Question

Broxton Group, a consumer electronics conglomerate, is reviewing its annual budget in wireless technology. It is considering investments in three different technologies to develop wireless

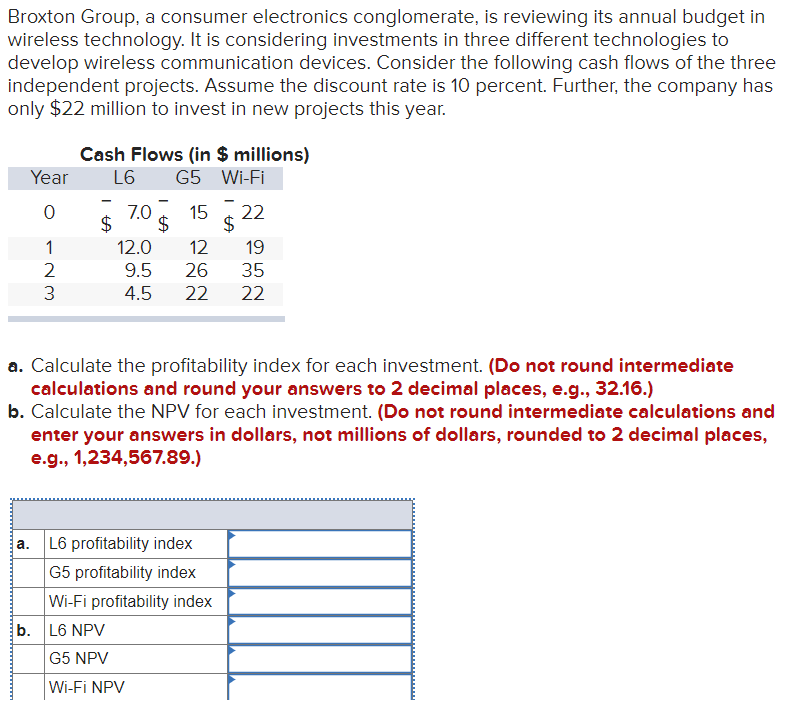

Broxton Group, a consumer electronics conglomerate, is reviewing its annual budget in wireless technology. It is considering investments in three different technologies to develop wireless communication devices. Consider the following cash flows of the three independent projects. Assume the discount rate is 10 percent. Further, the company has only $22 million to invest in new projects this year. Cash Flows (in $ millions) Year L6 G5 Wi-Fi 0 bar($)7.0 15 bar($)^(22) 1 12.0 12 19 2 9.5 26 35 3 4.5 22 22 a. Calculate the profitability index for each investment. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Calculate the NPV for  each investment. (Do not round intermediate calculations and enter

each investment. (Do not round intermediate calculations and enter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started