Answered step by step

Verified Expert Solution

Question

1 Approved Answer

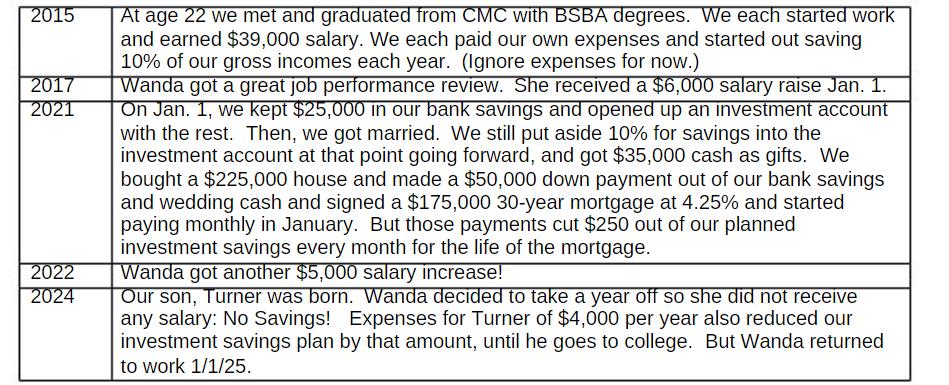

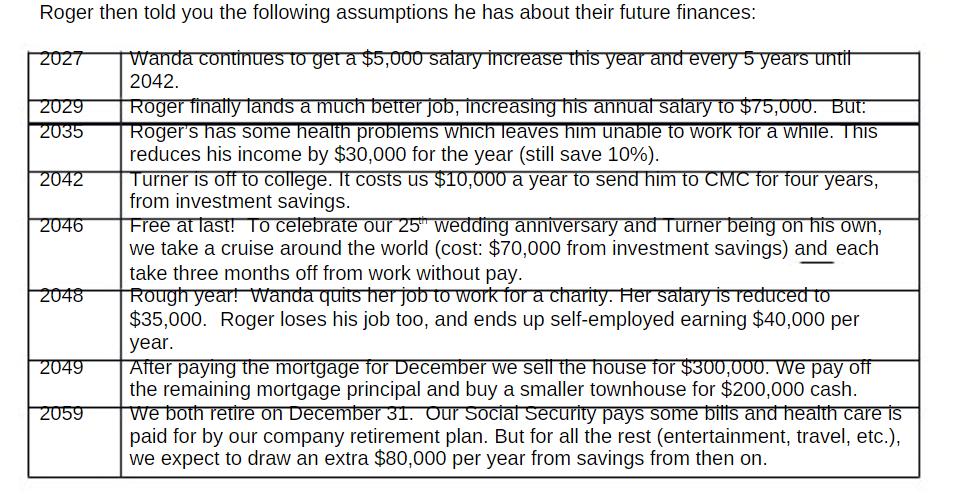

Roger and Wanda Person are average folks who want to live the good life. They meet at CMC during college and later decide to get

