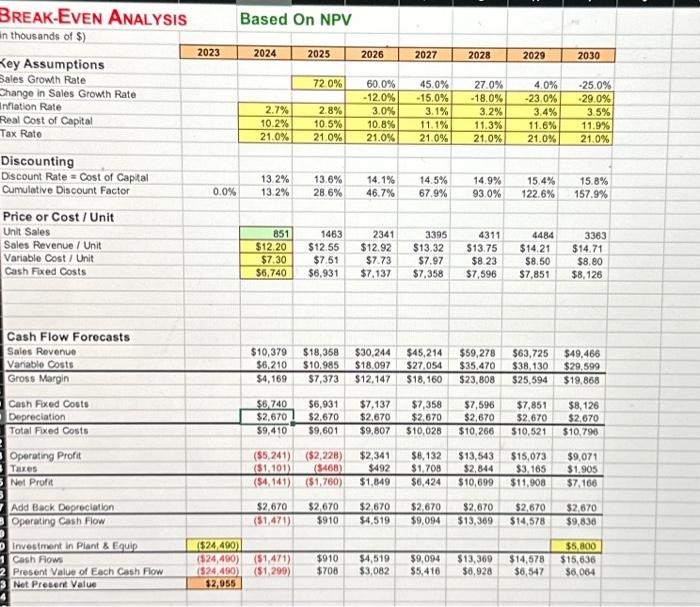

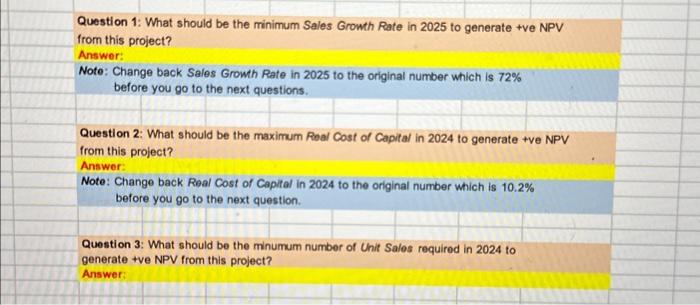

BREAK-EVEN ANALYSIS Based On NPV in thousands of \$) Key Assumptions Sales Growh Rate Inflation Rate Real Cost of Capital Tax Rate \begin{tabular}{|r|r|r|r|r|r|r|r|} \hline \multicolumn{1}{|c|}{2023} & \multicolumn{1}{|c|}{2024} & \multicolumn{1}{|c|}{2025} & \multicolumn{1}{c|}{2026} & 2027 & 2028 & \multicolumn{1}{|c|}{2029} & \multicolumn{1}{c|}{2030} \\ \hline & & & & & & & \\ \hline & & 72.0% & 60.0% & 45.0% & 27.0% & 4.0% & 25.0% \\ \hline & & & 12.0% & 15.0% & 18.0% & 23.0% & 29.0% \\ \hline & 2.7% & 2.8% & 3.0% & 3.1% & 3.2% & 3.4% & 3.5% \\ \hline & 10.2% & 10.5% & 10.8% & 11.1% & 11.3% & 11.6% & 11.9% \\ \hline 21.0% & 21.0% & 21.0% & 21.0% & 21.0% & 21.0% & 21.0% \\ \hline \end{tabular} Discounting Discount Rate = Cost of Captal Cumulative Discount Factor \begin{tabular}{|r|r|r|r|r|r|r|r|} \hline & 13.2% & 13.6% & 14.1% & 14.5% & 14.9% & 15.4% & 15.8% \\ \hline 0.0% & 13.2% & 28.6% & 46.7% & 67.9% & 93.0% & 122.6% & 157.9% \\ \hline \end{tabular} Price or Cost / Unit Unit Sales Sales Revenue / Unit Variable Cost / Unit Cash Fixed Costs \begin{tabular}{|r|r|r|r|r|r|r|} \hline 851 & 1463 & 2341 & 3395 & 4311 & 4484 & 3363 \\ \hline$12.20 & $12.55 & $12.92 & $13.32 & $13.75 & $14.21 & $14.71 \\ \hline$7.30 & $7.51 & $7.73 & $7.97 & $8.23 & $8.50 & $8.80 \\ \hline$6.740 & $6,931 & $7,137 & $7,358 & $7,596 & $7,851 & $8,126 \\ \hline & & & & & & \\ \hline \end{tabular} Cash Flow Forecasts Cash Fixed Conts Depreclation Total Fixed Costs \begin{tabular}{|r|r|r|r|r|r|r|} \hline$5,740 & $6,931 & $7,137 & $7,358 & $7,596 & $7,851 & $8,126 \\ \hline$2,670 & $2,670 & $2,670 & $2,670 & $2,670 & $2,670 & $2,670 \\ \hline$9,410 & $9,601 & $9,807 & $10,028 & $10,266 & $10,521 & $10,796 \\ \hline \end{tabular} Operating Profit Net Profit \begin{tabular}{|r|r|r|r|r|r|r|} \hline($5,241) & ($2,228) & $2,341 & $8,132 & $13,543 & $15,073 & $9,071 \\ \hline($1,101) & ($468) & $492 & $1,708 & $2,844 & $3,165 & $1,905 \\ \hline($4,141) & ($1,760) & $1,849 & $6,424 & $10,699 & $11,908 & $7,166 \\ \hline \end{tabular} Add Back Depreciation Operating Cash Flow \begin{tabular}{rr|r|r|r|r|r|} \hline$2,670 & $2,670 & $2,670 & $2,670 & $2,670 & $2,670 & $2,670 \\ \hline($1,471) & $910 & $4,519 & $9,094 & $13,369 & $14,578 & $9,836 \\ \hline \end{tabular} Investment in Plant 8 Equip Cash flows Present Value of Each Cash Flow Net Presere Value Question 1: What should be the minimum Sales Growth Rate in 2025 to generate +ve NPV from this project? Answer: Note: Change back Sales Growth Rate in 2025 to the original number which is 72% before you go to the next questions. Question 2: What should be the maximum Real Cost of Capital in 2024 to generate +ve NPV from this project? Answer: Note: Change back Real Cost of Cepital in 2024 to the original number which is 10.2% before you go to the next question. Question 3: What should be the minumum number of Unit Sales required in 2024 