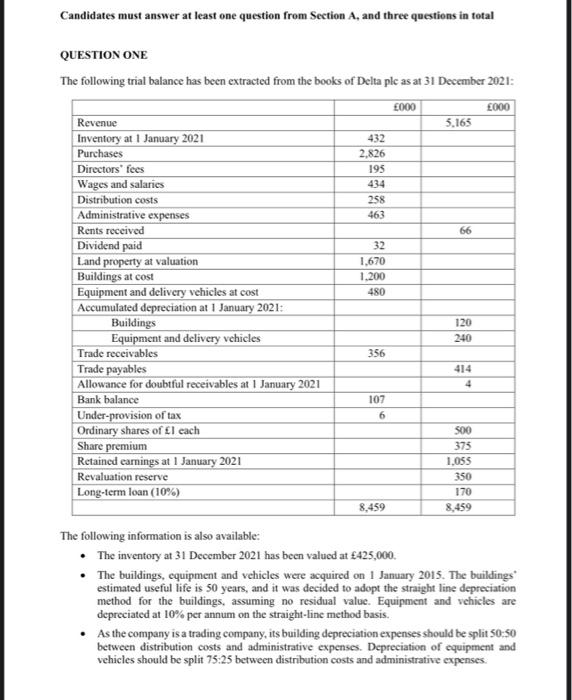

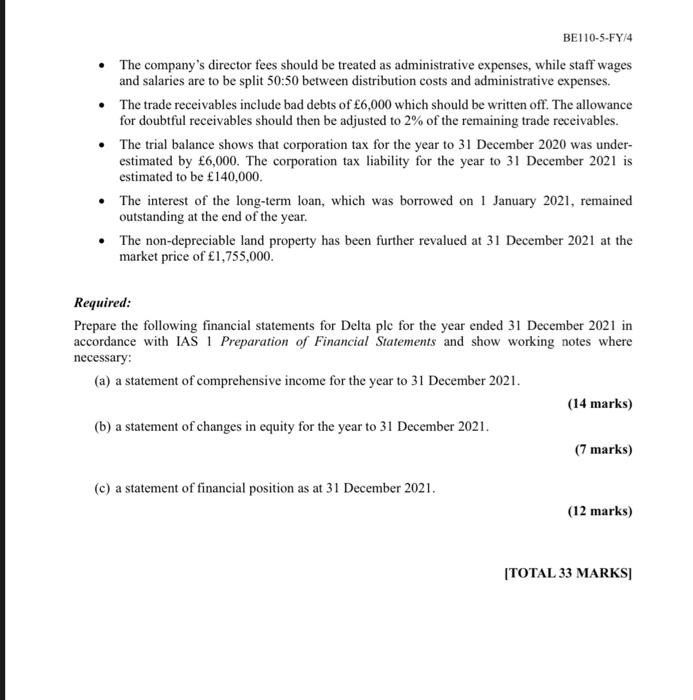

Candidates must answer at least one question from Section A, and three questions in total 432 434 258 66 32 QUESTION ONE The following trial balance has been extracted from the books of Delta plc as at 31 December 2021: 000 000 Revenue 5.165 Inventory at 1 January 2021 Purchases 2.826 Directors' fees 195 Wages and salaries Distribution costs Administrative expenses 463 Rents received Dividend paid Land property at valuation 1.670 Buildings at cost 1.200 Equipment and delivery vehicles at cost 480 Accumulated depreciation at 1 January 2021: Buildings 120 Equipment and delivery vehicles 240 Trade receivables 356 Trade payables 414 Allowance for doubtful receivables at 1 January 2021 4 Bank balance 107 Under-provision of tax Ordinary shares of l each 500 Share premium 375 Retained earings at 1 January 2021 1,055 Revaluation reserve 350 Long-term loan (10%) 170 8,459 8,459 The following information is also available: The inventory at 31 December 2021 has been valued at 425,000 The buildings, equipment and vehicles were acquired on 1 January 2015. The buildings estimated useful life is 50 years, and it was decided to adopt the straight line depreciation method for the buildings, assuming no residual value Equipment and vehicles are depreciated at 10% per annum on the straight-line method basis. As the company is a trading company, its building depreciation expenses should be split 50:50 between distribution costs and administrative expenses. Depreciation of equipment and vehicles should be split 75:25 between distribution costs and administrative expenses. 6 BE110-5-FY/4 The company's director fees should be treated as administrative expenses, while staff wages and salaries are to be split 50:50 between distribution costs and administrative expenses. The trade receivables include bad debts of 6,000 which should be written off. The allowance for doubtful receivables should then be adjusted to 2% of the remaining trade receivables. The trial balance shows that corporation tax for the year to 31 December 2020 was under- estimated by 6,000. The corporation tax liability for the year to 31 December 2021 is estimated to be 140,000. The interest of the long-term loan, which was borrowed on 1 January 2021, remained outstanding at the end of the year. The non-depreciable land property has been further revalued at 31 December 2021 at the market price of 1,755,000. Required: Prepare the following financial statements for Delta ple for the year ended 31 December 2021 in accordance with IAS 1 Preparation of Financial Statements and show working notes where necessary: (a) a statement of comprehensive income for the year to 31 December 2021. (14 marks) (b) a statement of changes in equity for the year to 31 December 2021. (7 marks) (c) a statement of financial position as at 31 December 2021. (12 marks) [TOTAL 33 MARKS