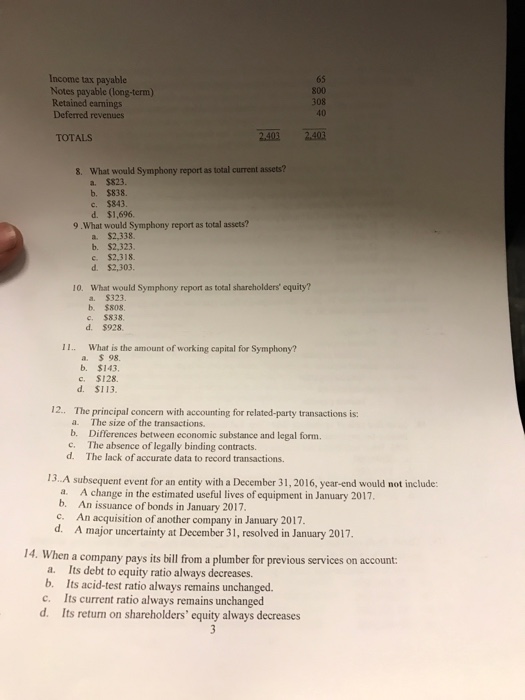

What would symphony report as total current assets? $823. $838. $843. $1, 696. What would Symphony report as total assets? $2, 338. $2, 323. $2, 318. $2, 303. What would Symphony report as total shareholders' equity? $323. $808. $838. $928. What is the amount of working capital for symphony? $ 98. $143. $128. $113. The principal concern with accounting for related-party transactions is: The size of the transactions. Differences between economic substance and legal form. The absence of legally binding contracts. The lack of accurate data to record transactions. A subsequent event for an entity with a December 31, 2016, year-end would not include: A change in the estimated useful lives of equipment in January 2017. An issuance of bonds in January 2017. An acquisition of another company in January 2017. A major uncertainty at December 31, resolved in January 2017. When a company pays its bill from a plumber for previous services on account Its debt to equity ratio always decreases Its acid-test ratio always remains unchanged Its current ratio always remains unchanged Its return on shareholders' equity always decreases What would symphony report as total current assets? $823. $838. $843. $1, 696. What would Symphony report as total assets? $2, 338. $2, 323. $2, 318. $2, 303. What would Symphony report as total shareholders' equity? $323. $808. $838. $928. What is the amount of working capital for symphony? $ 98. $143. $128. $113. The principal concern with accounting for related-party transactions is: The size of the transactions. Differences between economic substance and legal form. The absence of legally binding contracts. The lack of accurate data to record transactions. A subsequent event for an entity with a December 31, 2016, year-end would not include: A change in the estimated useful lives of equipment in January 2017. An issuance of bonds in January 2017. An acquisition of another company in January 2017. A major uncertainty at December 31, resolved in January 2017. When a company pays its bill from a plumber for previous services on account Its debt to equity ratio always decreases Its acid-test ratio always remains unchanged Its current ratio always remains unchanged Its return on shareholders' equity always decreases