Answered step by step

Verified Expert Solution

Question

1 Approved Answer

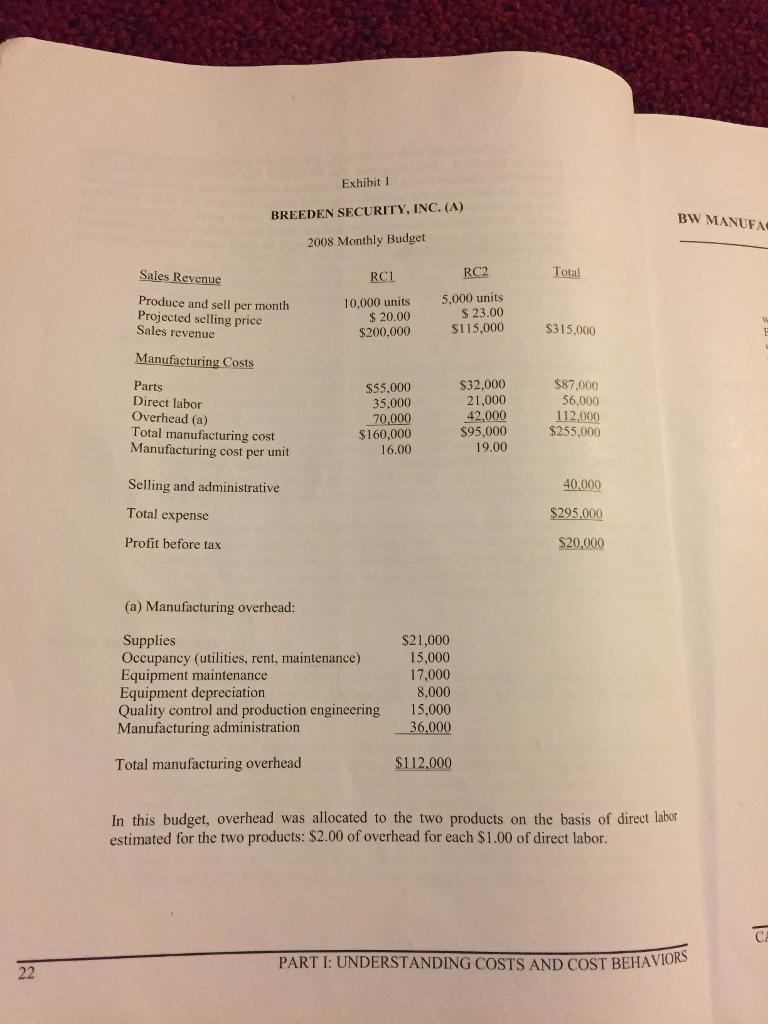

Required: 1. Complete the highlighted items in the VC & FC worksheet to compute variable cost per unit for RC1 and RC2, fixed cost per

| Required: |

| 1. Complete the highlighted items in the VC & FC worksheet to compute variable cost per unit for RC1 and RC2, fixed cost per month, and contribution margin per unit. Base your calculations on the information provided in Exhibit 1, 2008 Monthly Budget, which is provided in the VC & FC worksheet. |

| Use the information computed in #1, above, to answer the following questions in the Breakeven Analysis worksheet. Show all of your work. Label each item carefully and neatly. |

| a) What would break-even sales volume be, assuming a ratio of two RC1s sold for each RC2 sold? |

b) What level of sales would provide the profit target specified by the parent company of $210,000 for the year? (Assume that they sell all that they produce.) |

