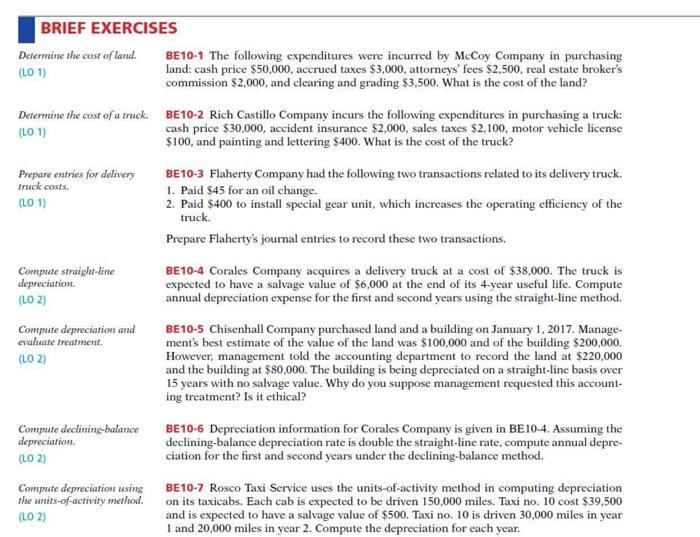

BRIEF EXERCISES Determine the cost of land. BE10-1 The following expenditures were incurred by McCoy Company in purchasing (LO 1) land: cash price $50,000, accrued taxes $3,000, attorneys' fees $2,500, real estate broker's commission $2,000, and clearing and grading $3,500. What is the cost of the land? Determine the cost of a truck: BE10-2 Rich Castillo Company incurs the following expenditures in purchasing a truck: (LO 1) cash price $30,000, accident insurance $2,000, sales taxes $2,100, motor vehicle license $100, and painting and lettering $400. What is the cost of the truck? Prepare entries for delivery truck costs. (LD1) Compute straight-line depreciation. (LO) BE10-3 Flaherty Company had the following two transactions related to its delivery truck. 1. Paid $45 for an oil change. 2. Paid $400 to install special gear unit, which increases the operating efficiency of the truck. Prepare Flaherty's journal entries to record these two transactions. BE10-4 Corales Company acquires a delivery truck at a cost of $38,000. The truck is expected to have a salvage value of $6,000 at the end of its 4-year useful life. Compute annual depreciation expense for the first and second years using the straight-line method. BE10-5 Chisenhall Company purchased land and a building on January 1, 2017. Manage- ment's best estimate of the value of the land was $100,000 and of the building $200,000. However, management told the accounting department to record the land at $220,000 and the building at $80,000. The building is being depreciated on a straight-line basis over 15 years with no salvage value. Why do you suppose management requested this account- ing treatment? Is it ethical? Compute depreciation and evaluate treatment. (LO 2) Compute declining-balance depreciation. (LO 2) BE10-6 Depreciation information for Corales Company is given in BE10-4. Assuming the declining-balance depreciation rate is double the straight-line rate, compute annual depre- ciation for the first and second years under the declining-balance method. Compute depreciation using the wits-of-activity method. (LO 2) BE10-7 Rosco Taxi Service uses the units-of-activity method in computing depreciation on its taxicabs. Each cab is expected to be driven 150,000 miles. Taxi no. 10 cost $39,500 and is expected to have a salvage value of $500. Taxi no. 10 is driven 30,000 miles in year 1 and 20,000 miles in year 2. Compute the depreciation for each year