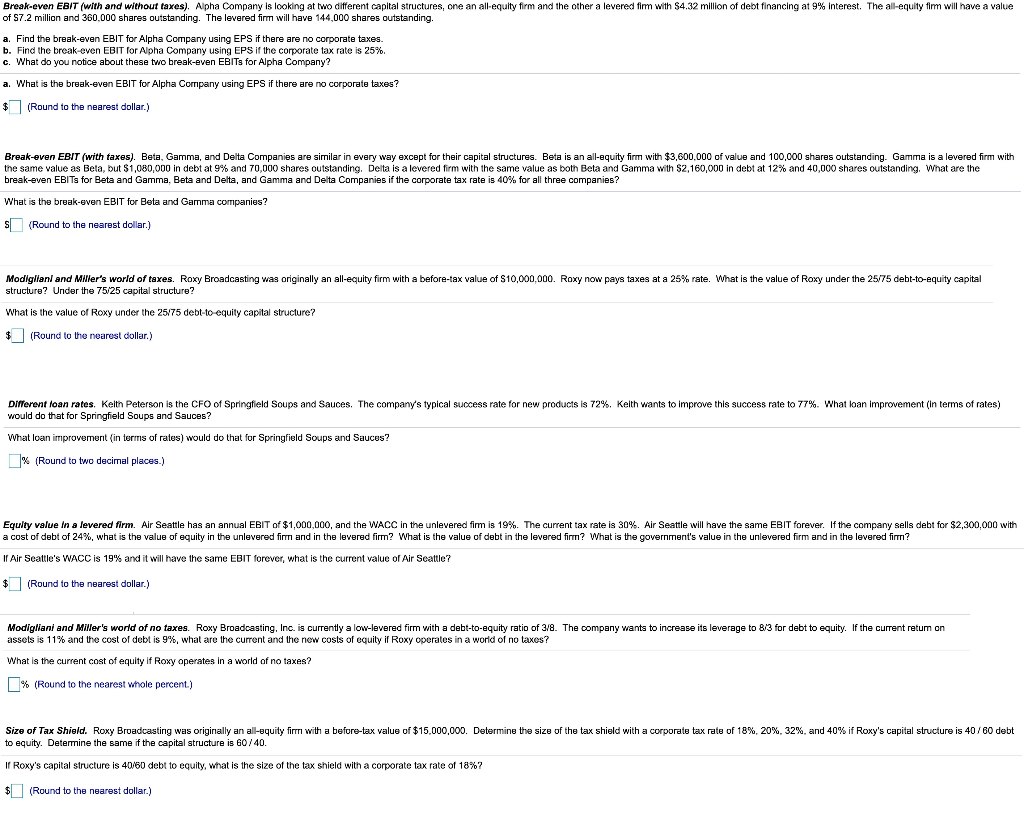

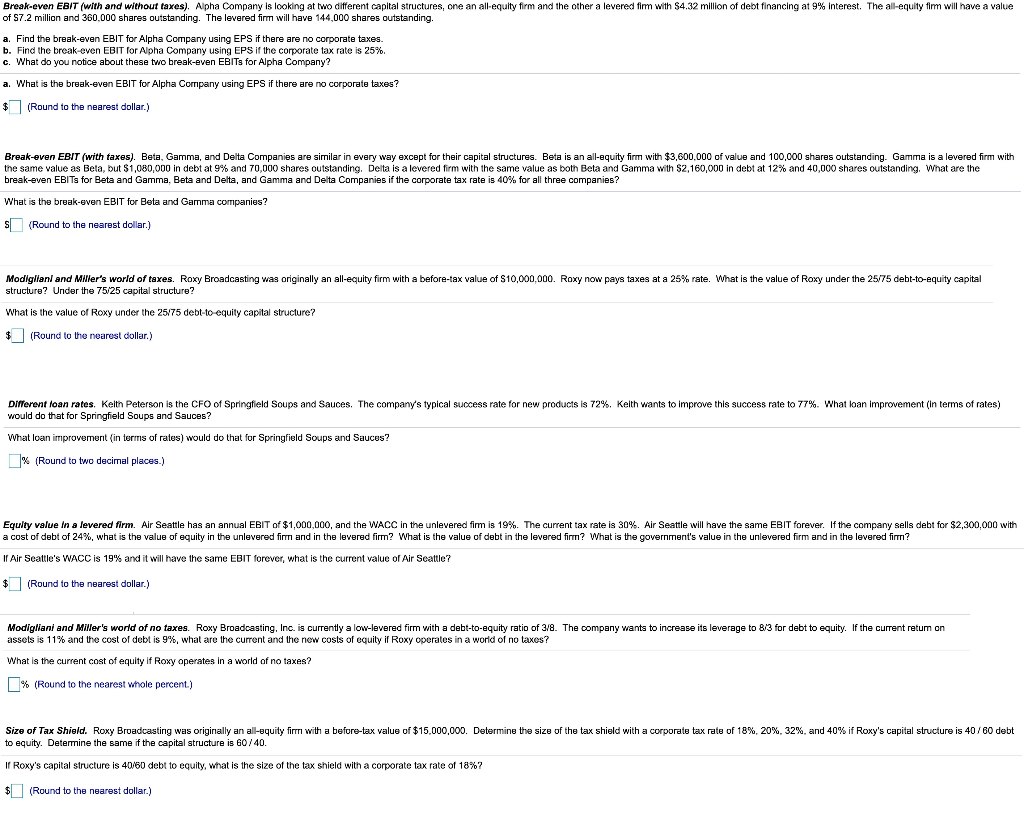

Break-even EBIT (with and without taxes). Alpha Company is looking at two different capital structures, one an all-equity firm and the other a levered fimm with $4.32 million of debt financing at 9% interest. The all-equity firm will have a value of S7.2 million and 360.000 shares outstanding. The levered firm will have 144,000 shares outstanding. a. Find the break-even EBIT for Alpha Company using EPS if there are no corporate taxes. b. Find the break-even EBIT for Alpha Company using EPS if the corporate tax rate is 25%. c. What do you notice about these two break-even EBITs for Alpha Company? a. What is the break-even EBIT for Alpha Company using EPS if there are no corporate taxes? $ (Round to the nearest dollar.) Break-even EBIT (with taxes). Beta, Gamma, and Delta Companies are similar in every way except for their capital structures. Beta is an all-equity firm with $3,600,000 of value and 100,000 shares outstanding. Gamma is a levered firm with the same value as Beta, but $1,080,000 in debt at 9% and 70,000 shares outstanding. Delta is a levered firm with the same value as both Beta and Gamma with $2,160,000 in debt at 12% and 40,000 shares outstanding. What are the break-even EBITS for Beta and Gamma, Beta and Delta, and Gamma and Delta Companies if the corporate tax rate is 40% for all three companies? What is the break-even EBIT for Beta and Gamma companies? s (Round to the nearest dollar.) Modigliani and Miller's world of taxes. Roxy Broadcasting was originally an all-equity firm with a before-tax value of $10,000,000. Roxy now pays taxes at a 25% rate. What is the value of Roxy under the 25/75 debt-to-equity capital structure? Under the 75/25 capital structure? What is the value of Roxy under the 25/75 debt-to equity capital structure? $ (Round to the nearest dollar.) Different loan rates. Keith