Answered step by step

Verified Expert Solution

Question

1 Approved Answer

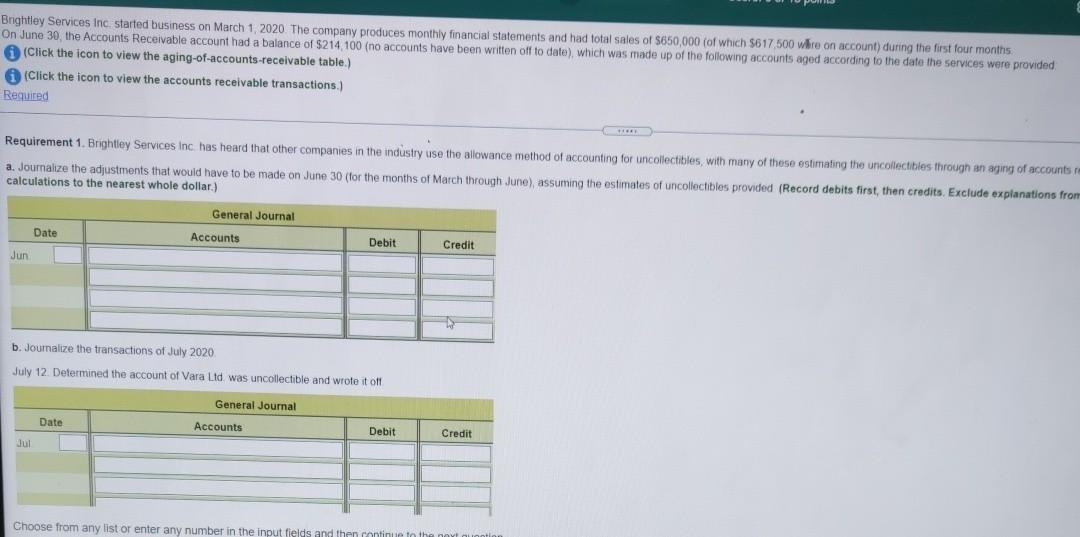

Brightley Services Inc. started business on March 1, 2020 The company produces monthly financial statements and had total sales of $650,000 (of which $617 500