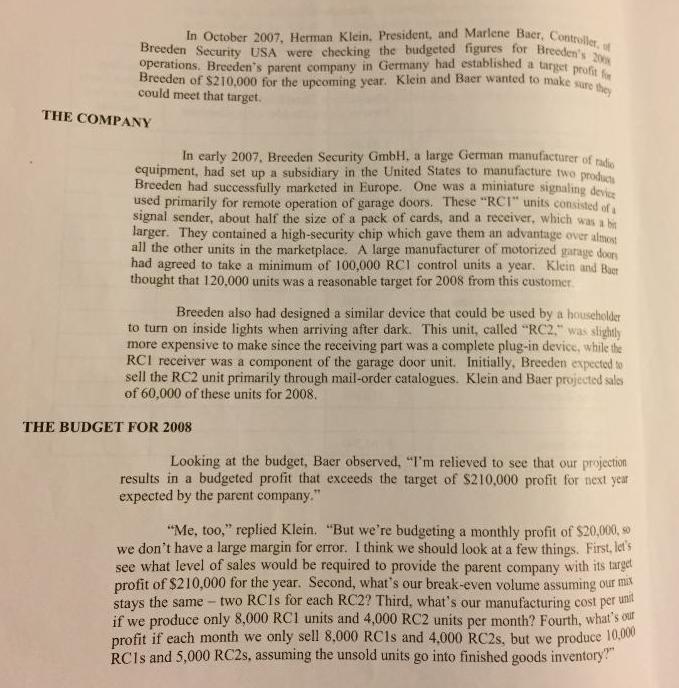

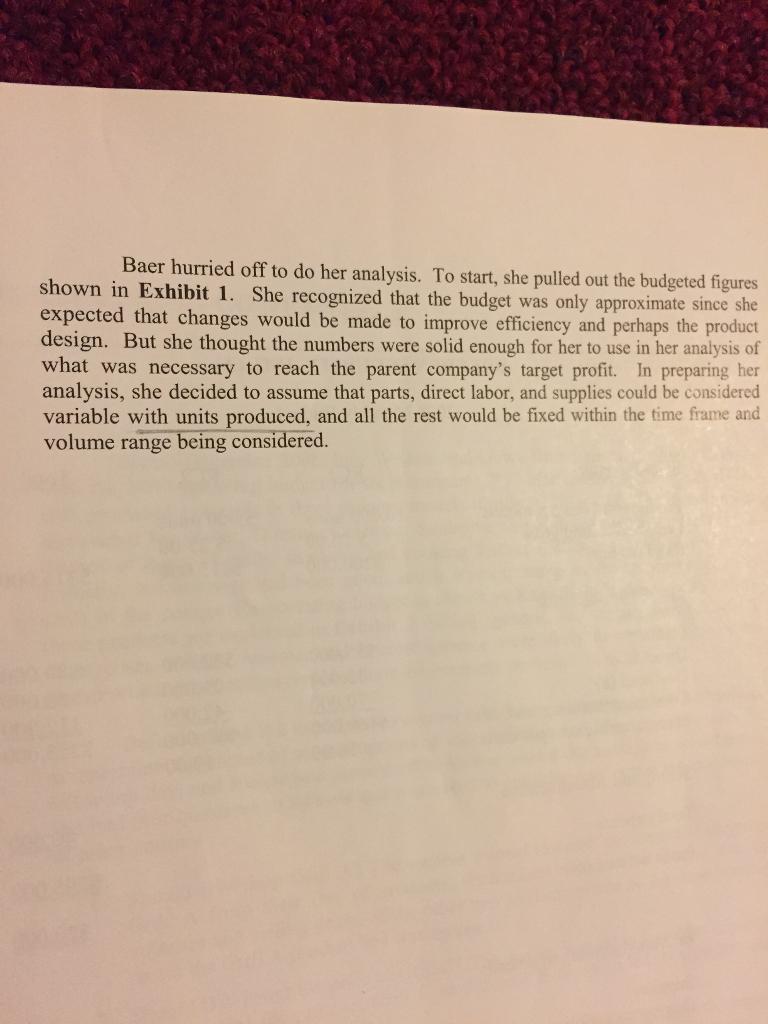

In October 2007, Herman Klein, President, and Marlene Baer, Controller, ot Breeden Security USA were checking the budgeted figures for Breeden's 20 operations. Breeden's parent company in Germany had established a target prof Breeden of $210,000 for the upeoming year. Klein and Baer wanted to make sure could meet that target. THE COMPANY In early 2007, Breeden Security GmbH. a large German manufacturer of mod equipment, had set up a subsidiary in the United States to manufacture two prod Breeden had successfully marketed in Europe. One was a miniature signaling devi used primarily for remote operation of garage doors. These "RCI" units consisted of signal sender, about half the size of a pack of cards, and a receiver, which was a b larger. They contained a high-security chip which gave them an advantage over almot all the other units in the marketplace. A large manufacturer of motorized garage door had agreed to take a minimum of 100,000 RCI control units a year. Klein and Baer thought that 120,000 units was a reasonable target for 2008 from this customer. Breeden also had designed a similar device that could be used by a householder to turn on inside lights when arriving after dark. This unit, called "RC2," was slightly more expensive to make since the receiving part was a complete plug-in device, while the RCI receiver was a component of the garage door unit. Initially, Breeden expected to sell the RC2 unit primarily through mail-order catalogues. Klein and Baer projected sales of 60,000 of these units for 2008. THE BUDGET FOR 2008 Looking at the budget, Baer observed, "I'm relieved to see that our projection results in a budgeted profit that exceeds the target of $210,000 profit for next year expected by the parent company." "Me, too," replied Klein. "But we're budgeting a monthly profit of $20,000, so we don't have a large margin for error. I think we should look at a few things. First, let's see what level of sales would be required to provide the parent company with its target profit of $210,000 for the year. Second, what's our break-even volume assuming our max two RCIS for each RC2? Third, what's our manufacturing cost per unil if we produce only 8,000 RC1 units and 4,000 RC2 units per month? Fourth, what's our profit if each month we only sell 8,000 RC1S and 4,000 RC2S, but we produce 10,000 RC1S and 5,000 RC2S, assuming the unsold units go into finished goods inventory" stays the same -

Step by Step Solution

★★★★★

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

1 RC1 RC2 Total Variable costs Parts 55000 32000 Direct labor Supplies 21000 100005000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started