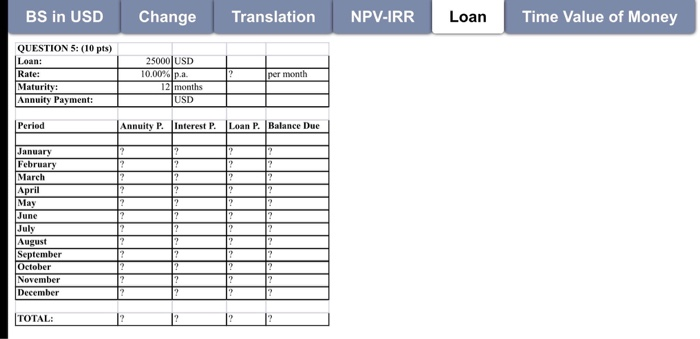

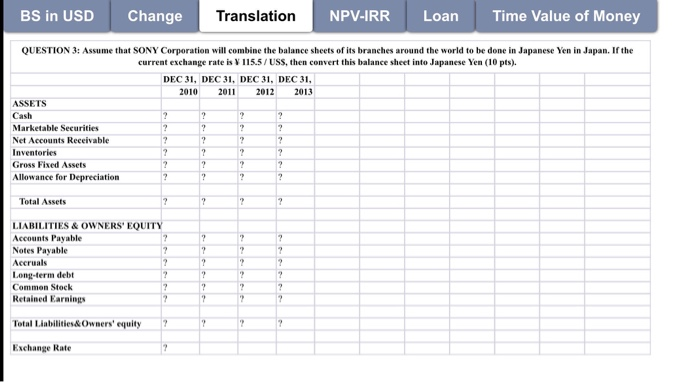

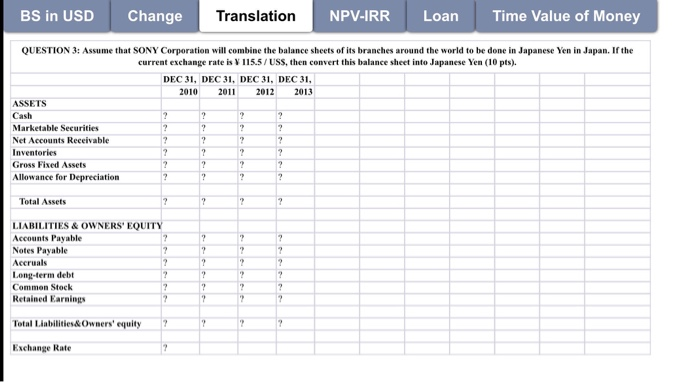

BS in USD Change Translation NPV-IRR Loan Time Value of Money QUESTION 5: (10 pts) Loan: Rate: Maturity: Annuity Payment: ? per month 25000 USD 10.00% pa. 12 months USD Period Annuity P. Interest P. Loan P. Balance Due 2 ? ? 1? 2 ? ? 2 January February March April May June July August September October November December ? ? 2 7 ? TOTAL: BS in USD Change Translation NPV-IRR Loan Time Value of Money QUESTION 3: Assume that SONY Corporation will combine the balance sheets of its branches around the world to be done in Japanese Yen in Japan. If the current exchange rate is 115.5/USS, then convert this balance sheet into Japanese Yen (10 pts). DEC 31, DEC 31, DEC 31, DEC 31, 2010 2012 2013 ASSETS Cash ? ? 2 ? Marketable Securities 2 ? ? ? Net Accounts Receivable ? ? ? ? Inventories 2 ? 2 ? Gross Fixed Assets 2 ? 2 ? Allowance for Depreciation ? ? 2 ? 2011 Total Assets ? 2 2 ? ? LIABILITIES & OWNERS' EQUITY Accounts Payable Notes Payable 7 Accruals 2 Long-term debt ? Common Stock ? Retained Earnings 2 ? ? ? ? ? 2 2 ? ? ? ? ? 2 2 2 Total Liabilities & Owners' equity 2 2 2 ? Exchange Rate ? BS in USD Change Translation NPV-IRR Loan Time Value of Money QUESTION 5: (10 pts) Loan: Rate: Maturity: Annuity Payment: ? per month 25000 USD 10.00% pa. 12 months USD Period Annuity P. Interest P. Loan P. Balance Due 2 ? ? 1? 2 ? ? 2 January February March April May June July August September October November December ? ? 2 7 ? TOTAL: BS in USD Change Translation NPV-IRR Loan Time Value of Money QUESTION 3: Assume that SONY Corporation will combine the balance sheets of its branches around the world to be done in Japanese Yen in Japan. If the current exchange rate is 115.5/USS, then convert this balance sheet into Japanese Yen (10 pts). DEC 31, DEC 31, DEC 31, DEC 31, 2010 2012 2013 ASSETS Cash ? ? 2 ? Marketable Securities 2 ? ? ? Net Accounts Receivable ? ? ? ? Inventories 2 ? 2 ? Gross Fixed Assets 2 ? 2 ? Allowance for Depreciation ? ? 2 ? 2011 Total Assets ? 2 2 ? ? LIABILITIES & OWNERS' EQUITY Accounts Payable Notes Payable 7 Accruals 2 Long-term debt ? Common Stock ? Retained Earnings 2 ? ? ? ? ? 2 2 ? ? ? ? ? 2 2 2 Total Liabilities & Owners' equity 2 2 2 ? Exchange Rate