Question

Bronco Chemical uses a standard cost system to account for the costs of its production of Chemical X. As per the standard cost card, standards

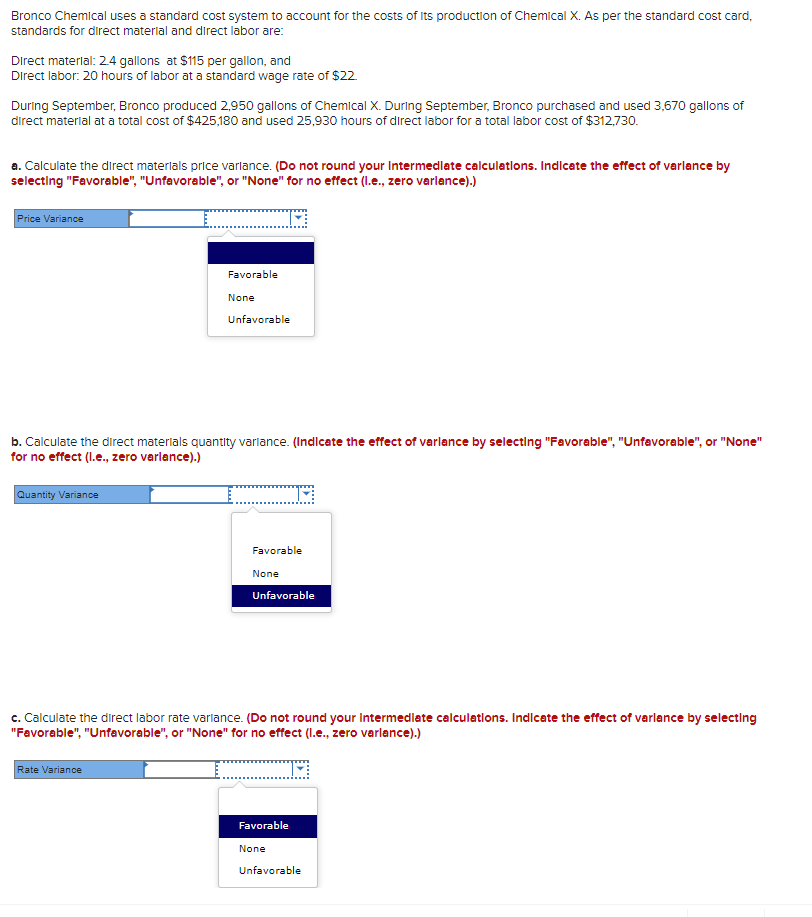

Bronco Chemical uses a standard cost system to account for the costs of its production of Chemical X. As per the standard cost card, standards for direct material and direct labor are:

Direct material: 2.4 gallons at $115 per gallon, and

Direct labor: 20 hours of labor at a standard wage rate of $22.

During September, Bronco produced 2,950 gallons of Chemical X. During September, Bronco purchased and used 3,670 gallons of direct material at a total cost of $425,180 and used 25,930 hours of direct labor for a total labor cost of $312,730. a. Calculate the direct materials price variance. (Do not round your intermediate calculations. Indicate the effect of variance by selecting "Favorable", "Unfavorable", or "None" for no effect (i.e., zero variance).) b. Calculate the direct materials quantity variance. (Indicate the effect of variance by selecting "Favorable", "Unfavorable", or "None" for no effect (i.e., zero variance).) c. Calculate the direct labor rate variance. (Do not round your intermediate calculations. Indicate the effect of variance by selecting "Favorable", "Unfavorable", or "None" for no effect (i.e., zero variance).) d. Calculate the direct labor efficiency variance. (Indicate the effect of variance by selecting "Favorable", "Unfavorable", or "None" for no effect (i.e., zero variance).)

