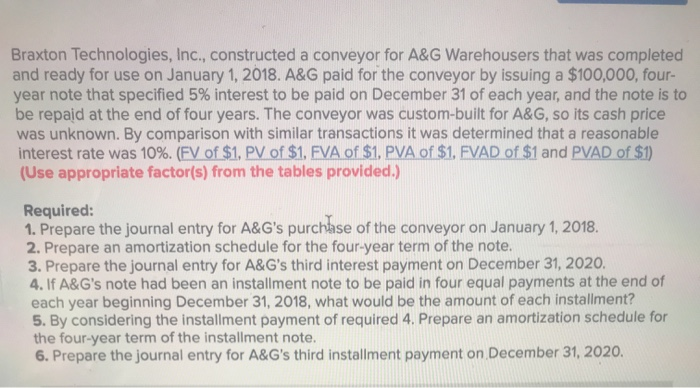

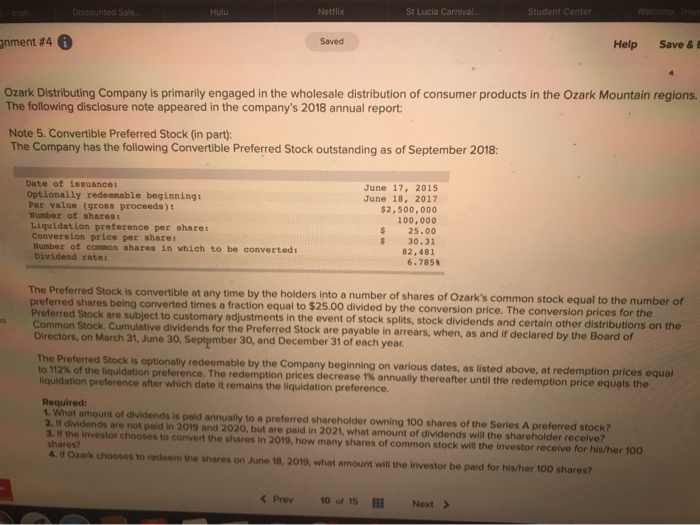

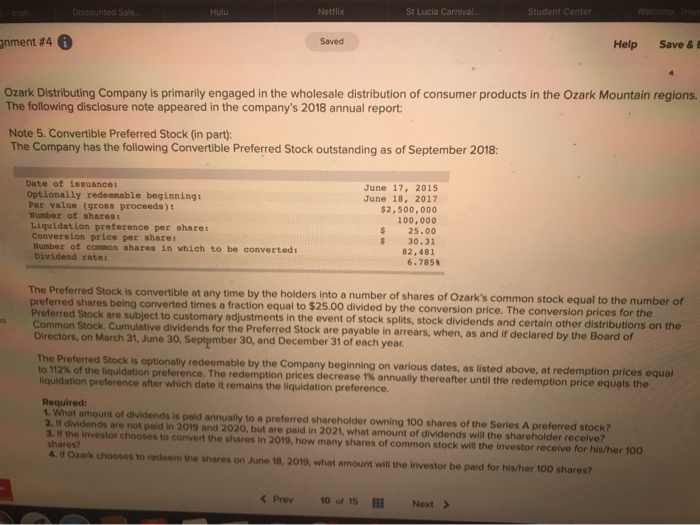

Braxton Technologies, Inc., constructed a conveyor for A&G Warehousers that was completed and ready for use on January 1, 2018. A&G paid for the conveyor by issuing a $100,000, four- year note that specified 5% interest to be paid on December 31 of each year, and the note is to be repaid at the end of four years. The conveyor was custom-built for A&G, so its cash price was unknown. By comparison with similar transactions it was determined that a reasonable interest rate was 10%. (FV of $1, PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare the journal entry for A&G's purchase of the conveyor on January 1, 2018. 2. Prepare an amortization schedule for the four-year term of the note. 3. Prepare the journal entry for A&G's third interest payment on December 31, 2020. 4. If A&G's note had been an installment note to be paid in four equal payments at the end of each year beginning December 31, 2018, what would be the amount of each installment? 5. By considering the installment payment of required 4. Prepare an amortization schedule for the four-year term of the installment note. 6. Prepare the journal entry for A&G's third installment payment on December 31, 2020. Discounted Sale Netflix St Lucia Carnival Student Center unment #4 Saved Help Save & Ozark Distributing Company is primarily engaged in the wholesale distribution of consumer products in the Ozark Mountain regions The following disclosure note appeared in the company's 2018 annual report: Note 5. Convertible Preferred Stock (in part): The Company has the following Convertible Preferred Stock outstanding as of September 2018: Date of issuance: Optionally redeemable beginning Par value (gross proceeds) Wumber of sharest Liquidation preference per share Conversion price per Share: Number of coon shares in which to be converted Dividend ratet June 17, 2015 June 18, 2017 $2,500,000 100,000 $ 25.00 30.31 82,481 6.785 The Preferred Stock is convertible at any time by the holders into a number of shares of Ozark's common stock equal to the number of preferred shares being converted times a fraction equal to $25.00 divided by the conversion price. The conversion prices for the Preferred Stock are subject to customary adjustments in the event of stock splits, stock dividends and certain other distributions on the Common Stock Cumulative dividends for the Preferred Stock are payable in arrears, when, as and if declared by the Board of Directors, on March 31, June 30, Septimber 30, and December 31 of each year. The Preferred Stock is optionally redeemable by the Company beginning on various dates, as listed above, at redemption prices equal to 112% of the liquidation preference. The redemption prices decrease 1% annually thereafter until the redemption price equals the liquidation preference after which date it remains the liquidation preference Required: What amount of dividends is paid annually to a preferred shareholder owning 100 shares of the Series A preferred stock? 2. Il dividends are not paid in 2019 and 2020, but are paid in 2021, what amount of dividends will the shareholder receive? 3. If the investor chooses to convert the shares in 2019, how many shares of common stock will the investor receive for his/her 100 shares? 4. If Ozark chooses to redeem the shares on June 18, 2019, what amount will the investor be paid for his/her 100 shares?