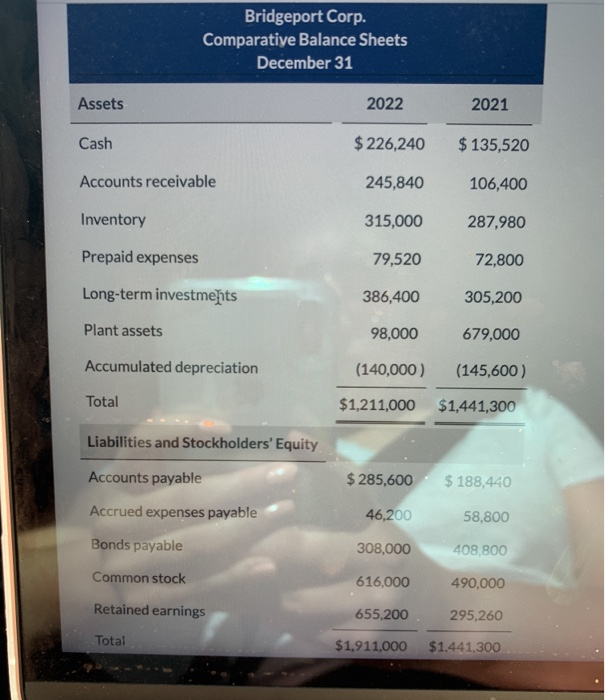

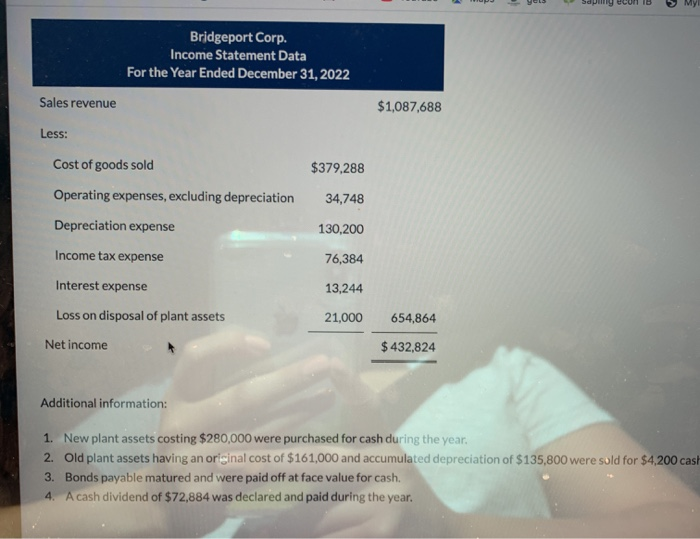

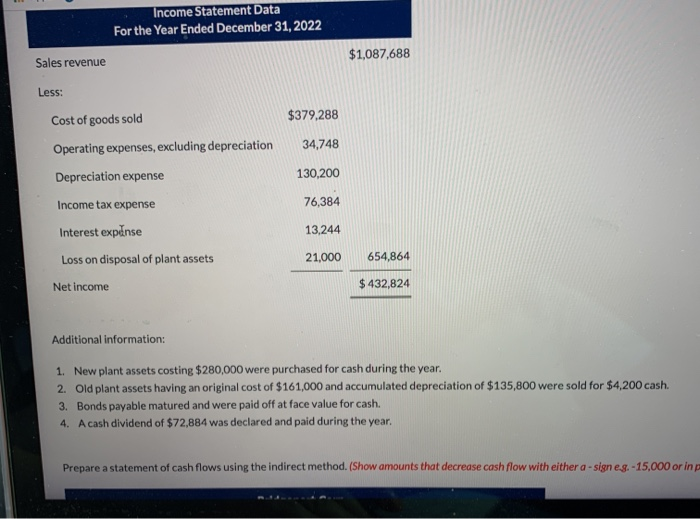

Bridgeport Corp. Comparative Balance Sheets December 31 Assets 2022 2021 Cash $ 226,240 $ 135,520 Accounts receivable 245,840 106,400 Inventory 315,000 287,980 Prepaid expenses 79,520 72,800 Long-term investments 386,400 305,200 Plant assets 98,000 679,000 Accumulated depreciation (140,000) (145,600) Total $1,211,000 $1,441,300 Liabilities and Stockholders' Equity Accounts payable $285,600 $ 188,440 Accrued expenses payable 46,200 58,800 Bonds payable 308,000 408,800 Common stock 616,000 490,000 Retained earnings 655,200 295,260 Total $1,911,000 $1.441,300 Say ecum Bridgeport Corp. Income Statement Data For the Year Ended December 31, 2022 Sales revenue $1,087,688 Less: $379,288 Cost of goods sold Operating expenses, excluding depreciation 34,748 Depreciation expense 130,200 Income tax expense 76,384 Interest expense 13,244 Loss on disposal of plant assets 21,000 654,864 Net income $432,824 Additional information: 1. New plant assets costing $280,000 were purchased for cash during the year. 2. Old plant assets having an original cost of $161,000 and accumulated depreciation of $135,800 were sold for $4,200 cash 3. Bonds payable matured and were paid off at face value for cash. 4. A cash dividend of $72,884 was declared and paid during the year. repare Bridgeport Corp. Statement of Cash Flows $ Adjustments to reconcile net income to $ e Income Statement Data For the Year Ended December 31, 2022 $1,087,688 Sales revenue $379,288 Less: Cost of goods sold Operating expenses, excluding depreciation Depreciation expense 34,748 130,200 Income tax expense 76,384 13,244 Interest expense Loss on disposal of plant assets Net income 21,000 654,864 $432,824 Additional information: 1. New plant assets costing $280,000 were purchased for cash during the year. 2. Old plant assets having an original cost of $161,000 and accumulated depreciation of $135,800 were sold for $4,200 cash. 3. Bonds payable matured and were paid off at face value for cash. 4. A cash dividend of $72,884 was declared and paid during the year. Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a-sign e.g.-15,000 or in