Answered step by step

Verified Expert Solution

Question

1 Approved Answer

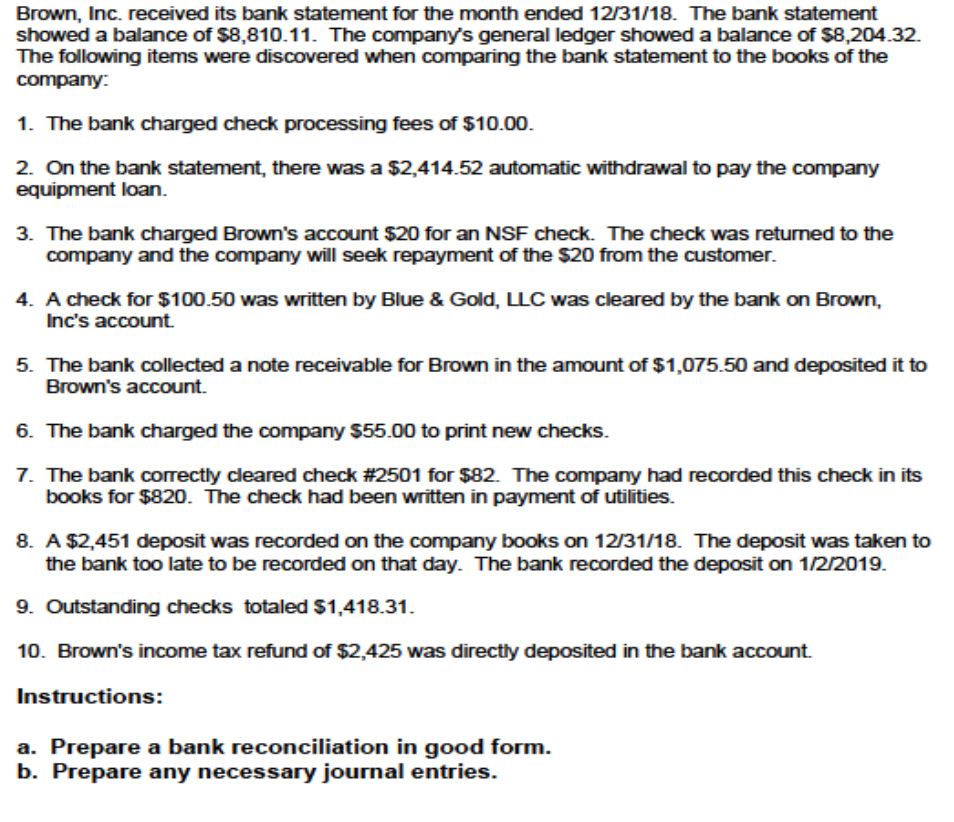

Brown, Inc. received its bank statement for the month ended 12/31/18. The bank statement showed a balance of $8,810.11. The company's general ledger showed a

Brown, Inc. received its bank statement for the month ended 12/31/18. The bank statement showed a balance of \$8,810.11. The company's general ledger showed a balance of \$8,204.32. The following items were discovered when comparing the bank statement to the books of the company: 1. The bank charged check processing fees of $10.00. 2. On the bank statement, there was a $2,414.52 automatic withdrawal to pay the company equipment loan. 3. The bank charged Brown's account $20 for an NSF check. The check was returned to the company and the company will seek repayment of the $20 from the customer. 4. A check for $100.50 was written by Blue \& Gold, LC was cleared by the bank on Brown, Inc's account. 5. The bank collected a note receivable for Brown in the amount of $1,075.50 and deposited it to Brown's account. 6. The bank charged the company $55.00 to print new checks. 7. The bank correctly cleared check #2501 for $82. The company had recorded this check in its books for $820. The check had been written in payment of utilities. 8. A $2,451 deposit was recorded on the company books on 12/31/18. The deposit was taken to the bank too late to be recorded on that day. The bank recorded the deposit on 1/2/2019. 9. Outstanding checks totaled $1,418.31. 10. Brown's income tax refund of $2,425 was directly deposited in the bank account. Instructions: a. Prepare a bank reconciliation in good form. b. Prepare any necessary journal entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started