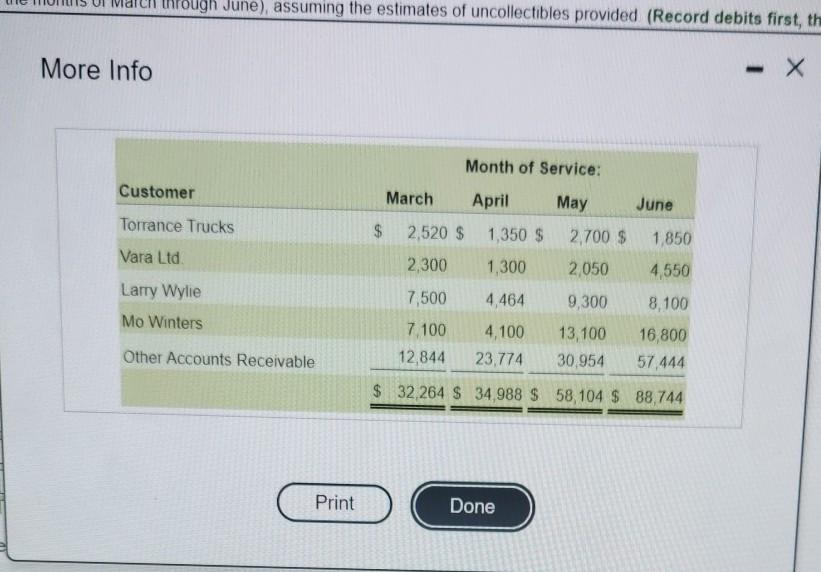

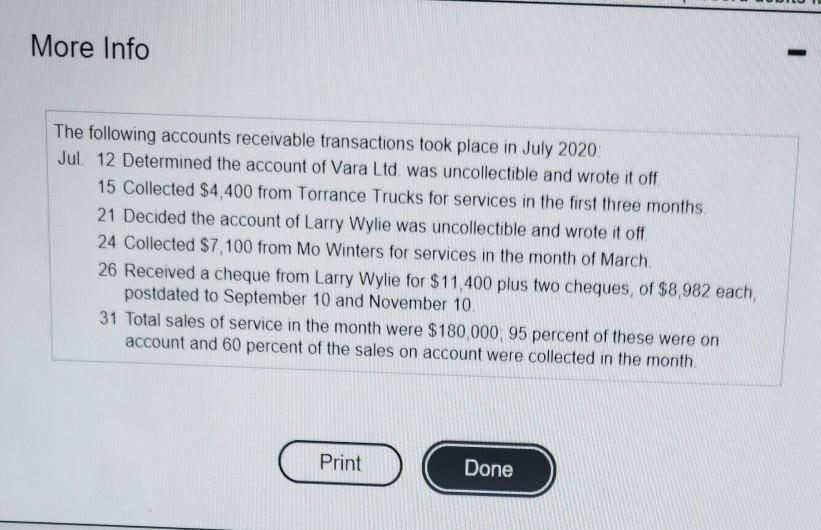

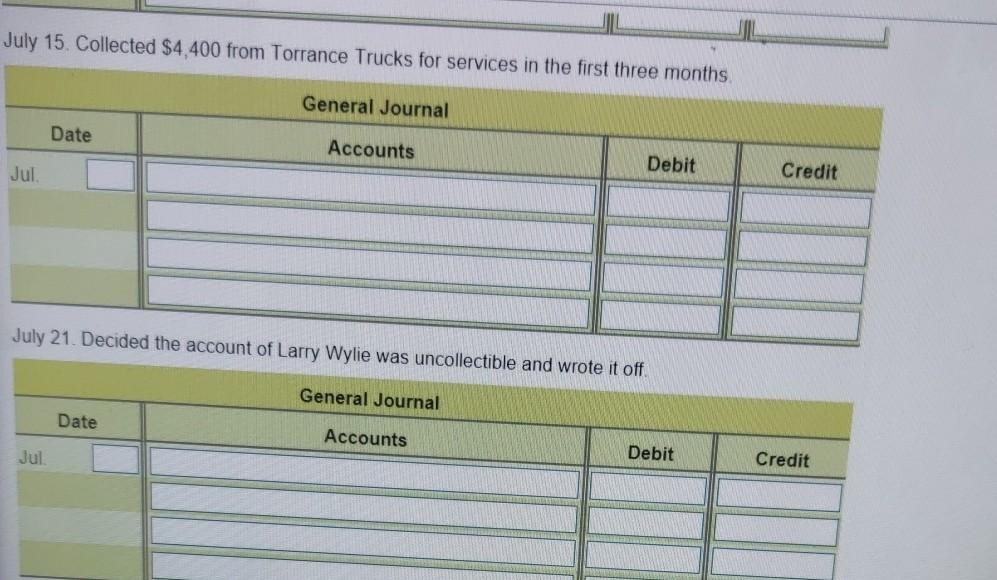

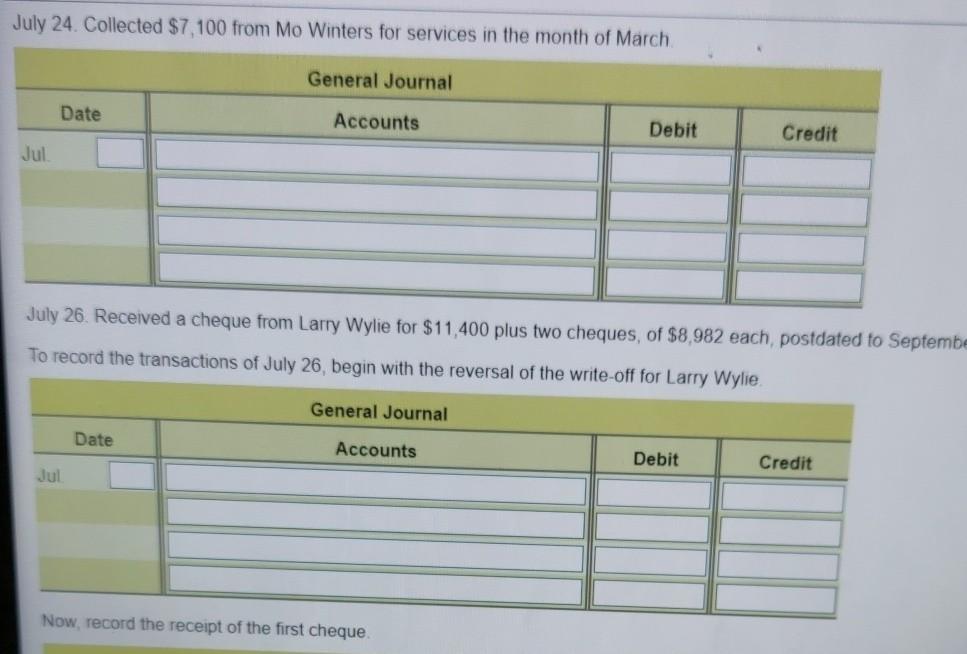

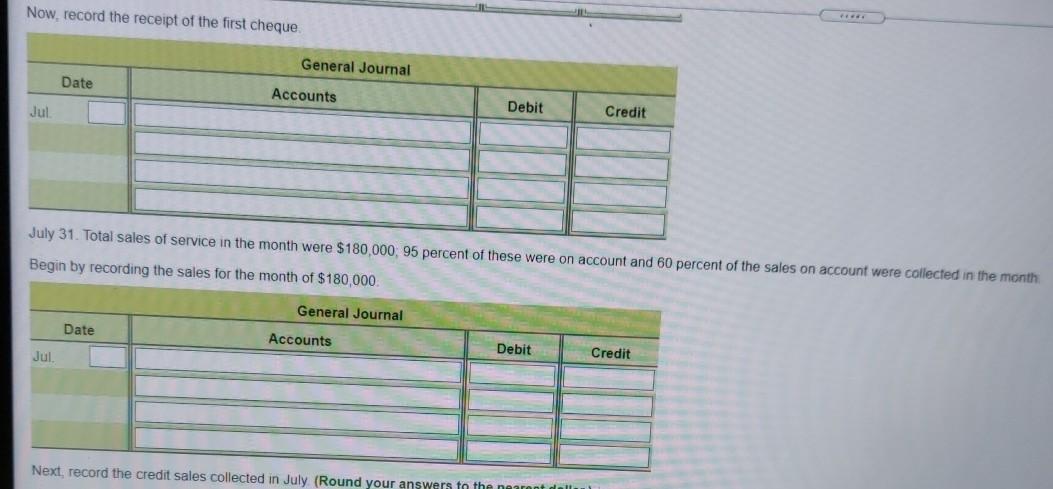

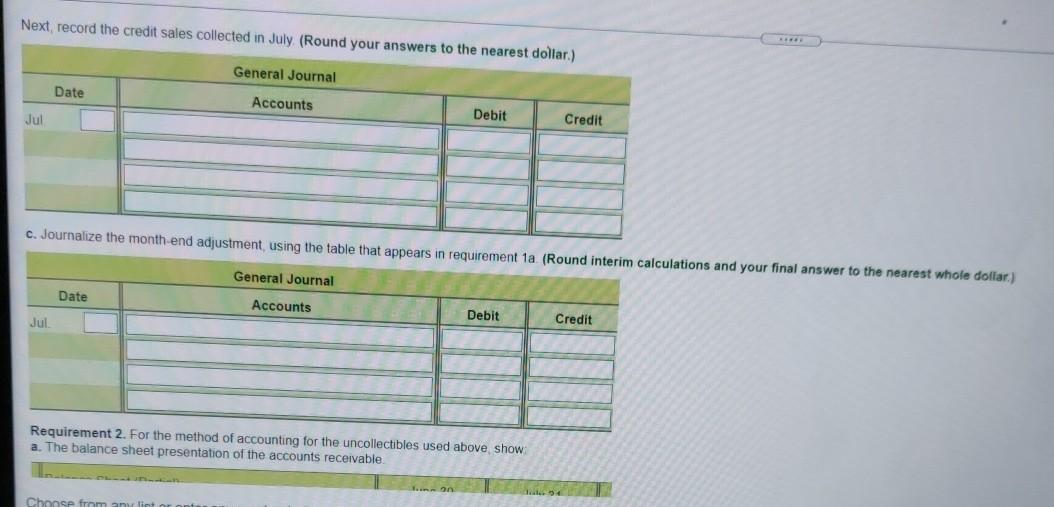

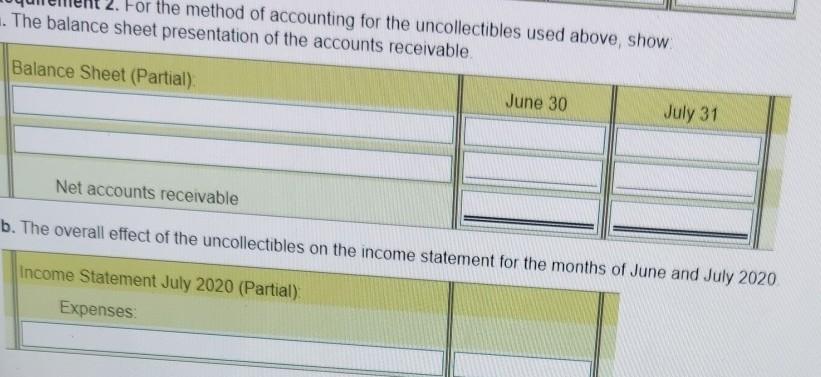

Brightley Services Inc. started business on March 1, 2020 The company produces monthly financial statements and had total sales of $650,000 (of which $617 500 Ware on account) during the first four months On June 30, the Accounts Receivable account had a balance of $214 100 (no accounts have been written off to date), which was made up of the following accounts aged according to the date the services were provided (Click the icon to view the aging-of-accounts receivable table.) i (Click the icon to view the accounts receivable transactions.) Required Requirement 1. Brightley Services Inc has heard that other companies in the industry use the allowance method of accounting for uncollectibles with many of these estimating the uncollectibles through an aging of accounts a. Journalize the adjustments that would have to be made on June 30 (for the months of March through June), assuming the estimates of uncollectibles provided (Record debits first, then credits. Exclude explanations from calculations to the nearest whole dollar.) General Journal Date Accounts Debit Credit Jun b. Joumalize the transactions of July 2020 July 12. Determined the account of Vara Lid was uncollectible and wrote it off General Journal Date Accounts Debit Credit Jul Choose from any list or enter any number in the input fields and then continue in the ta fough June), assuming the estimates of uncollectibles provided (Record debits first, th More Info Month of Service: Customer March April May June Torrance Trucks $ 2,520 $ 1,350 $ 2,700 $ 1,850 Vara Ltd 2,300 1,300 2,050 Larry Wylie Mo Winters 4550 8,100 4,464 7,500 7.100 12,844 4,100 23,774 9,300 13,100 30,954 Other Accounts Receivable 16,800 57,444 $ 32,264 $ 34,988 $ 58,104 $ 88,744 Print Done More Info The following accounts receivable transactions took place in July 2020 Jul 12 Determined the account of Vara Ltd. was uncollectible and wrote it off 15 Collected $4,400 from Torrance Trucks for services in the first three months 21 Decided the