Answered step by step

Verified Expert Solution

Question

1 Approved Answer

bro wnld Remaining Time: 1 hour, 57 minutes, 04 seconds. Question Completion Status: n't sa wsing and tion e > A Moving to another question

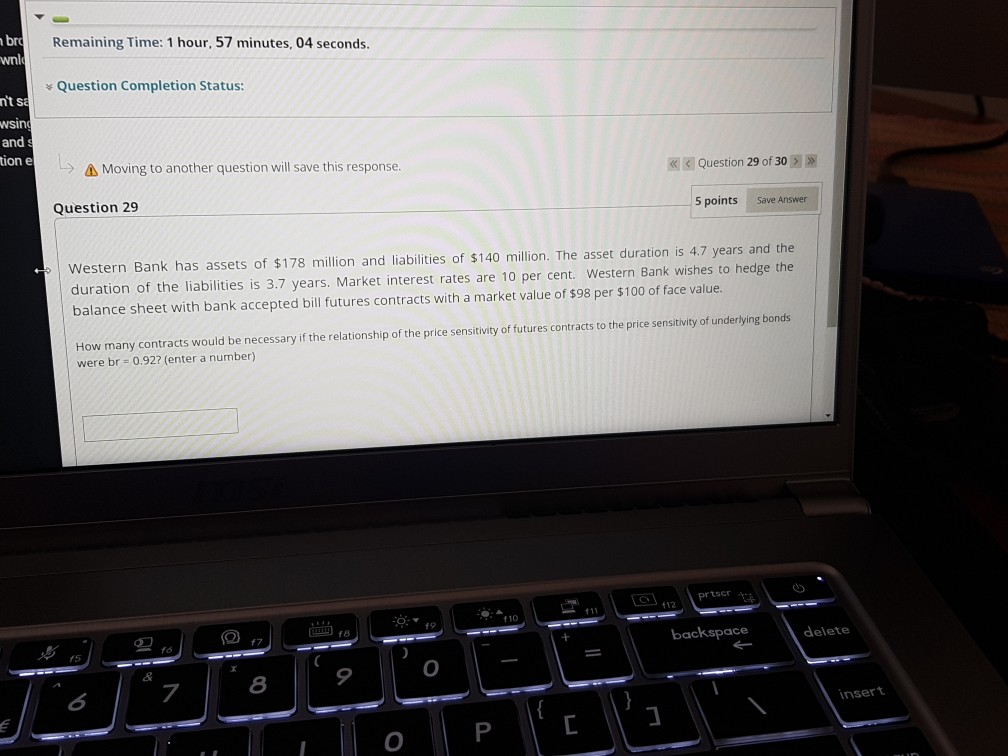

bro wnld Remaining Time: 1 hour, 57 minutes, 04 seconds. Question Completion Status: n't sa wsing and tion e > A Moving to another question will save this response. >> 5 points Question 29 Save Answer Western Bank has assets of $178 million and liabilities of $140 million. The asset duration is 4.7 years and the duration of the liabilities is 3.7 years. Market interest rates are 10 per cent. Western Bank wishes to hedge the balance sheet with bank accepted bill futures contracts with a market value of $98 per $100 of face value. How many contracts would be necessary if the relationship of the price sensitivity of futures contracts to the price sensitivity of underlying bonds were br= 0.92? (enter a number) priser *710 10 backspace delete 16 o & 8 insert O bro wnld Remaining Time: 1 hour, 57 minutes, 04 seconds. Question Completion Status: n't sa wsing and tion e > A Moving to another question will save this response. >> 5 points Question 29 Save Answer Western Bank has assets of $178 million and liabilities of $140 million. The asset duration is 4.7 years and the duration of the liabilities is 3.7 years. Market interest rates are 10 per cent. Western Bank wishes to hedge the balance sheet with bank accepted bill futures contracts with a market value of $98 per $100 of face value. How many contracts would be necessary if the relationship of the price sensitivity of futures contracts to the price sensitivity of underlying bonds were br= 0.92? (enter a number) priser *710 10 backspace delete 16 o & 8 insert O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started