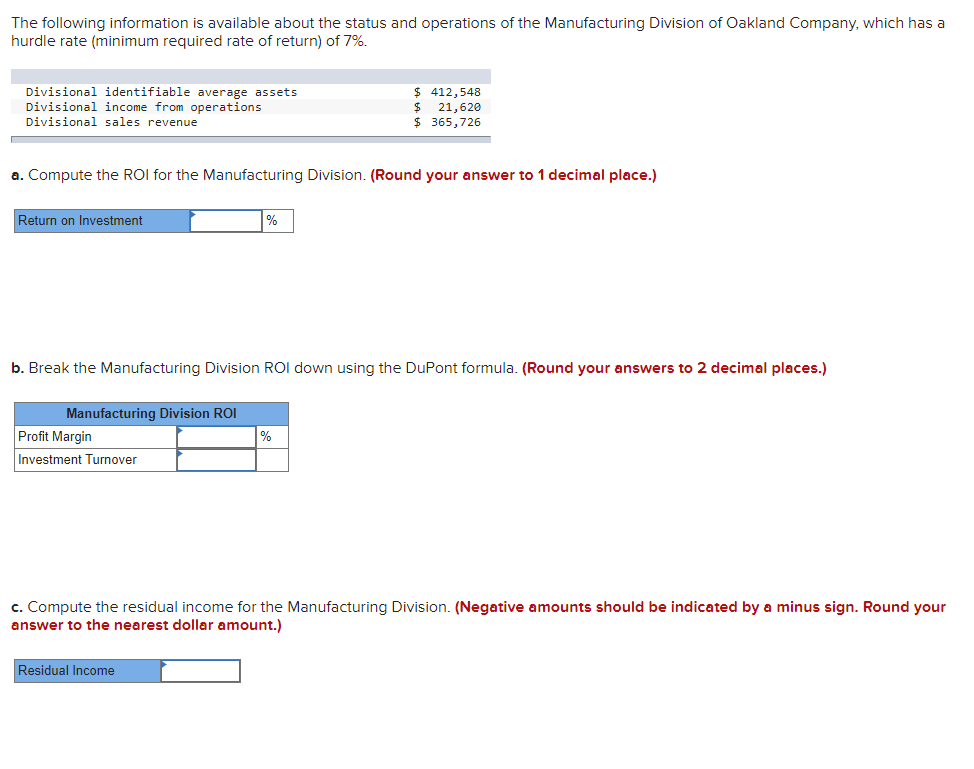

The following information is available about the status and operations of the Manufacturing Division of Oakland Company, which has a hurdle rate (minimum required rate of return) of 7%.

| Divisional identifiable average assets | $ | 412,548 |

| Divisional income from operations | $ | 21,620 |

| Divisional sales revenue | $ | 365,726 |

a. Compute the ROI for the Manufacturing Division. (Round your answer to 1 decimal place.) b. Break the Manufacturing Division ROI down using the DuPont formula. (Round your answers to 2 decimal places.) c. Compute the residual income for the Manufacturing Division. (Negative amounts should be indicated by a minus sign. Round your answer to the nearest dollar amount.)

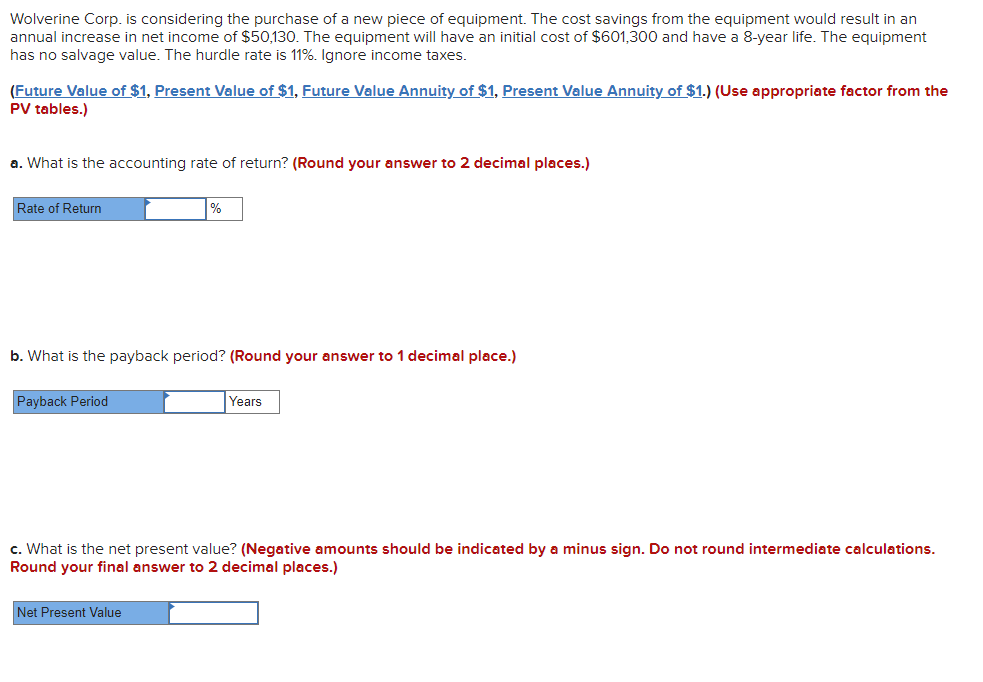

Wolverine Corp. is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual increase in net income of $50,130. The equipment will have an initial cost of $601,300 and have a 8-year life. The equipment has no salvage value. The hurdle rate is 11%. Ignore income taxes.

(Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor from the PV tables.) a. What is the accounting rate of return? (Round your answer to 2 decimal places.) b. What is the payback period? (Round your answer to 1 decimal place.) c. What is the net present value? (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your final answer to 2 decimal places.) d. What would the net present value be with a 16% hurdle rate? (Negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your final answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started