account of Larry Wylie was uncollectible and wrote it off 24 Collected $7,100 from Mo Winters for services in the month of March 26 Received a cheque from Larry Wylie for $11,400 plus two cheques, of $8,982 each, postdated to September 10 and November 10 31 Total sales of service in the month were $180,000, 95 percent of these were on account and 60 percent of the sales on account were collected in the month Print Done July 15. Collected $4,400 from Torrance Trucks for services in the first three months General Journal Date Accounts Debit Jul Credit July 21. Decided the account of Larry Wylie was uncollectible and wrote it off General Journal Date Accounts Jul Debit Credit July 24. Collected $7,100 from Mo Winters for services in the month of March General Journal Date Accounts Debit Credit Jul July 26. Received a cheque from Larry Wylie for $11,400 plus two cheques, of $8.982 each, postdated to Septembe To record the transactions of July 26, begin with the reversal of the write-off for Larry Wylie General Journal Date Accounts Debit Credit Jul Now, record the receipt of the first cheque Now, record the receipt of the first cheque General Journal Date Accounts Jul Debit Credit July 31. Total sales of service in the month were $180,000, 95 percent of these were on account and 60 percent of the sales on account were collected in the month Begin by recording the sales for the month of $180,000 General Journal Date Accounts Debit Jul Credit Next, record the credit sales collected in July (Round your answers to the neemt dallu Next, record the credit sales collected in July (Round your answers to the nearest dollar.) General Journal Date Accounts Jul Debit Credit c. Journalize the month-end adjustment using the table that appears in requirement 1a (Round interim calculations and your final answer to the nearest whole dollar) General Journal Date Accounts Debit Jul Credit Requirement 2. For the method of accounting for the uncollectibles used above show a. The balance sheet presentation of the accounts receivable. Choose from anu lint For the method of accounting for the uncollectibles used above, show . The balance sheet presentation of the accounts receivable Balance Sheet (Partial). June 30 July 31 Net accounts receivable b. The overall effect of the