to generate tve NPV from this project? Answer: BREAK-EVEN ANALYSIS Based On NPV in thousands of \$) Key Assumptions Sales Growh Rate Inflation Rate Real Cost of Capital Tax Rate \begin{tabular}{|r|r|r|r|r|r|r|r|} \hline \multicolumn{1}{|c|}{2023} & \multicolumn{1}{|c|}{2024} & \multicolumn{1}{|c|}{2025} & \multicolumn{1}{c|}{2026} & 2027 & 2028 & \multicolumn{1}{|c|}{2029} & \multicolumn{1}{c|}{2030} \\ \hline & & & & & & & \\ \hline & & 72.0% & 60.0% & 45.0% & 27.0% & 4.0% & 25.0% \\ \hline & & & 12.0% & 15.0% & 18.0% & 23.0% & 29.0% \\ \hline & 2.7% & 2.8% & 3.0% & 3.1% & 3.2% & 3.4% & 3.5% \\ \hline & 10.2% & 10.5% & 10.8% & 11.1% & 11.3% & 11.6% & 11.9% \\ \hline 21.0% & 21.0% & 21.0% & 21.0% & 21.0% & 21.0% & 21.0% \\ \hline \end{tabular} Discounting Discount Rate = Cost of Captal Cumulative Discount Factor \begin{tabular}{|r|r|r|r|r|r|r|r|} \hline & 13.2% & 13.6% & 14.1% & 14.5% & 14.9% & 15.4% & 15.8% \\ \hline 0.0% & 13.2% & 28.6% & 46.7% & 67.9% & 93.0% & 122.6% & 157.9% \\ \hline \end{tabular} Price or Cost / Unit Unit Sales Sales Revenue / Unit Variable Cost / Unit Cash Fixed Costs \begin{tabular}{|r|r|r|r|r|r|r|} \hline 851 & 1463 & 2341 & 3395 & 4311 & 4484 & 3363 \\ \hline$12.20 & $12.55 & $12.92 & $13.32 & $13.75 & $14.21 & $14.71 \\ \hline$7.30 & $7.51 & $7.73 & $7.97 & $8.23 & $8.50 & $8.80 \\ \hline$6.740 & $6,931 & $7,137 & $7,358 & $7,596 & $7,851 & $8,126 \\ \hline & & & & & & \\ \hline \end{tabular} Cash Flow Forecasts Cash Fixed Conts Depreclation Total Fixed Costs \begin{tabular}{|r|r|r|r|r|r|r|} \hline$5,740 & $6,931 & $7,137 & $7,358 & $7,596 & $7,851 & $8,126 \\ \hline$2,670 & $2,670 & $2,670 & $2,670 & $2,670 & $2,670 & $2,670 \\ \hline$9,410 & $9,601 & $9,807 & $10,028 & $10,266 & $10,521 & $10,796 \\ \hline \end{tabular} Operating Profit Net Profit \begin{tabular}{|r|r|r|r|r|r|r|} \hline($5,241) & ($2,228) & $2,341 & $8,132 & $13,543 & $15,073 & $9,071 \\ \hline($1,101) & ($468) & $492 & $1,708 & $2,844 & $3,165 & $1,905 \\ \hline($4,141) & ($1,760) & $1,849 & $6,424 & $10,699 & $11,908 & $7,166 \\ \hline \end{tabular} Add Back Depreciation Operating Cash Flow \begin{tabular}{rr|r|r|r|r|r|} \hline$2,670 & $2,670 & $2,670 & $2,670 & $2,670 & $2,670 & $2,670 \\ \hline($1,471) & $910 & $4,519 & $9,094 & $13,369 & $14,578 & $9,836 \\ \hline \end{tabular} Investment in Plant 8 Equip Cash flows Present Value of Each Cash Flow Net Presere Value Question 1: What should be the minimum Sales Growth Rate in 2025 to generate +ve NPV from this project? Answer: Note: Change back Sales Growth Rate in 2025 to the original number which is 72% before you go to the next questions. Question 2: What should be the maximum Real Cost of Capital in 2024 to generate +ve NPV from this project? Answer: Note: Change back Real Cost of Cepital in 2024 to the original number which is 10.2% before you go to the next question. Question 3: What should be the minumum number of Unit Sales required in 2024 to generate tve NPV from this project