Peterson is the CFO of Springfield Soups and Sauces. The company's typical success rate for new products is 72%. Keith wants to improve this success rate to 77%. What loan improvement (in terms of rates) would do that for Springfield Soups and Sauces? What loan improvement in terms of rates) would do that for Springfield Soups and Sauces? Round to two decimal places.) Equity value in a levered firm. Air Seattle has an annual EBIT of $1,000,000, and the WACC in the unlevered firm is 19%. The current tax rate is 30%. Air Seattle will have the same EBIT forever. If the company sells debt for $2,300,000 with a cost of debt of 24%, what is the value of equity in the unlevered firm and in the levered firm? What is the value of debt in the levered firm? What is the government's value in the unlevered firm and in the levered firmn? If Air Seattle's WACC is 19% and it will have the same EBIT forever, what is the current value of Air Seattle? $ (Round to the nearest dollar.) Modigliani and Miller's world of no taxes. Roxy Broadcasting, Inc. is currently a low-levered firm with a debt-to-equity ratio of 3/8. The company wants to increase its leverage to 8/3 for debt to equity. If the current retum on assets is 11% and the cost of debt is 9%, what are the current and the new costs of equity if Roxy operates in a world of no laxes? What is the current cost of equity if Roxy operates in a world of no taxes? % (Round to the nearest Whole percent.) Size of Tax Shield. Roxy Broadcasting was originally an all-equity firm with a before-tax value of $15,000,000. Determine the size of the tax shield with a corporate tax rate of 18%, 20%, 32% and 40% if Roxy's capital structure is 40 / 60 debt to equity. Determine the same if the capital structure is 60/40. If Roxy's capital structure is 40/60 debt to equity, what is the size of the tax shield with a corporate tax rate of 18%? $ (Round to the nearest dollar.)