uncollectibles on the income statement for the months of June and July 2020 Income Statement July 2020 (Partial) Expenses Brightley Services Inc. started business on March 1, 2020 The company produces monthly financial statements and had total sales of $650,000 (of which $617 500 Ware on account) during the first four months On June 30, the Accounts Receivable account had a balance of $214 100 (no accounts have been written off to date), which was made up of the following accounts aged according to the date the services were provided (Click the icon to view the aging-of-accounts receivable table.) i (Click the icon to view the accounts receivable transactions.) Required Requirement 1. Brightley Services Inc has heard that other companies in the industry use the allowance method of accounting for uncollectibles with many of these estimating the uncollectibles through an aging of accounts a. Journalize the adjustments that would have to be made on June 30 (for the months of March through June), assuming the estimates of uncollectibles provided (Record debits first, then credits. Exclude explanations from calculations to the nearest whole dollar.) General Journal Date Accounts Debit Credit Jun b. Joumalize the transactions of July 2020 July 12. Determined the account of Vara Lid was uncollectible and wrote it off General Journal Date Accounts Debit Credit Jul Choose from any list or enter any number in the input fields and then continue in the ta fough June), assuming the estimates of uncollectibles provided (Record debits first, th More Info Month of Service: Customer March April May June Torrance Trucks $ 2,520 $ 1,350 $ 2,700 $ 1,850 Vara Ltd 2,300 1,300 2,050 Larry Wylie Mo Winters 4550 8,100 4,464 7,500 7.100 12,844 4,100 23,774 9,300 13,100 30,954 Other Accounts Receivable 16,800 57,444 $ 32,264 $ 34,988 $ 58,104 $ 88,744 Print Done More Info The following accounts receivable transactions took place in July 2020 Jul 12 Determined the account of Vara Ltd. was uncollectible and wrote it off 15 Collected $4,400 from Torrance Trucks for services in the first three months 21 Decided the account of Larry Wylie was uncollectible and wrote it off 24 Collected $7,100 from Mo Winters for services in the month of March 26 Received a cheque from Larry Wylie for $11,400 