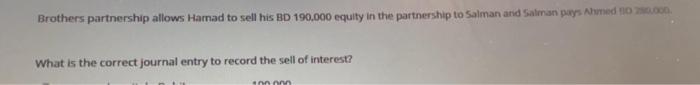

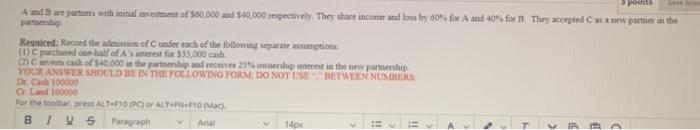

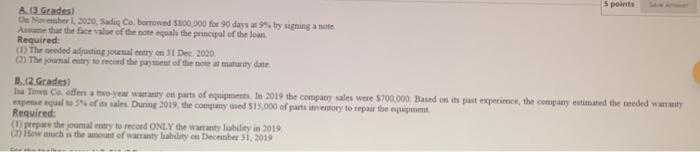

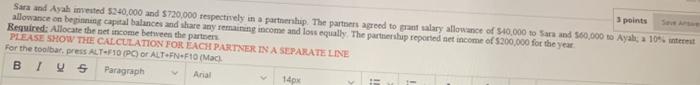

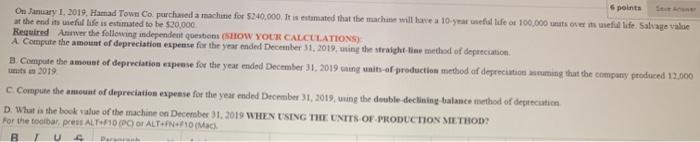

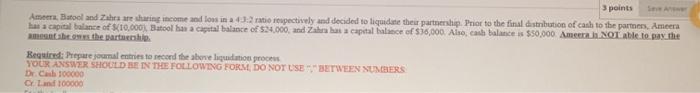

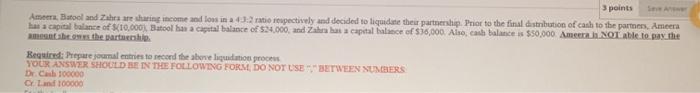

Brothers partnership allows Hamad to sell his BD 190,000 equity in the partnership to Salman and Salman pays Ahed 20.000 What is the correct journal entry to record the sell of interest? an 3 points A and 3 we partners with initial investment of $60,000 and $40,000 rupectively. They share income and low by 60% for A and 40% for 3: They corpted as a new parter in the partnership Required: Record the admission of under each of the following separate sumption (1) purchased coe-half of Aest for $35.000 cash cath of $40,000 in the partnership and receive 35 interest in the new parmi YOUR ANSWER SHOULD BE IN THE FOLLOWINO FORM, DO NOT USE BETWEEN NUMBERS Dr. C 100000 C Land 100000 For the totales ALTF10 PO O ALTFF10 MG I gs Paragraph Arial T 3 5 points 3 Grades! O Nober 2020, Sadiq Co. borrowed $800.000 for 90 days by igning a note A me that the face of the teaquals the principal of the loan Required: (1) the needed using journal entry on 31 Dec. 2020 (2) The only to record the act of the more at maturity date B.12 Grades In Town Cano-year on parts of equips 2019 the company sales were $700.000. Based on its past experience, the company estimated the needed wait expense quals of its sales. During 2019, the company sed $15.000 of a mentory to repair the purent Required: (prepare the youmal try to record ONLY the warranty lubility in 2019 Chow much is the amount of way bality on December 31, 2019 3 points Sara and Ayah vested $340,000 and 5720.000 respectively in a partnp. The parts agreed to a salary allowance of S40.000 to Sara and 560,000 to Ayali: 10% allowance on being capital balances and share any remaining income and loss equally The partnership reported net income of $200,000 for the year Required: Allocate the net income between the partner PLEASE SHOW THE CALCULATION FOR EACH PARTNER IN A SEPARATE LINE For the toolbar, press ALT-10 Por ALTF10 (Mac Blys Paragraph Anal 14px 6 points On January 1, 2019. Hamad Town Co purchased a machine for 5.240,000 ft is estimated that the machine will have a 10-year el lide o 100.000 units over weful life. Salvage value at the end its eful life is estimated to be $20,000 Required Annie the following independent questions (SHOW YOUR CALCULATIONS A Compute the amount of depreciation expense for the year ended December 31, 2019, wing the straight-time method of depreciation B Compute the amount of depreciation expense for the year ended December 31, 2019 ning ait-of production method of defeciation oming that the company produced 12.000 units 2019 Compute the amount of depreciation expense for the year ended December 31, 2019, uning the double declining balance method of depreciation D. What is the book of the machine on December 31, 2019 WHEN USING THE UNITS OF PRODUCTION METHOD For the toolbar, press ALT-10 (C) or ALT FNF 10 (Mac). B U 3 points Ameera Batool and Zahes are sharing income and low in a 43:2 ratio repectively and decided to liquidate their partnership Prior to the final distribution of cash to the partners, Ameera has a capital balance of $10,000) Batool has a capital balance of $24.000, and Zarata capital balance of $36,000. Also, cash balance is $50,000 Ameer. Not able to pay the Show the watch Bequired: pregarejomaleries to record the above laudation process YOUR ANSWER SHOULD BE IN THE FOLLOWING FORM DO NOT USE BETWEEN NUMBERS De Cab 100000 C Lund 100000 Brothers partnership allows Hamad to sell his BD 190,000 equity in the partnership to Salman and Salman pays Ahed 20.000 What is the correct journal entry to record the sell of interest? an 3 points A and 3 we partners with initial investment of $60,000 and $40,000 rupectively. They share income and low by 60% for A and 40% for 3: They corpted as a new parter in the partnership Required: Record the admission of under each of the following separate sumption (1) purchased coe-half of Aest for $35.000 cash cath of $40,000 in the partnership and receive 35 interest in the new parmi YOUR ANSWER SHOULD BE IN THE FOLLOWINO FORM, DO NOT USE BETWEEN NUMBERS Dr. C 100000 C Land 100000 For the totales ALTF10 PO O ALTFF10 MG I gs Paragraph Arial T 3 5 points 3 Grades! O Nober 2020, Sadiq Co. borrowed $800.000 for 90 days by igning a note A me that the face of the teaquals the principal of the loan Required: (1) the needed using journal entry on 31 Dec. 2020 (2) The only to record the act of the more at maturity date B.12 Grades In Town Cano-year on parts of equips 2019 the company sales were $700.000. Based on its past experience, the company estimated the needed wait expense quals of its sales. During 2019, the company sed $15.000 of a mentory to repair the purent Required: (prepare the youmal try to record ONLY the warranty lubility in 2019 Chow much is the amount of way bality on December 31, 2019 3 points Sara and Ayah vested $340,000 and 5720.000 respectively in a partnp. The parts agreed to a salary allowance of S40.000 to Sara and 560,000 to Ayali: 10% allowance on being capital balances and share any remaining income and loss equally The partnership reported net income of $200,000 for the year Required: Allocate the net income between the partner PLEASE SHOW THE CALCULATION FOR EACH PARTNER IN A SEPARATE LINE For the toolbar, press ALT-10 Por ALTF10 (Mac Blys Paragraph Anal 14px 6 points On January 1, 2019. Hamad Town Co purchased a machine for 5.240,000 ft is estimated that the machine will have a 10-year el lide o 100.000 units over weful life. Salvage value at the end its eful life is estimated to be $20,000 Required Annie the following independent questions (SHOW YOUR CALCULATIONS A Compute the amount of depreciation expense for the year ended December 31, 2019, wing the straight-time method of depreciation B Compute the amount of depreciation expense for the year ended December 31, 2019 ning ait-of production method of defeciation oming that the company produced 12.000 units 2019 Compute the amount of depreciation expense for the year ended December 31, 2019, uning the double declining balance method of depreciation D. What is the book of the machine on December 31, 2019 WHEN USING THE UNITS OF PRODUCTION METHOD For the toolbar, press ALT-10 (C) or ALT FNF 10 (Mac). B U 3 points Ameera Batool and Zahes are sharing income and low in a 43:2 ratio repectively and decided to liquidate their partnership Prior to the final distribution of cash to the partners, Ameera has a capital balance of $10,000) Batool has a capital balance of $24.000, and Zarata capital balance of $36,000. Also, cash balance is $50,000 Ameer. Not able to pay the Show the watch Bequired: pregarejomaleries to record the above laudation process YOUR ANSWER SHOULD BE IN THE FOLLOWING FORM DO NOT USE BETWEEN NUMBERS De Cab 100000 C Lund 100000