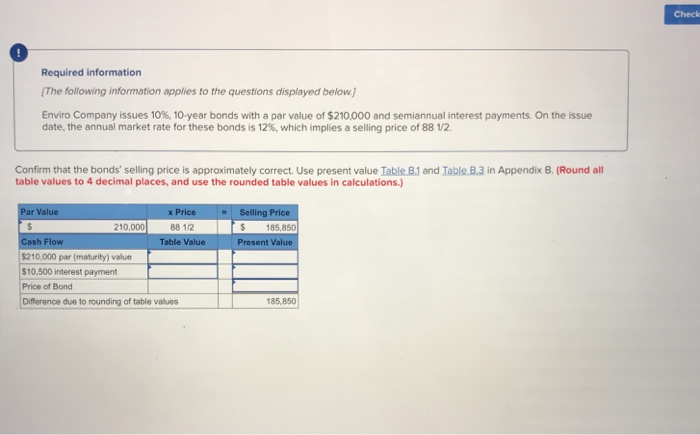

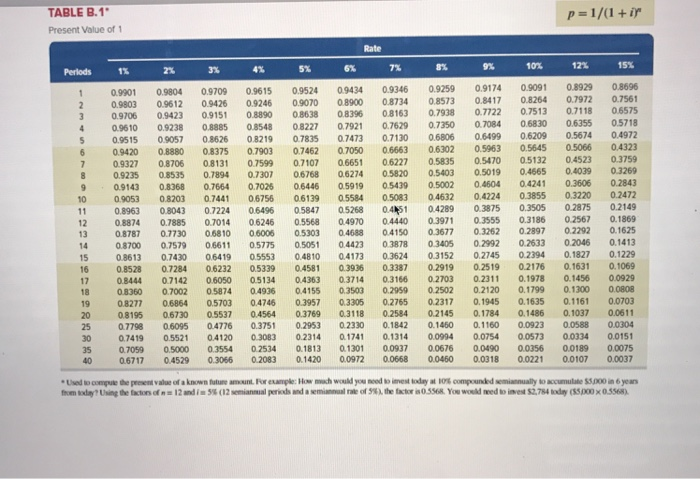

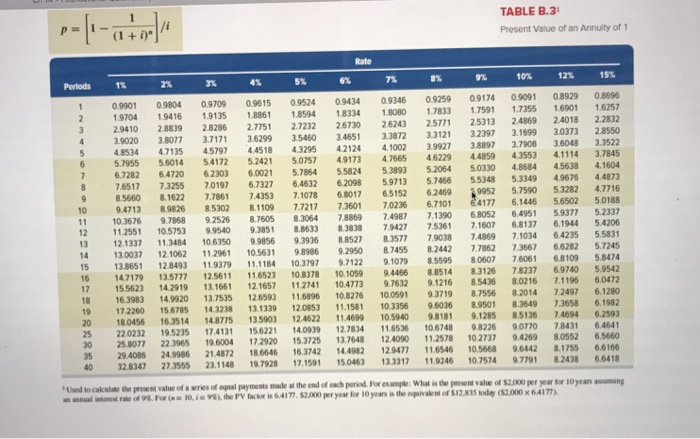

Check Required information The following information applies to the questions displayed below. Enviro Company issues 10%, 10-year bonds with a par value of $210,000 and semiannual interest payments. On the issue date, the annual m arket rate for these bonds is 12%, which implies a selling price of 88 12. Confirm that the bonds' selling price is approximately correct. Use present value Table B.1 and Table B.3 in Appendix B. (Round all table values to 4 decimal places, and use the rounded table values in calculations) x PriceSelling Price 88 1/2 Par Value 210,000 $ 185 Present Value h Flow $210,000 par (maturity) value $10,500 interest payment Price of Bond Difference due to rounding of table values Table Value 85,850 TABLE B.1 Present Value of 1 Rate 15% 4% 4% Periods 0.9901 0.9804 0.9709 09615 0.9524 09434 0.9346 0.9259 0.9174 09091 0.8929 0.8696 0.9803 0.9612 0.9426 09246 09070 0890 0.8734 08573 08417 0.8264 0.7972 0.7561 0.9706 0.9423 9151 0889 08638 0836 08163 07938 0.7722 0.7513 0.7118 0.6575 40.9610 0.9238 0.8885 08548 08227 0.7921 0.7629 0.7350 0.7084 0.6830 0.6355 05718 0.9515 0.90570.626 08219 07835 07473 0.7130 06806 06499 0.6209 0.5674 0.4972 6 0.9420 0.8880 0.8375 0.7903 07462 07050 0.6663 0.6302 05963 0.5645 0.5066 0.4323 0.9327 0.8706 08131 07599 0.7107 06651 06227 0.5835 0.5470 05132 04523 0.3759 8 0.9235 08535 0.7894 07307 06768 06274 05820 0.5403 0.5019 0.4665 0.4039 0.3269 9 0.9143 0.8368 0.7664 0.7026 06446 05919 05439 500 0.4604 0.4241 03606 0.2843 10 09053 08203 07441 06756 06139 a5584 0.5083 4632 0.4224 0.3855 03220 0.2472 11 0.8963 08043 07224 06496 05847 05268 041 0.4289 0.3875 0.3505 0.2875 0.2149 12 0.8874 0.7885 0.7014 06246 05568 04970 04440 03971 0.3555 0.3186 02567 0.1869 13 08787 07730 06810 06006 5303 0.4688 04150 0.3677 0.3262 0.2897 0.2292 0.1625 14 0.8700 0.7579 06611 05775 50 04423 0.3878 0.3405 02992 02633 02046 0.1413 15 0.8613 07430 06419 05553 0.4810 04173 0.3624 0.3152 0.2745 0.2394 0.1827 0.1229 6 0.8528 0.7284 06232 05339 0458 0.3936 0.3387 02919 0.2519 0.2176 0.1631 0.1069 17 0.8444 0.7142 06050 05134 04363 0.3714 0.3166 0.2703 0.2311 0.1978 0.1456 00929 18 08360 07002 05874 04936 0.4155 0.3503 0.2959 02502 0.2120 0.1799 0.1300 0.0808 19 0.8277 06864 05703 04746 0.3957 03305 0.2765 0.2317 0.1945 0.1635 0.1161 0.0703 20 08195 