performed at year-end and revealed inventory worth R30 680 . 6. The income tax expense was correctly calculated. 3.1 Prepare the General Journal entries to account for the adjustments mentioned above (under Additional information) as at 30 June 2022. (10) 3.2 Prepare a Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started