Question

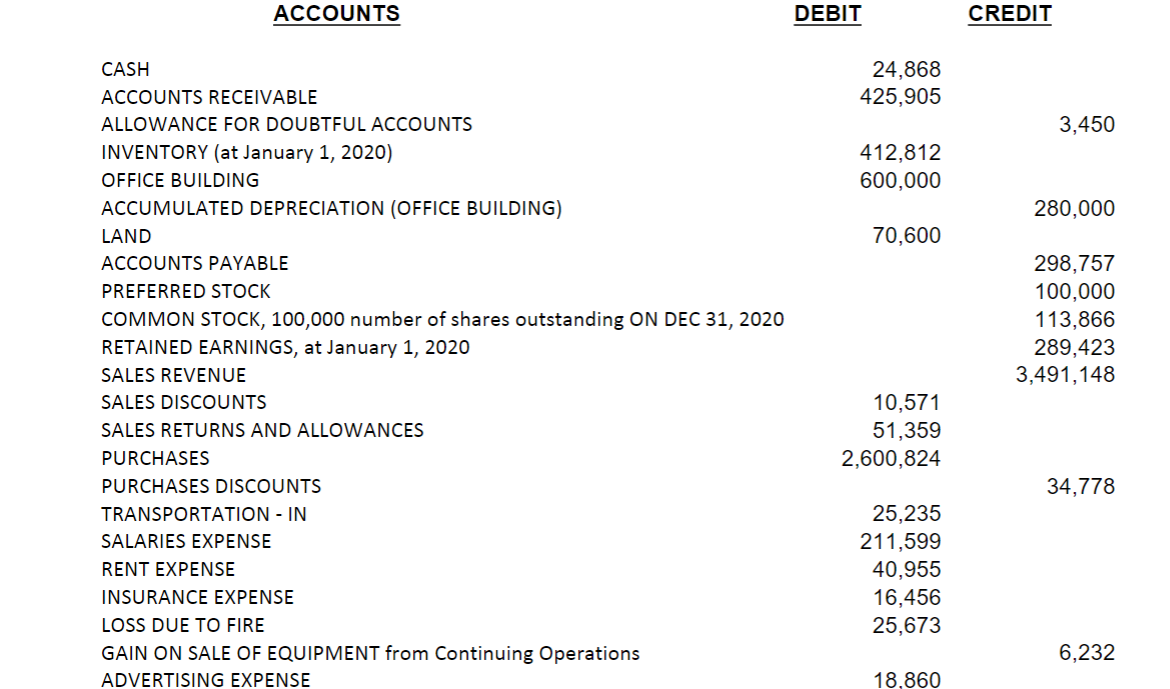

BUDDY CORPORATION ADJUSTED TRIAL BALANCE DECEMBER 31, 2020 ADDITIONAL INFORMATION: 1. The company performed a year end physical count of its inventory as at December

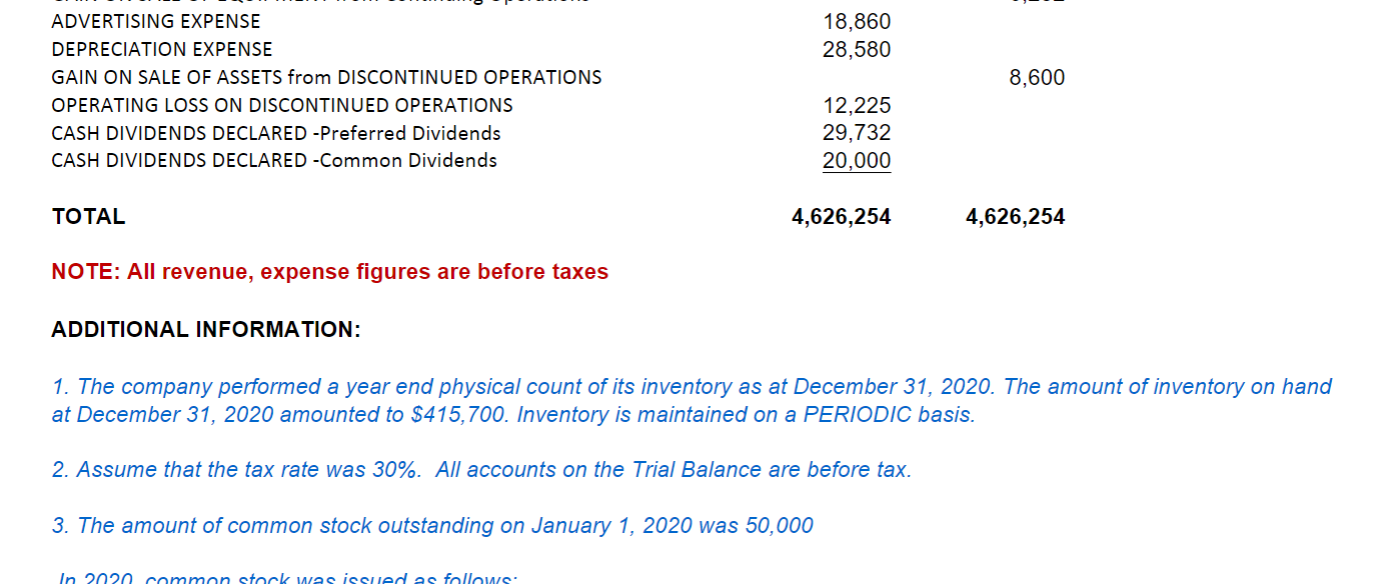

BUDDY CORPORATION ADJUSTED TRIAL BALANCE DECEMBER 31, 2020 ADDITIONAL INFORMATION: 1. The company performed a year end physical count of its inventory as at December 31, 2020. The amount of inventory on hand at December 31, 2020 amounted to $415,700. Inventory is maintained on a PERIODIC basis. 2. Assume that the tax rate was 30%. All accounts on the Trial Balance are before tax. 3. The amount of common stock outstanding on January 1, 2020 was 50,000 In 2020, common stock was issued as follows: on April 1: 20,000 common shares were issued and on September 1: 30,000 common shares were issued. 4. An error was discovered in the company's 2019 financial statements. Depreciation Expense in 2019 was understated by $35,000. REQUIRED: 1. a detailed multi-step income statement (including EPS presentation) for the year ended December 31, 2020. Show calculations for EPS (for continuing and discontinued sections) Show details of COST OF GOODS SOLD and OPERATING EXPENSES sections. 2. a Statement of Retained Earnings for the year ended December 31, 2020.

ADDITIONAL INFORMATION: 1. The company performed a year end physical count of its inventory as at December 31, 2020. The amount of inventory on hand at December 31, 2020 amounted to $415,700. Inventory is maintained on a PERIODIC basis. 2. Assume that the tax rate was 30%. All accounts on the Trial Balance are before tax. 3. The amount of common stock outstanding on January 1, 2020 was 50,000 In 2020, common stock was issued as follows: on April 1: 20,000 common shares were issued and on September 1: 30,000 common shares were issued. 4. An error was discovered in the company's 2019 financial statements. Depreciation Expense in 2019 was understated by $35,000. REQUIRED: 1. a detailed multi-step income statement (including EPS presentation) for the year ended December 31, 2020. Show calculations for EPS (for continuing and discontinued sections) Show details of COST OF GOODS SOLD and OPERATING EXPENSES sections. 2. a Statement of Retained Earnings for the year ended December 31, 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started