Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions: Either individually or in groups of up to 4 people (please include the names of all group members on the submission) complete the

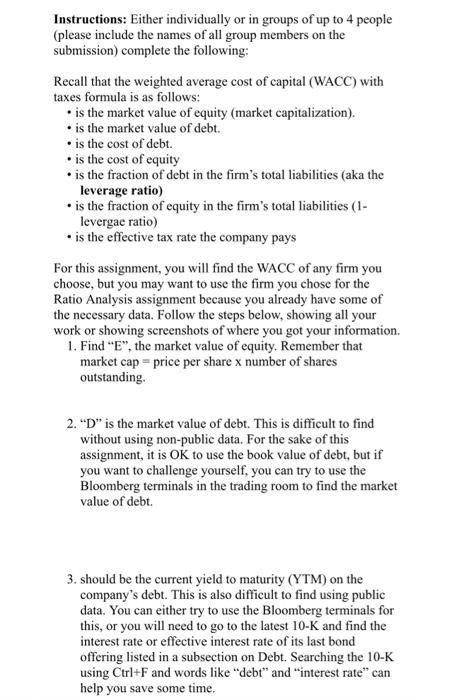

Instructions: Either individually or in groups of up to 4 people (please include the names of all group members on the submission) complete the following: Recall that the weighted average cost of capital (WACC) with taxes formula is as follows: is the market value of equity (market capitalization). is the market value of debt. is the cost of debt. is the cost of equity is the fraction of debt in the firm's total liabilities (aka the leverage ratio) is the fraction of equity in the firm's total liabilities (1- levergae ratio) is the effective tax rate the company pays For this assignment, you will find the WACC of any firm you choose, but you may want to use the firm you chose for the Ratio Analysis assignment because you already have some of the necessary data. Follow the steps below, showing all your work or showing screenshots of where you got your information. 1. Find "E", the market value of equity. Remember that market cap = price per share x number of shares outstanding. 2. "D" is the market value of debt. This is difficult to find without using non-public data. For the sake of this assignment, it is OK to use the book value of debt, but if you want to challenge yourself, you can try to use the Bloomberg terminals in the trading room to find the market value of debt. 3. should be the current yield to maturity (YTM) on the company's debt. This is also difficult to find using public data. You can either try to use the Bloomberg terminals for this, or you will need to go to the latest 10-K and find the interest rate or effective interest rate of its last bond offering listed in a subsection on Debt. Searching the 10-K using Ctrl+F and words like "debt" and "interest rate" can help you save some time.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Find E the market value of equity Remember that market cap price per share x number of shares outstanding Answer The market value of equity E is cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started