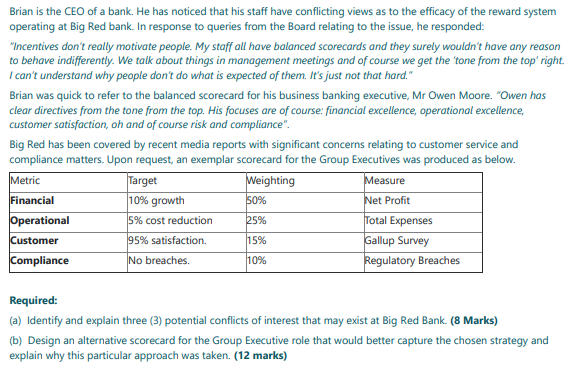

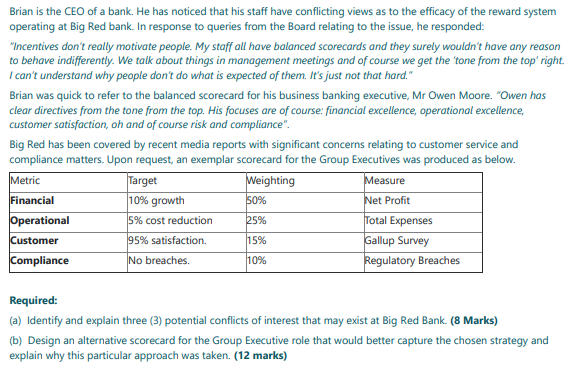

Brian is the CEO of a bank. He has noticed that his staff have conflicting views as to the efficacy of the reward system operating at Big Red bank. In response to queries from the Board relating to the issue, he responded: "Incentives don't really motivate people. My staff all have balanced Scorecards and they surely wouldn't have any reason to behave indifferently. We talk about things in management meetings and of course we get the 'tone from the top right. I can't understand why people don't do what is expected of them. It's just not that hard." Brian was quick to refer to the balanced Scorecard for his business banking executive, Mr Owen Moore. "Owen has clear directives from the tone from the top. His focuses are of course: financial excellence, operational excellence, customer satisfaction, oh and of course risk and compliance". Big Red has been covered by recent media reports with significant concerns relating to customer service and compliance matters. Upon request, an exemplar scorecard for the Group Executives was produced as below. Metric Target Weighting Measure Financial 10% growth 50% Net Profit Operational 5% cost reduction 25% Total Expenses Customer 95% satisfaction. Gallup Survey Compliance No breaches. Regulatory Breaches 15% 10% Required: (a) Identify and explain three (3) potential conflicts of interest that may exist at Big Red Bank. (8 Marks) (b) Design an alternative scorecard for the Group Executive role that would better capture the chosen strategy and explain why this particular approach was taken. (12 marks) Brian is the CEO of a bank. He has noticed that his staff have conflicting views as to the efficacy of the reward system operating at Big Red bank. In response to queries from the Board relating to the issue, he responded: "Incentives don't really motivate people. My staff all have balanced Scorecards and they surely wouldn't have any reason to behave indifferently. We talk about things in management meetings and of course we get the 'tone from the top right. I can't understand why people don't do what is expected of them. It's just not that hard." Brian was quick to refer to the balanced Scorecard for his business banking executive, Mr Owen Moore. "Owen has clear directives from the tone from the top. His focuses are of course: financial excellence, operational excellence, customer satisfaction, oh and of course risk and compliance". Big Red has been covered by recent media reports with significant concerns relating to customer service and compliance matters. Upon request, an exemplar scorecard for the Group Executives was produced as below. Metric Target Weighting Measure Financial 10% growth 50% Net Profit Operational 5% cost reduction 25% Total Expenses Customer 95% satisfaction. Gallup Survey Compliance No breaches. Regulatory Breaches 15% 10% Required: (a) Identify and explain three (3) potential conflicts of interest that may exist at Big Red Bank. (8 Marks) (b) Design an alternative scorecard for the Group Executive role that would better capture the chosen strategy and explain why this particular approach was taken. (12 marks)