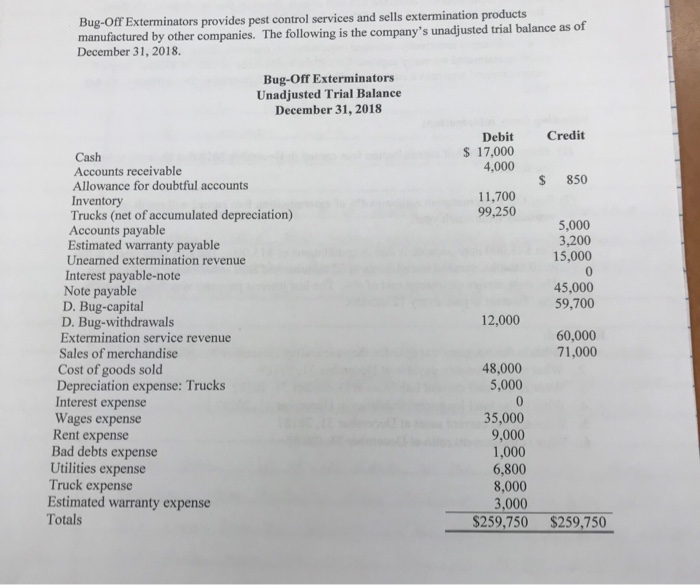

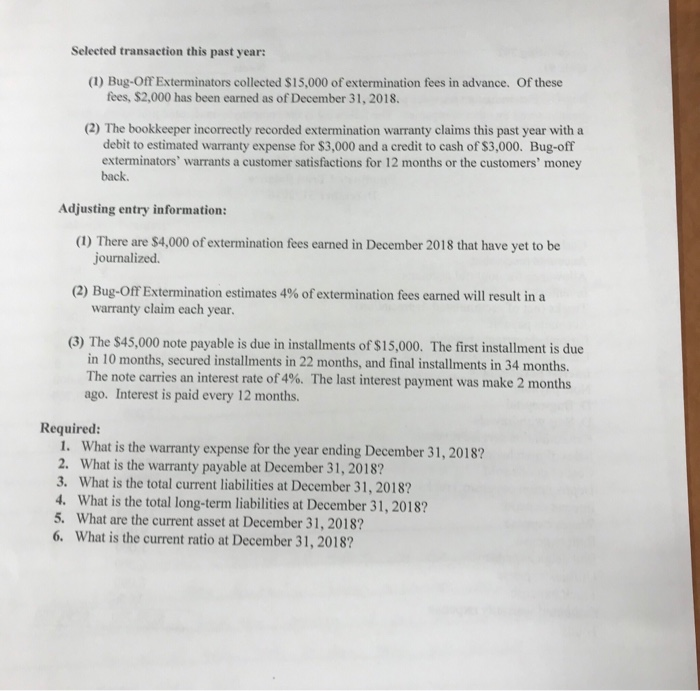

Bug-Off Exterminators provides pest control services and sells extermination products manufactured by other companies. The following is the company's unadj December 31, 2018. usted trial balance as of Bug-Off Exterminators Unadjusted Trial Balance December 31, 2018 Debit Credit 4,000 11,700 Cash 17,000 Accounts receivable Allowance for doubtful accounts $ 850 Inventory Trucks (net of accumulated depreciation) 99,250 5,000 3,200 15,000 Accounts payable Estimated warranty payable Unearned extermination revenue Interest payable-note 45,000 59,700 Note payable D. Bug-capital D. Bug-withdrawals Extermination service revenue Sales of merchandise Cost of goods sold Depreciation expense: Trucks Interest expense Wages expense 2000 ,000 71,000 48,000 5,000 35,000 9,000 1,000 6,800 8,000 3,000 Rent expense Bad debts expense Utilities expense Truck expense Estimated warranty expense Totals $259,750 $259,750 Selected transaction this past year: (1) Bug-Off Exterminators collected $15,000 of extermination fees in advance. Of these fees, $2,000 has been earned as of December 31, 2018. (2) The bookkeeper incorrectly recorded extermination warranty claims this past year with a debit to estimated warranty expense for $3,000 and a credit to cash of $3,000. Bug-off exterminators' warrants a customer satisfactions for 12 months or the customers' money back. Adjusting entry information: (1) There are $4,000 of extermination fees earned in December 2018 that have yet to be journalized (2) Bug-Off Extermination estimates 4% of extermination fees earned will result in a warranty claim each year. (3) The $45,000 note payable is due in installments of $15,000. The first installment is due in 10 months, secured installments in 22 months, and final installments in 34 months. The note carries an interest rate of 4%. The last interest payment was make 2 months ago. Interest is paid every 12 months Required: 1. What is the warranty expense for the year ending December 31, 2018? 2. What is the warranty payable at December 31, 2018? 3. What is the total current liabilities at December 31, 2018? 4. What is the total long-term liabilities at December 31,2018? 5. What are the current asset at December 31, 2018? 6. What is the current ratio at December 31, 2018