In January 2007 Ashley purchased a house in Strathfield for $1,184,500. Ashley lived in the Strathfield house until July 2011 when she accepted a

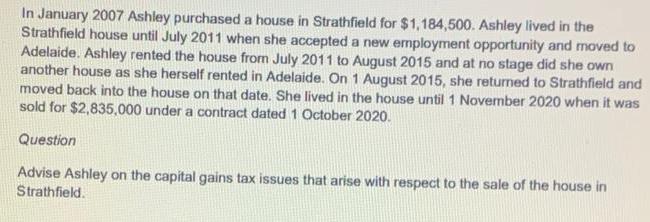

In January 2007 Ashley purchased a house in Strathfield for $1,184,500. Ashley lived in the Strathfield house until July 2011 when she accepted a new employment opportunity and moved to Adelaide. Ashley rented the house from July 2011 to August 2015 and at no stage did she own another house as she herself rented in Adelaide. On 1 August 2015, she returmed to Strathfield and moved back into the house on that date. She lived in the house until 1 November 2020 when it was sold for $2,835,000 under a contract dated 1 October 2020. Question Advise Ashley on the capital gains tax issues that arise with respect to the sale of the house in Strathfield.

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Capital Gains Tax It is the tax levied by the government on the profits realized on ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started