Brown transfers Blackacre to XYZ Corp., a newly formed corporation, in exchange for 140 shares of its common stock having a FMV of $70,000.

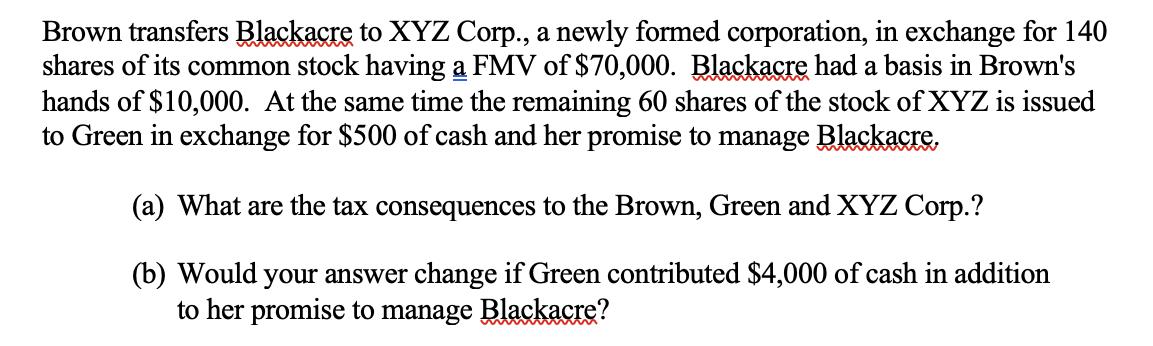

Brown transfers Blackacre to XYZ Corp., a newly formed corporation, in exchange for 140 shares of its common stock having a FMV of $70,000. Blackacre had a basis in Brown's hands of $10,000. At the same time the remaining 60 shares of the stock of XYZ is issued to Green in exchange for $500 of cash and her promise to manage Blackacre. (a) What are the tax consequences to the Brown, Green and XYZ Corp.? (b) Would your answer change if Green contributed $4,000 of cash in addition to her promise to manage Blackacre?

Step by Step Solution

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Brown Troms fero v140shanes to x yz wwtn 1700...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started