Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Briggs & Stratton is one of the world's largest manufacturers of gasoline engines for lawn mowers based in Australia. Briggs & Stratton is interested in

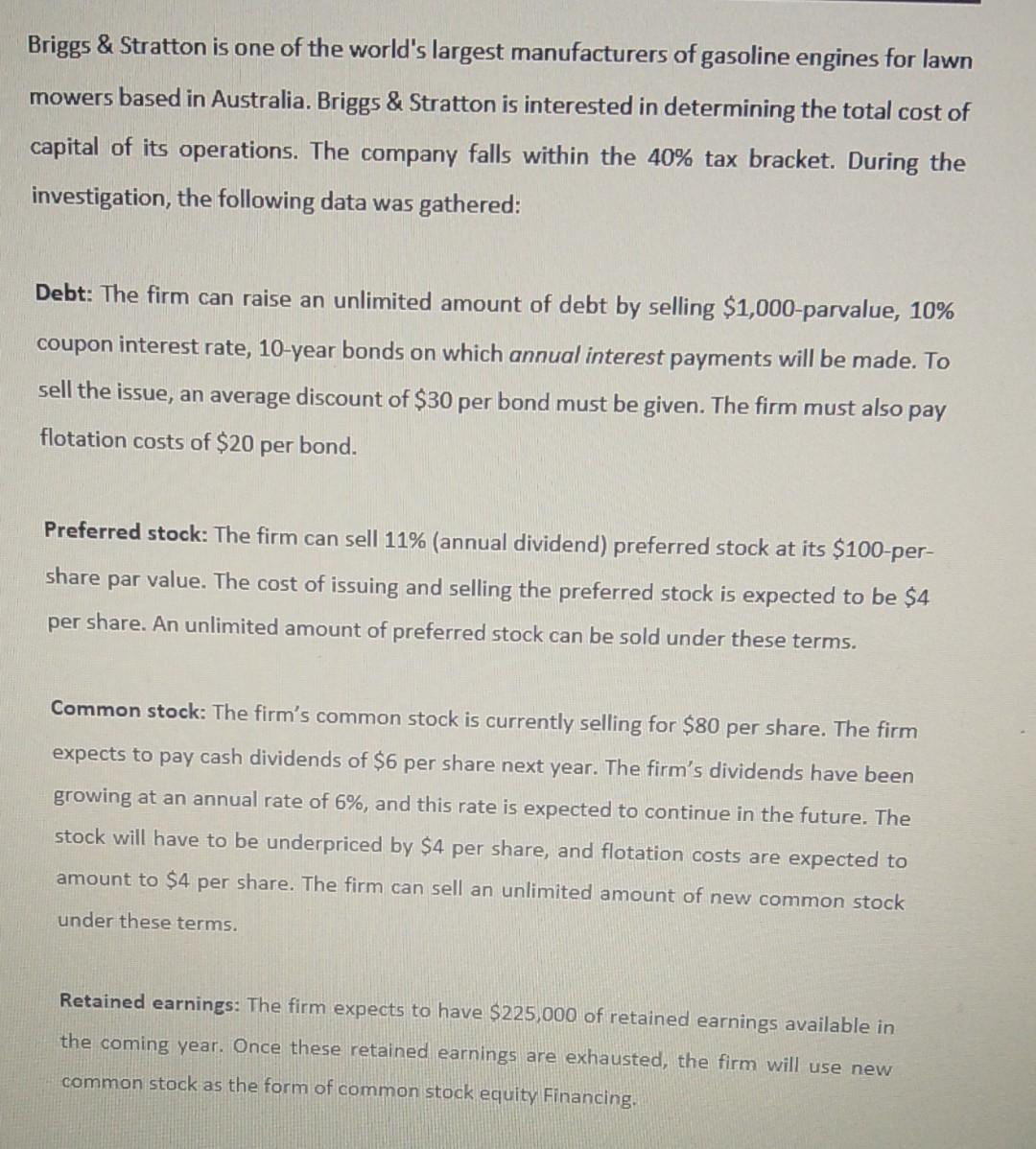

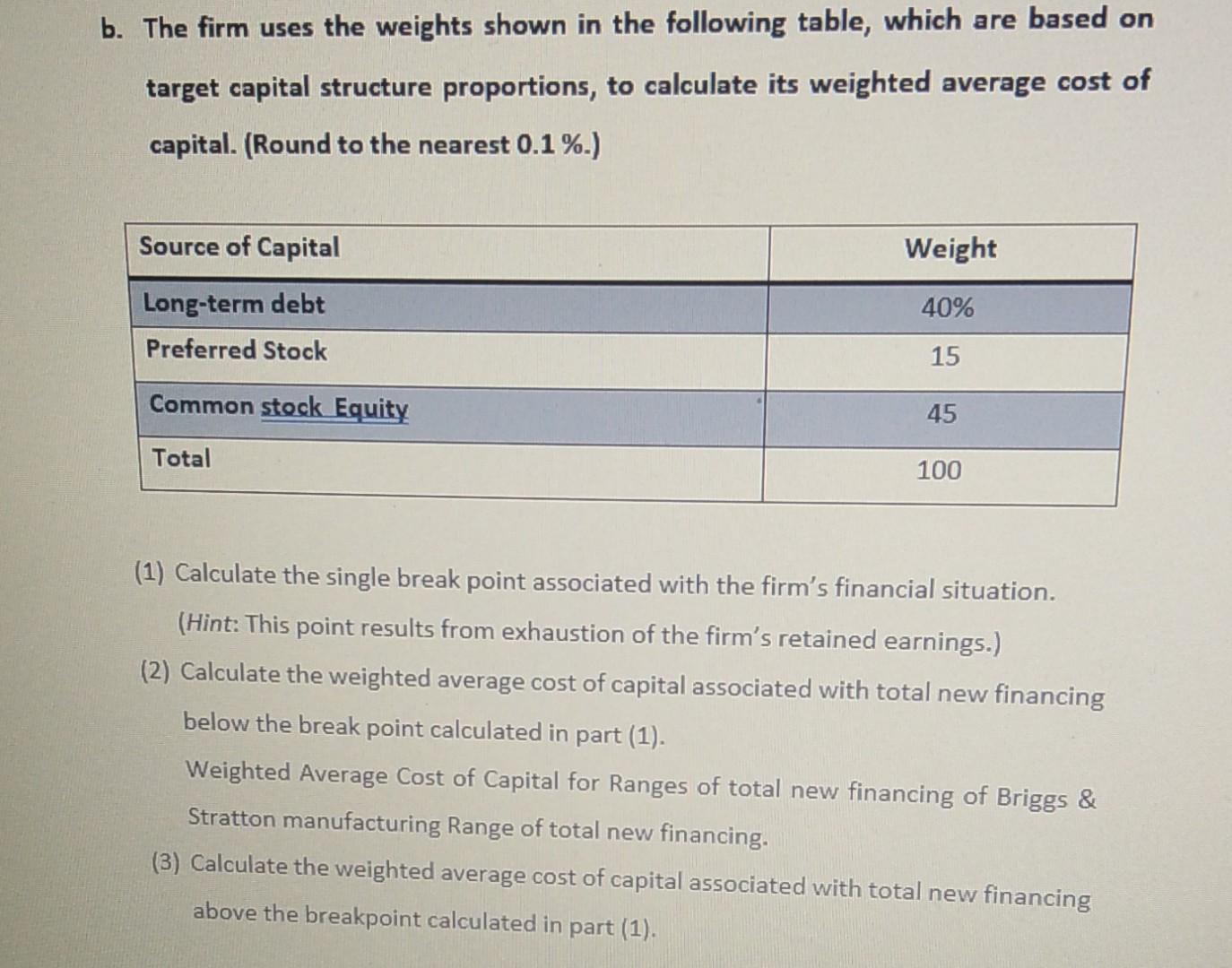

Briggs & Stratton is one of the world's largest manufacturers of gasoline engines for lawn mowers based in Australia. Briggs & Stratton is interested in determining the total cost of capital of its operations. The company falls within the 40% tax bracket. During the investigation, the following data was gathered: Debt: The firm can raise an unlimited amount of debt by selling $1,000-parvalue, 10% coupon interest rate, 10-year bonds on which annual interest payments will be made. To sell the issue, an average discount of $30 per bond must be given. The firm must also pay flotation costs of $20 per bond. Preferred stock: The firm can sell 11% (annual dividend) preferred stock at its $100-per- share par value. The cost of issuing and selling the preferred stock is expected to be $4 per share. An unlimited amount of preferred stock can be sold under these terms. Common stock: The firm's common stock is currently selling for $80 per share. The firm expects to pay cash dividends of $6 per share next year. The firm's dividends have been growing at an annual rate of 6%, and this rate is expected to continue in the future. The stock will have to be underpriced by $4 per share, and flotation costs are expected to amount to $4 per share. The firm can sell an unlimited amount of new common stock under these terms. Retained earnings: The firm expects to have $225,000 of retained earnings available in the coming year. Once these retained earnings are exhausted, the firm will use new common stock as the form of common stock equity Financing. b. The firm uses the weights shown in the following table, which are based on target capital structure proportions, to calculate its weighted average cost of capital. (Round to the nearest 0.1%.) Source of Capital Weight Long-term debt 40% Preferred Stock 15 Common stock Equity 45 Total 100 (1) Calculate the single break point associated with the firm's financial situation. (Hint: This point results from exhaustion of the firm's retained earnings.) (2) Calculate the weighted average cost of capital associated with total new financing below the break point calculated in part (1). Weighted Average Cost of Capital for Ranges of total new financing of Briggs & Stratton manufacturing Range of total new financing. (3) Calculate the weighted average cost of capital associated with total new financing above the breakpoint calculated in part (1)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started