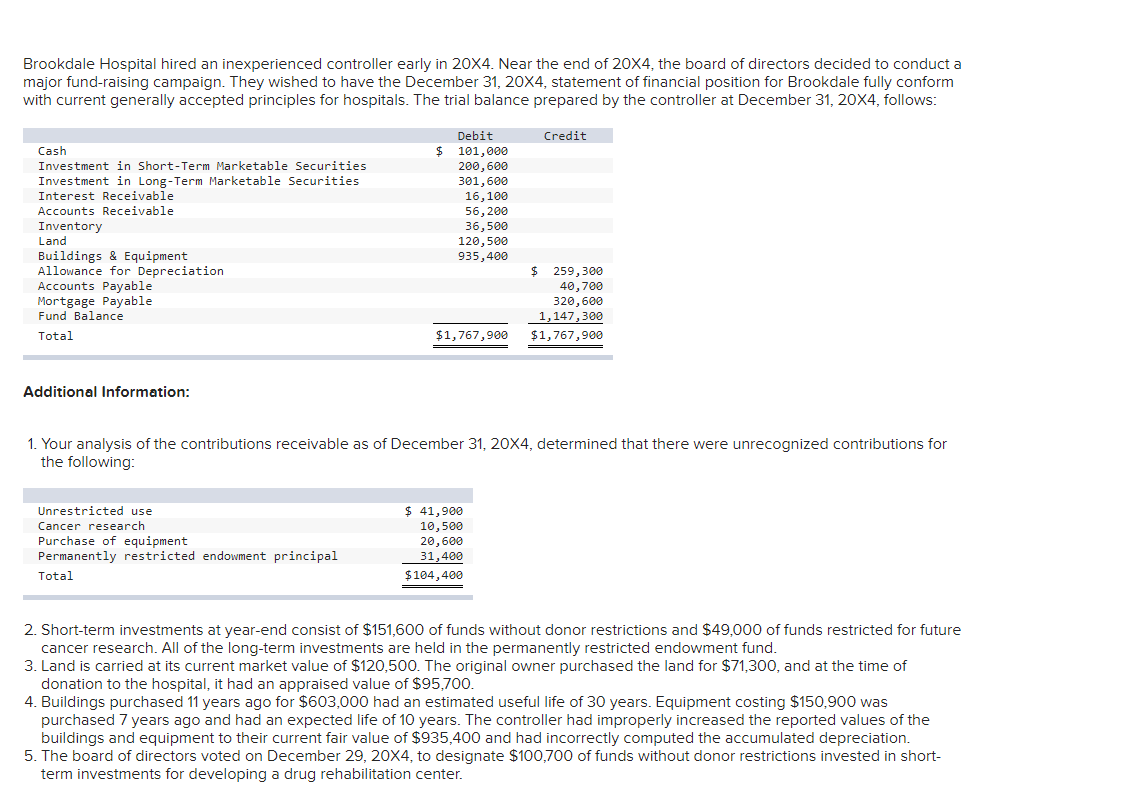

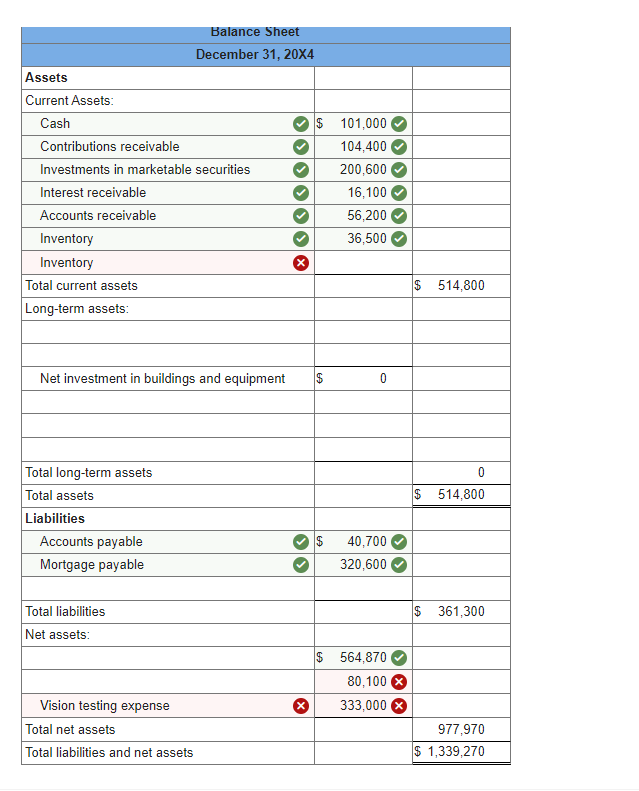

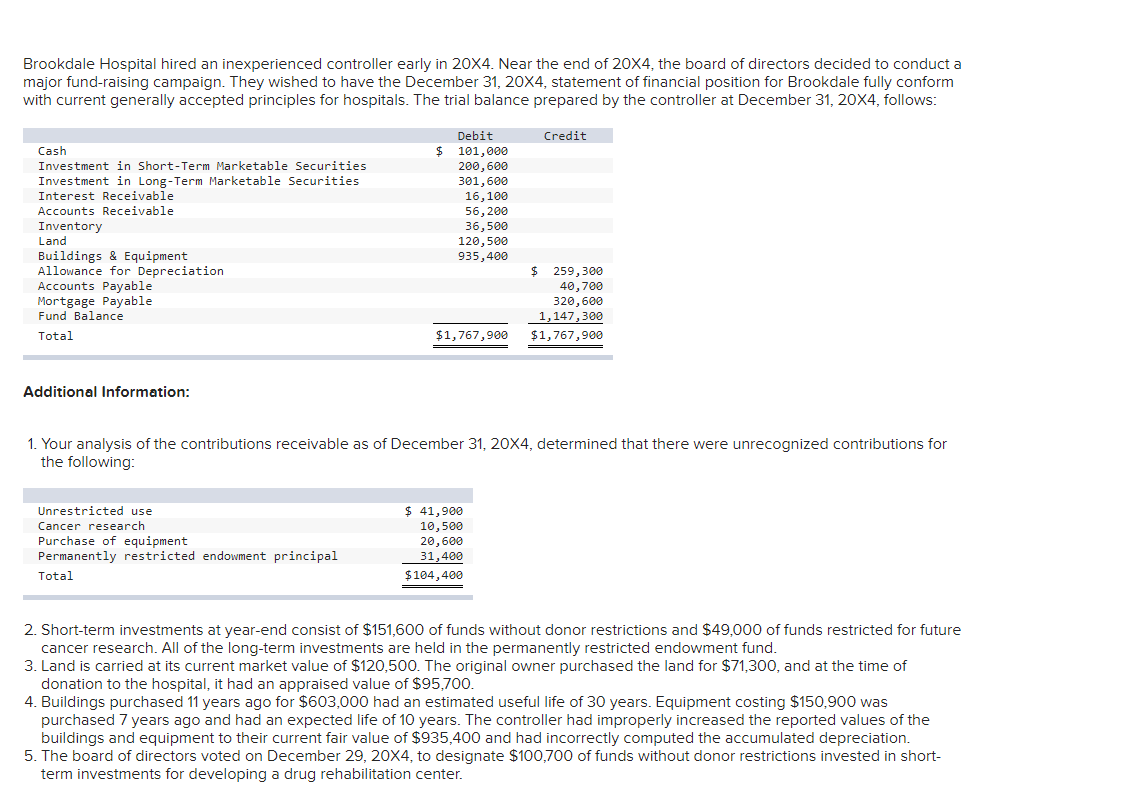

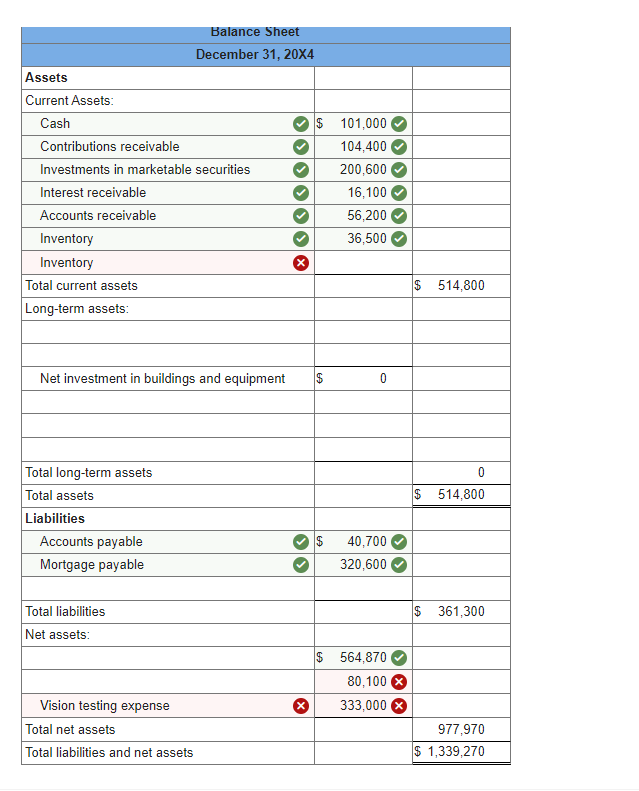

Brookdale Hospital hired an inexperienced controller early in 20X4. Near the end of 20X4, the board of directors decided to conduct a major fund-raising campaign. They wished to have the December 31, 20X4, statement of financial position for Brookdale fully conform with current generally accepted principles for hospitals. The trial balance prepared by the controller at December 31, 20X4, follows: Credit Debit $ 101,000 200,600 301,600 16,100 56,200 36,500 Cash Investment in Short-Term Marketable Securities Investment in Long-Term Marketable Securities Interest Receivable Accounts Receivable Inventory Land Buildings & Equipment Allowance for Depreciation Accounts Payable Mortgage Payable Fund Balance Total 120,500 935,400 $ 259,300 40,700 320,600 1,147,300 $1,767,900 $1,767,900 