Answered step by step

Verified Expert Solution

Question

1 Approved Answer

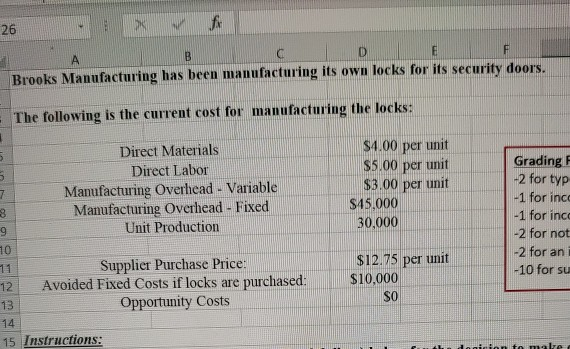

Brooks Manufacturing has been manufacturing its own locks for its security doors. The following is the current cost for manufacturing the locks: Direct Materials Direct

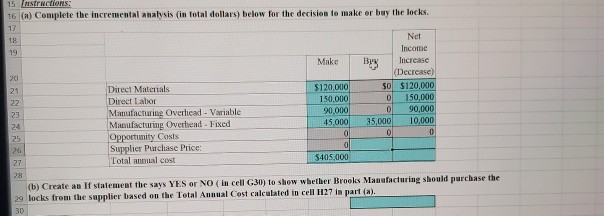

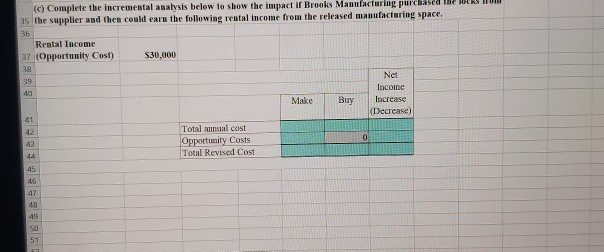

Brooks Manufacturing has been manufacturing its own locks for its security doors. The following is the current cost for manufacturing the locks: Direct Materials Direct Labor Manufacturing Overhead - Variable Manufacturing Overhead - Fixed Unit Production $4.00 per unit $5.00 per unit $3.00 per unit $45.000 30,000 Grading -2 for typ -1 for ind -1 for ind -2 for not -2 for an -10 for su Supplier Purchase Price: Avoided Fixed Costs if locks are purchased: Opportunity Costs $12.75 per unit $10,000 13 15 Instructions: 16 ) Complete the incremental analysis (in total dollars) below for the decision to make or buy the locks Nel Make B Direct Materials Direct Labor Manufacturing Overhead - Variable Manufacturing Overhead - Fixed Opportunity Costs Supplier Purchase Price Total anual cost $120.000 150.000 90.000 45.00 $0 0 0 35.000 Incarne Increate Decrca) $120.000 50,000 90,000 10.000 5-105.000 (b) Create an If statement the says YES or NO (in cell G30) to show whether Brooks Manufacturing should purchase the 29 locks from the supplier based on the Total Annual Cost calculated in cell 1127 In part al. (C) Complete the incremental analysis below to show the impact if Brooks Manufacturing purchased the TOURS TO 35 the supplier and then could earn the following rental income from the released manufacturing space Rental Income 37 (Opportunity Cost) $30,000 Net Make Buy Income Increase Decrease) Total anual cast Opportunity Costs Total Revised Cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started