plus two cheques, of $8,982 each, postdated to September 10 and November 10 31 Total sales of service in the month were $180,000, 95 percent of these were on account and 60 percent of the sales on account were collected in the month Print Done July 15. Collected $4,400 from Torrance Trucks for services in the first three months General Journal Date Accounts Debit Jul Credit July 21. Decided the account of Larry Wylie was uncollectible and wrote it off General Journal Date Accounts Jul Debit Credit July 24. Collected $7,100 from Mo Winters for services in the month of March General Journal Date Accounts Debit Credit Jul July 26. Received a cheque from Larry Wylie for $11,400 plus two cheques, of $8.982 each, postdated to Septembe To record the transactions of July 26, begin with the reversal of the write-off for Larry Wylie General Journal Date Accounts Debit Credit Jul Now, record the receipt of the first cheque Now, record the receipt of the first cheque General Journal Date Accounts Jul Debit Credit July 31. Total sales of service in the month were $180,000, 95 percent of these were on account and 60 percent of the sales on account were collected in the month Begin by recording the sales for the month of $180,000 General Journal Date Accounts Debit Jul Credit Next, record the credit sales collected in July (Round your answers to the neemt dallu Next, record the credit sales collected in July (Round your answers to the nearest dollar.) General Journal Date Accounts Jul Debit Credit c. Journalize the month-end adjustment using the table that appears in requirement 1a (Round interim calculations and your final answer to the nearest whole dollar) General Journal Date Accounts Debit Jul Credit Requirement 2. For the method of accounting for the uncollectibles used above show a. The balance sheet presentation of the accounts receivable. Choose from anu lint For the method of accounting for the uncollectibles used above, show . The balance sheet presentation of the accounts receivable Balance Sheet (Partial). June 30 July 31 Net accounts receivable b. The overall effect of the uncollectibles on the income statement for the months of June and July 2020 Income Statement July 2020 (Partial) Expenses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started