Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you explain #6 please Cosmos Enterprises has the following information: Selling Price per Unit $90 Per Unit Variable Production Costs: Direct materials $14 Direct

Can you explain #6 please

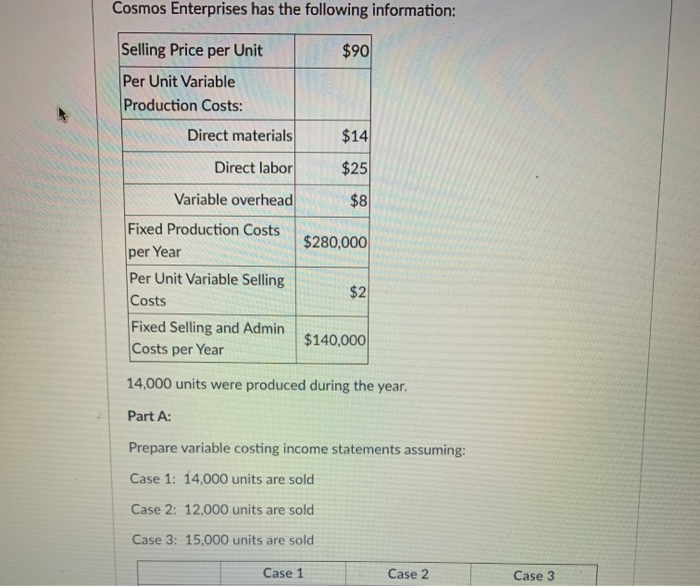

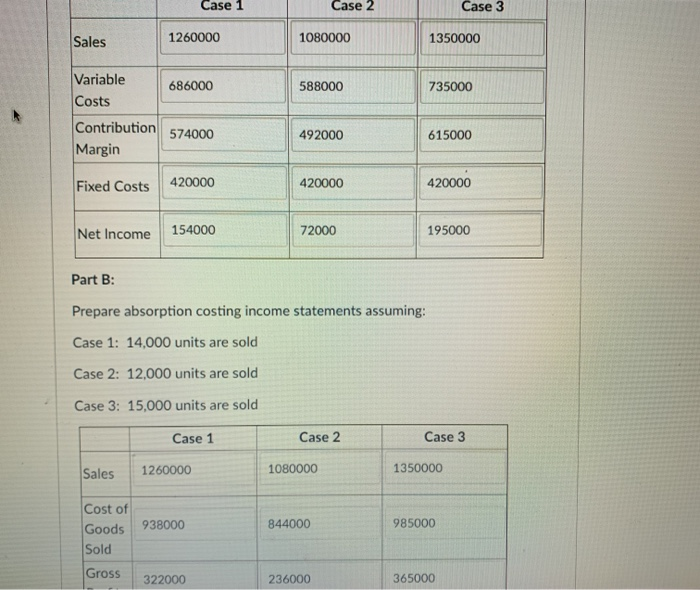

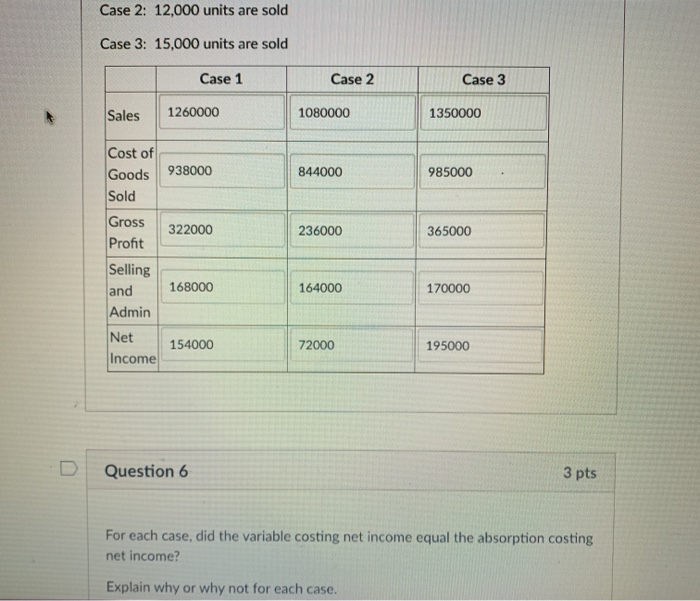

Cosmos Enterprises has the following information: Selling Price per Unit $90 Per Unit Variable Production Costs: Direct materials $14 Direct labor $25 Variable overhead $8 Fixed Production Costs $280,000 per Year $2 Per Unit Variable Selling Costs Fixed Selling and Admin Costs per Year $140,000 14,000 units were produced during the year. Part A: Prepare variable costing income statements assuming: Case 1: 14,000 units are sold Case 2: 12,000 units are sold Case 3: 15,000 units are sold Case 1 Case 2 Case 3 Case 1 Case 2 Case 3 Sales 1260000 1080000 1350000 Variable Costs 686000 588000 735000 Contribution Margin 574000 492000 615000 Fixed Costs 420000 420000 420000 Net Income 154000 72000 195000 Part B: Prepare absorption costing income statements assuming: Case 1: 14,000 units are sold Case 2: 12,000 units are sold Case 3: 15,000 units are sold Case 1 Case 2 Case 3 Sales 1260000 1080000 1350000 938000 844000 985000 Cost of Goods Sold Gross 322000 236000 365000 Case 2: 12,000 units are sold Case 3: 15,000 units are sold Case 1 Case 2 Case 3 Sales 1260000 1080000 1350000 844000 985000 Cost of Goods 938000 Sold Gross 322000 Profit Selling and 168000 Admin 236000 365000 164000 170000 Net Income 154000 72000 195000 Question 6 3 pts For each case, did the variable costing net income equal the absorption costing net income? Explain why or why not for each case Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started