Additional Information: 1. Your analysis of the contributions receivable as of December 31, 20X4, determined that there were unrecognized contributions for the following: Unrestricted use Cancer research Purchase of equipment Permanently restricted endowment principal Total $ 41,900 10,500 20,600 31,400 $104,400 2. Short-term investments at year-end consist of $151,600 of funds without donor restrictions and $49,000 of funds restricted for future cancer research. All of the long-term investments are held in the permanently restricted endowment fund. 3. Land is carried at its current market value of $120,500. The original owner purchased the land for $71,300, and at the time of donation to the hospital, it had an appraised value of $95,700. 4. Buildings purchased 11 years ago for $603,000 had an estimated useful life of 30 years. Equipment costing $150,900 was purchased 7 years ago and had an expected life of 10 years. The controller had improperly increased the reported values of the buildings and equipment to their current fair value of $935,400 and had incorrectly computed the accumulated depreciation. 5. The board of directors voted on December 29, 20X4, to designate $100,700 of funds without donor restrictions invested in short- term investments for developing a drug rehabilitation center. Balance Sheet December 31, 20X4 Assets Current Assets: Cash $ 101,000 Contributions receivable 104,400 Investments in marketable securities 200,600 Interest receivable 16,100 Accounts receivable 56,200 Inventory 36,500 Inventory Total current assets Long-term assets: $ 514,800 Net investment in buildings and equipment $ 0 0 $ 514,800 Total long-term assets Total assets Liabilities Accounts payable Mortgage payable $ 40,700 320,600 $ 361,300 Total liabilities Net assets: $ 564,870 80,100 333,000 Vision testing expense Total net assets Total liabilities and net assets 977,970 $ 1,339,270