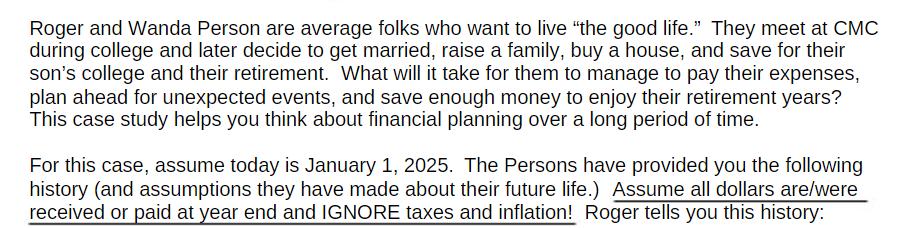

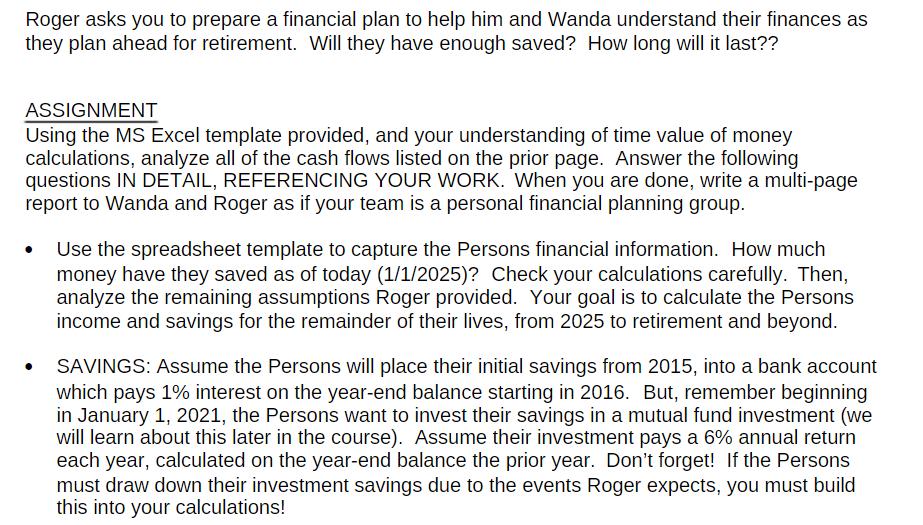

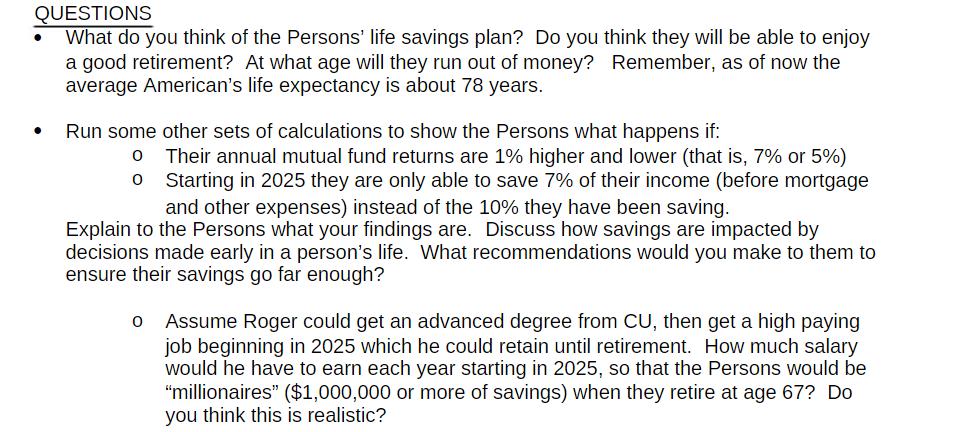

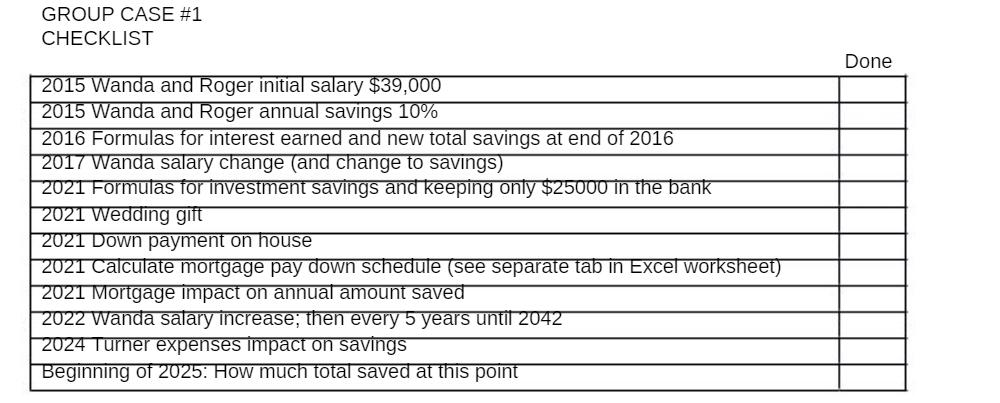

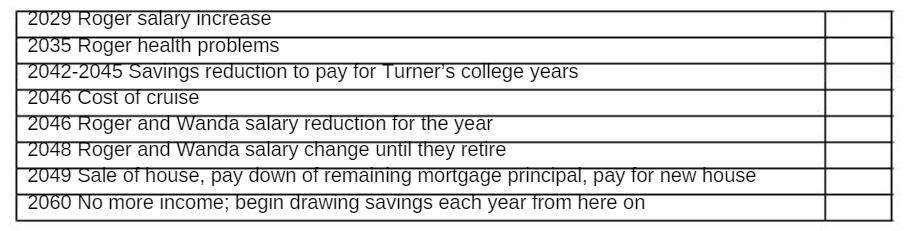

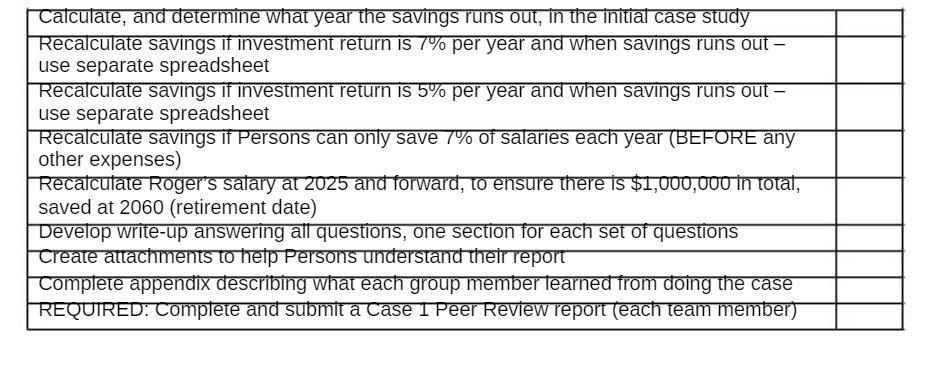

Roger and Wanda Person are average folks who want to live "the good life." They meet at CMC during college and later decide to get married, raise a family, buy a house, and save for their son's college and their retirement. What will it take for them to manage to pay their expenses, plan ahead for unexpected events, and save enough money to enjoy their retirement years? This case study helps you think about financial planning over a long period of time.

continues in the attachment

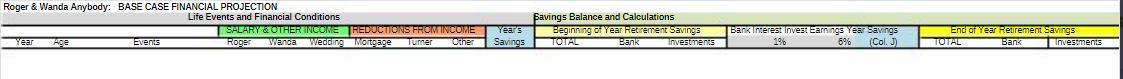

Roger & Wanda Anybody: BASE CASE FINANCIAL PROJECTION Life Events and Financial Conditions Year Events SALARY & OTHER INCOME REDUCTIONS FROM INCOME Roger Wanda Wedding Mortgage Turner Other Year's Savings Savings Balance and Calculations Beginning of Year Retirement Savings TOTAL Investments Bank Bank Interest Invest Earnings Year Savings 1% 6% (Col. J) End of Year Retirement Savings Bank TOTAL Investments

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

ase Wanda 75000 60000 0 89250 4000 0 9500 80100 25000 55100 0 2406 2406 93600 25000 40100 2033 40 continued working 75000 60000 0 89250 4000 0 9500 93600 25000 68600 0 3216 3216 107100 25000 53600 203...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started