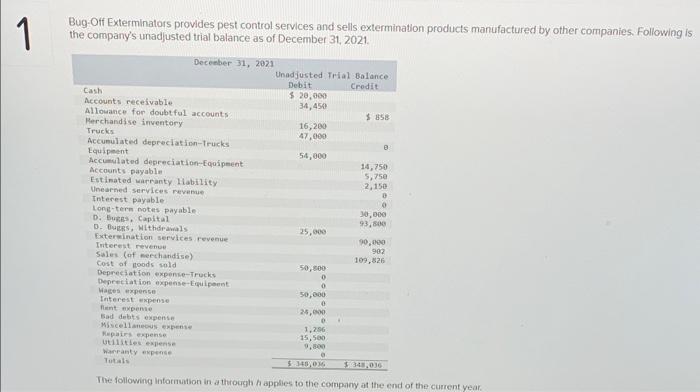

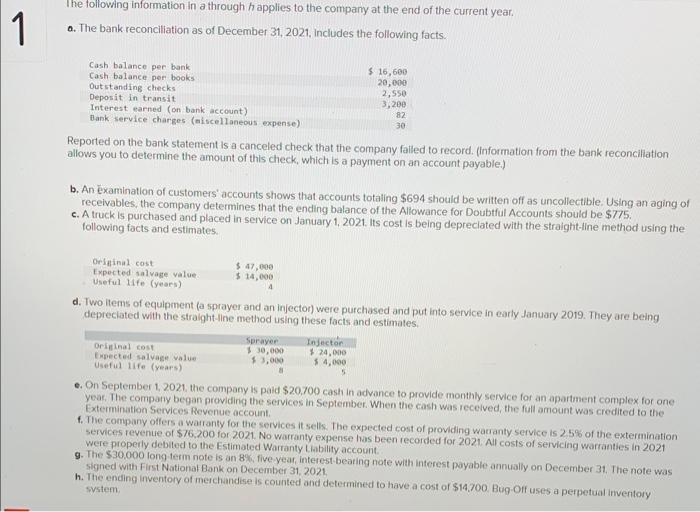

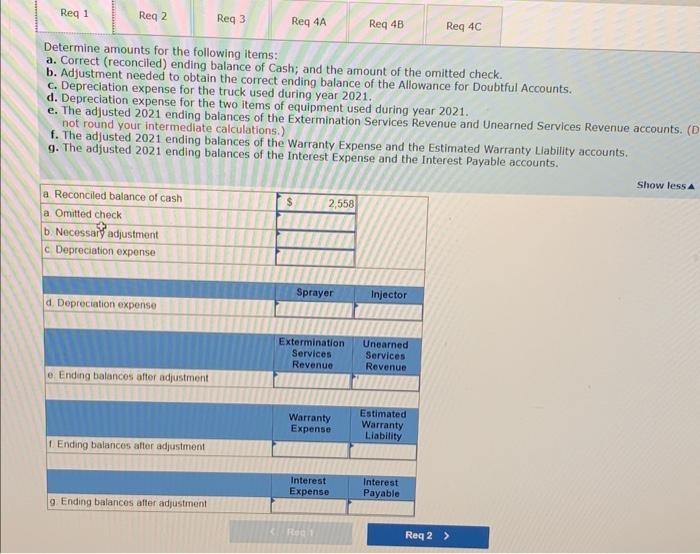

Bug-Off Exterminators provides pest control services and sells extermination products manufactured by other companies. Following is the company's unadjusted trial balance as of December 31,2021. The following Intornuation in a through f applies to the company at the end of the curent year. The following information in a through h applies to the company at the end of the current year. o. The bank reconciliation as of December 31, 2021, includes the following facts. Reported on the bank statement is a canceled check that the company falled to record. (information from the bank reconciliation allows you to determine the amount of this check, which is a payment on an account payable.) receivables, the company determines that the ending balance of the Allowance for Doubtful Accounts should be $775. c. A truck is purchased and placed in service on January 1, 2021. It cost is being depreclated with the straight-line method using the following facts and estimates. d. Two items of equipment (a sprayer and an injector) were purchased and put into service in early January 2019. They are being depreciated with the straight-line method using these facts and estimates, e. On September 1, 2021, the company is paid $20700 cash in advance to provide monthly service for an apartment complex for one year. The company began providing the services in September. When the cash was recelved, the full amount was credited to the Extermination Services Revenue account. f. The company offers a warranty for the services it sells. The expected cost of providing watranty service is 25% of the extermination services revenue of \$76,200 for 2021 . No warranty expense has been recorded for 2021 . All costs of servicing warranties in 2021 were properly debited to the Estimated Warranty Liability account. 9. The $30.000 long-term note is an 8 g, five -year, interest-beating note with interest payable annually on December 31 . The note was signed with First National Bank on December 31,2021. h. The ending inventory of merchandise is counted and determined to have a cost of $14.700. Bug-Oif uses a perpetual inventory Determine amounts for the following items: a. Correct (reconciled) ending balance of Cash; and the amount of the omitted check. b. Adjustment needed to obtain the correct ending balance of the Allowance for Doubtful Accounts. c. Depreciation expense for the truck used during year 2021. d. Depreciation expense for the two items of equipment used during year 2021. e. The adjusted 2021 ending balances of the Extermination Services Revenue and Unearned Services Revenue accounts. not round your intermediate calculations.) f. The adjusted 2021 ending balances of the Warranty Expense and the Estimated Warranty Liability accounts. 9. The adjusted 2021 ending balances of the Interest Expense and the Interest Payable accounts