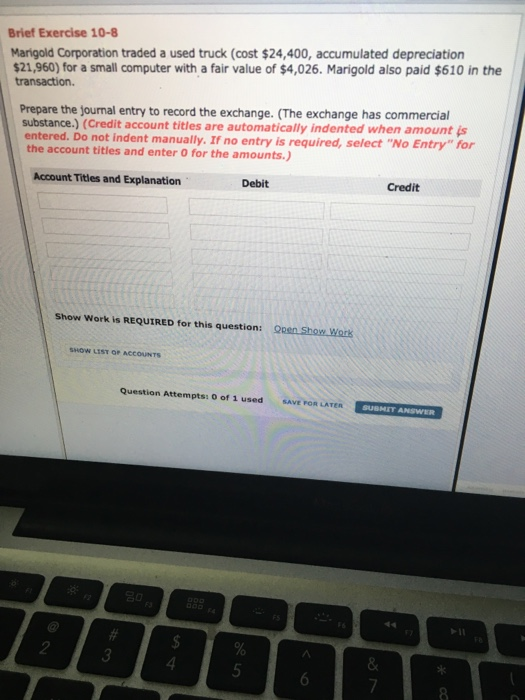

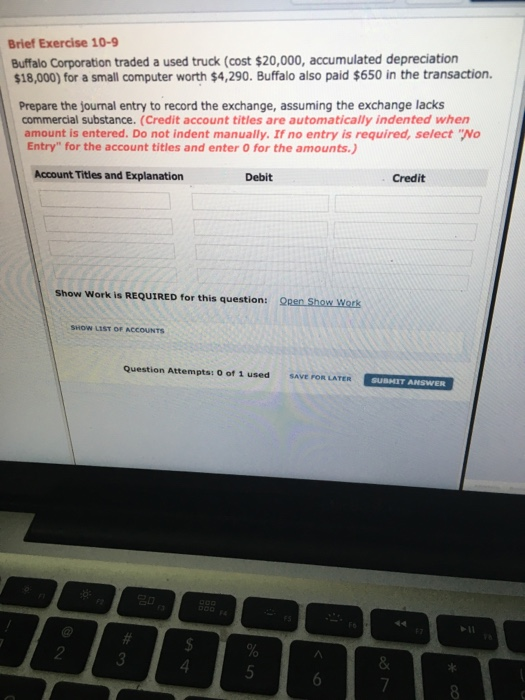

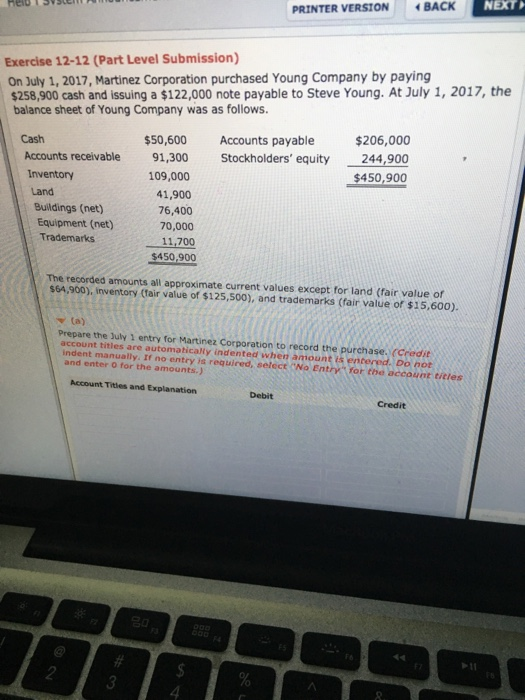

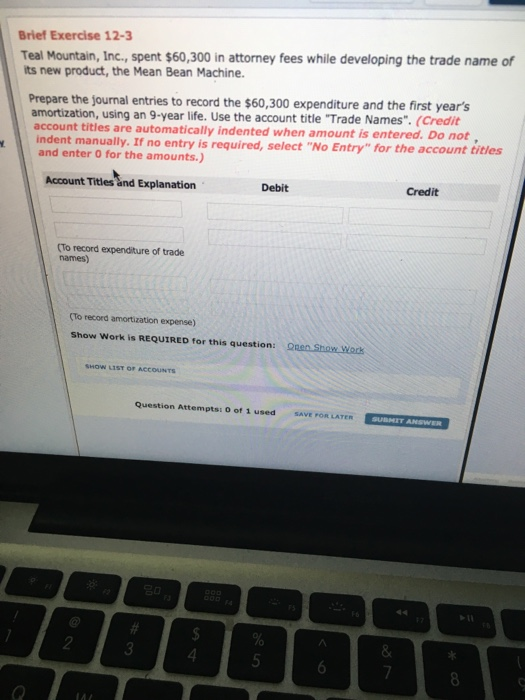

Brief Exercise 10-8 Marigold Corporation traded a used truck (cost $24,400, accumulated depreciation $21,960) for a small computer with a fair value of $4,026. Marigold also paid $610 in the transaction. Prepare the journal entry to record the exchange. (The exchange has commercial substance.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit Show Work is REQUIRED for this question: Qen Show Work SHOW LIST OF ACCOUNTS Question Attempts of 1 used SAVE FOR LATER SUBMIT ANSWER Brief Exercise 10-9 Buffalo Corporation traded a used truck (cost $20,000, accumulated depreciation $18,000) for a small computer worth $4,290. Buffalo also paid $650 in the transaction. Prepare the journal entry to record the exchange, assuming the exchange lacks commercial substance. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Show Work is REQUIRED for this question: Open Show Work SHOW LIST OF ACCOUNTS Question Attempts: 0 of 1 used SAVE FOR LATER SUBMIT ANSWER HEIU SVIH PRINTER VERSION BACK NEXT Exercise 12-12 (Part Level Submission) On July 1, 2017, Martinez Corporation purchased Young Company by paying $258,900 cash and issuing a $122,000 note payable to Steve Young. At July 1, 2017, the balance sheet of Young Company was as follows. $50,600 91,300 109,000 Accounts payable Stockholders' equity $206,000 244,900 $450,900 Cash Accounts receivable Inventory Land Buildings (net) Equipment (net) Trademarks 41,900 76,400 70,000 11,700 $450,900 The recorded amounts all approximate current values except for land (fair value of 564,900), inventory (Tair value of $125,500), and trademarks (fair value of $15,600). Prepare the July 1 entry for Martinez Corporation to record the purchase. (Credit account titles are automatically indented when amounts entered. Do not Indent manually. If no entry is required, select No Entry for the account t/cles and enter for the amounts.) Account Titles and Explanation Debit Credit Brief Exercise 12-3 Teal Mountain, Inc., spent $60,300 in attorney fees while developing the trade name of its new product, the Mean Bean Machine. Prepare the journal entries to record the $60,300 expenditure and the first year's amortization, using an 9-year life. Use the account title "Trade Names". (Credit account tities are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit (To record expenditure of trade names) (To record amortization expense) Show Work is REQUIRED for this questioni Oren Show Work SHOW LIST OF ACCOUNTS Question Attempts of 1 used SUBMIT ANSWER og HA