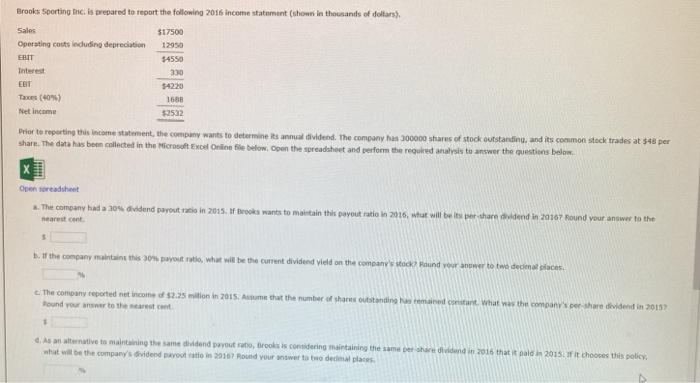

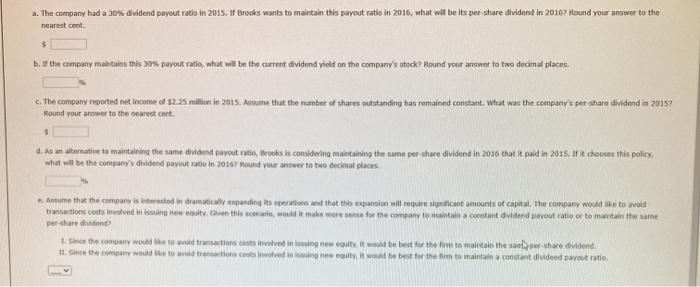

Brooks Sporting Dic. is prepared to report the following 2016 income statement shows in thousands of dollars) Sales $17500 Operating costs lecluding depreciation 12950 ERIT 54550 Tnterest 330 EBI 54220 Taxes (40) 1688 Net Income 2532 Prior to reporting this income statement, the company wants to determine its annual dividend. The company has 300000 shares of stock outstanding and its common stock trades at 548 per share. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions belom. Open treadsheet 2. The company had 10 dividend payout at in 2015. If Brooks wants to maintain this payout ratio in 2016, what will be per share vidend in 20167 Round your answer to the nearest cont 5 b. the company maintain this 30 Dayout ratio, what will be the current dividend vield on the company's stock und vor answer to two decimal places c. The company reported net income $2.5 million in 2015. Andme that the number of share outstanding his temained constant, what was the company's share dividend in 2015 Pound your answer to the start at + d. As an alternative to maintaining the same dividend payout ratio books is considering maintaining the same per se divided in 2015 that old in 2015. If it chooses this policy what will be the company's dividend potatin 29167 Rould your owe to tradeda plates a. The company had a 20% dividend payout ratio in 2015. If Brooks wants to maintain this payout ratio in 2016, what will be its per-share dividend in 20167 Round your answer to the nearest cent $ If the company maitutes this 30% payout ratio, what will be the current dividend yield on the company's stock Round your answer to two decimal bilaces. c. The company reported met Income of $2.25 million in 2015. Assume that the number of shares outstanding has remained constant. What was the company's per share dividend in 2017 Round your answer to the nearest cont. 3 d. As an alternative tu maintaining the same dividend payout ruto, teks is considering maintaining the same per share dividend in 2016 that it paid in 2015. I chooses this polley. what wit be the company's dividend payout ratio in 20107 Hound your answer to two decimal places Arume that the company is thered in dramatically expanding its operation and that the expansion will require significant amounts of capital. The company would he to avoit transactions containvalved in ing new buit. On this scenario, would it make more te for the company to main constant dvided out ratio or to maintain the same Det share dividend 1. Since the company would tow transactions is involved in issuing new city, it would be best for the firm to maintain the same care dividende 1. Since the company would he townsione con involved in swing new it would be best for the firm to maintain a constant dividend payout ratio