0.6730 05537 0.4564 0.3769 03118 0.2584 02145 0.1784 0.1486 0.1037 0.0611 25 07798 06095 04776 0.3751 0.2953 02330 0.1842 0.140 0.1160 00923 0.0588 00304 30 0.7419 0.5521 0.4120 0.3083 0.2314 074 01314 0994 0.0754 005730.0334 0.0151 35 0.7059 0.5000 03554 0.2534 0.1813 30 00937 00676 0.0490 00356 0.0189 0.0075 40 06717 04529 0.3066 0.2083 0.1420 0092 00668 00460 00318 0022 00107 0.0037 Used to compule the present value of a known future amount For example: How mch would you meed to innest today at 8t compounded semiannually to accumulate $3,000 in 6 year 1 TABLE B.3 Present Value of an Annuity of 1 15% 7% 09709 09615 09524 09434 09346 09259 09174 09091 08929 0.8696 19704 1.9416 19135 1861 18594 18334 18080 1.7833 1591 1.7355 1.6901 1625 09901 .9804 2.4869 24018 2.2832 5460 34651 3.3872 3312 32397 3.1699 30373 28550 3 2.9410 28839 28286 27751 27232 26730 26243 25771 25313 37171 3.6299 3.9020 3.8077 4.8534 4.7135 45797 4.4518 4.3295 421244.10023.9927 38897 3 0757 49173 47665 46229 44859 43553 4111 3.7845 303 6.001 57 55824 53893 5.2064 50330 48684 45638 4.1604 76.4632 6.2098 5.9713 5.7466 55348 5.3349 49676 44873 5.6014 54172 6.7282 64720 6 76517 7.3255 85660 8.1622 7.7861 74353 7.1078 68017 65152 62460 9952 47716 5.7590 53282 771 0236 6.7101 64177 6.144656502 5.0188 71390 8052 6.4951 5937 52337 9540 93851 8633 3 7,9427 5361 7.1607 68137 6.1944 5.426 10 94713 9826 8502 1109 77217 73601 11 10.3676 9.7868 9.2526 8.7605 8.3064 7.8869 7.4987 2 112551 10.5753 8.8527 83577 14 130037 12.1062 1261 10.5631 9.8986 9.290 87455 8.2442 15 13.8651 128493 119379 11.1184 10.3797 97122 91079 85595 80607 147179 135777 125611 116523 108378 6.0472 17 155623 142919 13.1661 12.1657 112741 10.4773 9.7632 9.1216 85436 80216 7.1196 18 16.3983 14.9920 13.7535 19 17.2260 156785 14.3238 13.1339 161896 10.8276 100591 93719 87556 8.2014 72497 6.1280 120853 11.1581 10.3356 9.6036 89501 8.3649 7.3658 6.1982 180456 16.3514 148775 13503 12.4622 11.4699 10.5940 98181 9.1285 85136 7.4694 62593 220232 19.5235 174131 156221 12734 11.6536 10.6748 98226 90770 78431 6.4641 19.6004 17.2920 153725 13.7648 12.4090 11.2578 102737 94269 80552 6.5660 35 294086 24 9986 21.4872 18.6646 16.3742 144982 129477 11.6546 ,0.5668 96442 1755 66100 133317 11.9246 10.7574 9.7791 82438 6.6418 13 0 25.8077 22.3965 19.6004 40 32.8347 27.3555 23.1148 19.7928 17.1591 15.0463 mole the end of each period lor example: what te penent value or smo poryenr ioyears amng