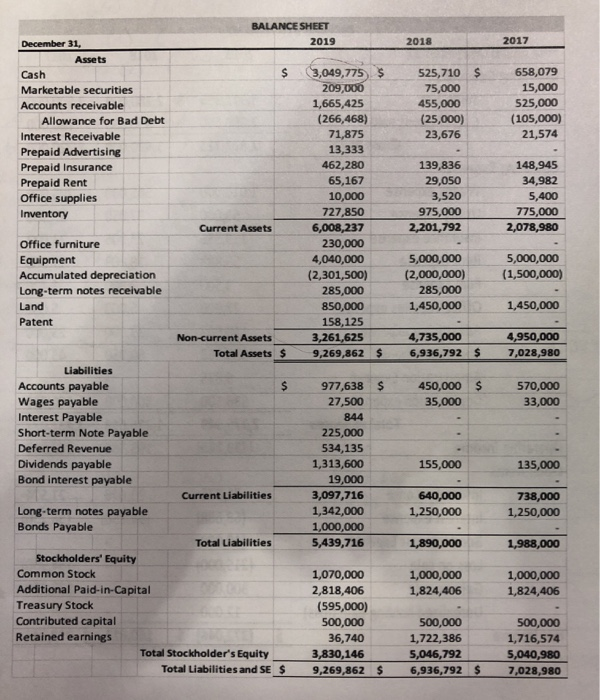

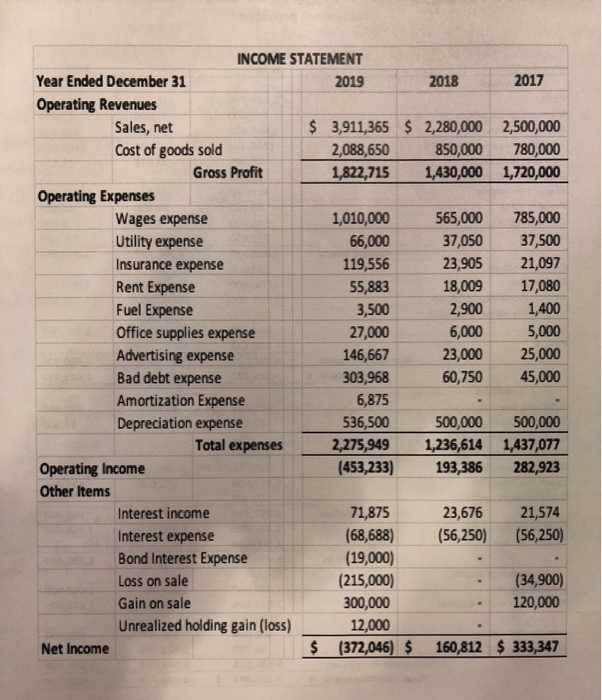

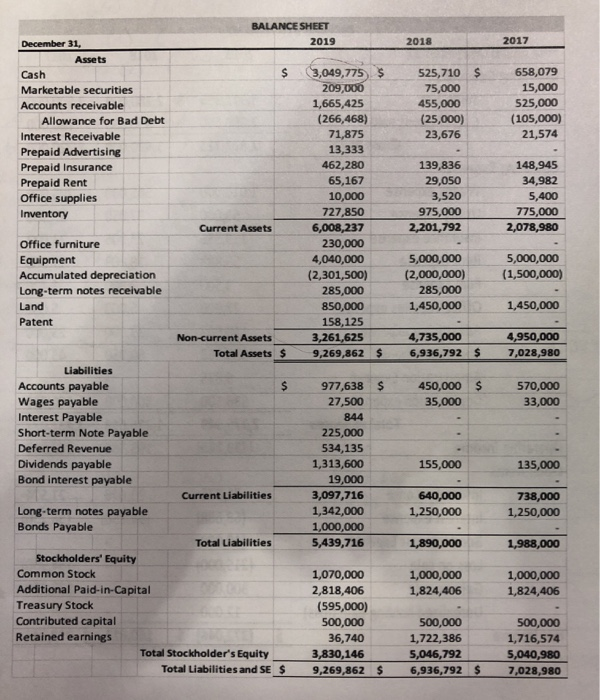

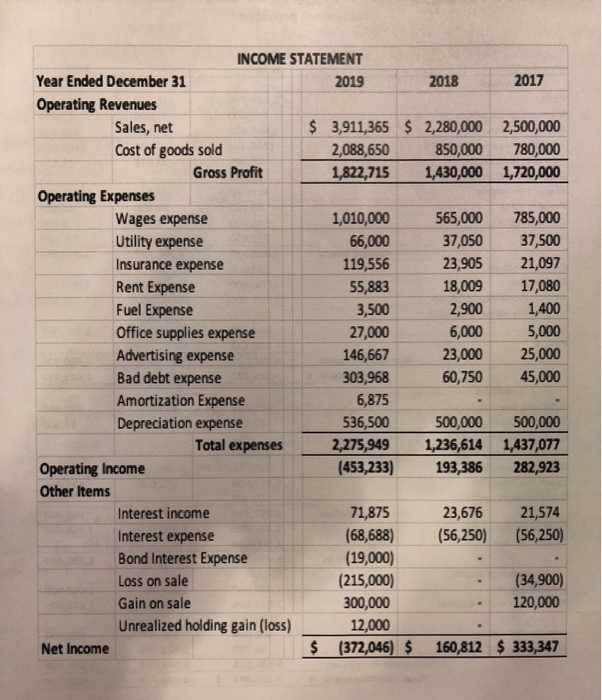

Build a Statement of Cash Flows using the Indirect method for 2019.

2018 2017 $ 525,710 75,000 455,000 (25,000) 23,676 658,079 15,000 525,000 (105,000) 21,574 139,836 29,050 3,520 975,000 2,201,792 148,945 34,982 5,400 775,000 2,078,980 5,000,000 (1,500,000) 5,000,000 (2,000,000) 285,000 1,450,000 1,450,000 BALANCE SHEET December 31, 2019 Assets Cash $ (3,049,775) $ Marketable securities 209,000 Accounts receivable 1,665,425 Allowance for Bad Debt (266,468) Interest Receivable 71,875 Prepaid Advertising 13,333 Prepaid Insurance 462,280 Prepaid Rent 65,167 Office supplies 10,000 Inventory 727,850 Current Assets 6,008,237 Office furniture 230,000 Equipment 4,040,000 Accumulated depreciation (2,301,500) Long-term notes receivable 285,000 Land 850,000 Patent 158,125 Non-current Assets 3,261,625 Total Assets $ 9,269,862 $ Liabilities Accounts payable 977,638 $ Wages payable 27,500 Interest Payable 844 Short-term Note Payable 225,000 Deferred Revenue 534,135 Dividends payable 1,313,600 Bond interest payable 19,000 Current Liabilities 3,097,716 Long-term notes payable 1,342,000 Bonds Payable 1,000,000 Total Liabilities 5,439,716 Stockholders' Equity Common Stock 1,070,000 Additional Paid-in-Capital 2,818,406 Treasury Stock (595,000) Contributed capital 500,000 Retained earnings 36,740 Total Stockholder's Equity 3,830,146 Total Liabilities and SE $ 9,269,862 $ 4,735,000 6,936,792 4,950,000 7,028,980 $ $ 450,000 35,000 570,000 33,000 155,000 135,000 640,000 1,250,000 738,000 1,250,000 1,890,000 1,988,000 1,000,000 1,824,406 1,000,000 1,824,406 500,000 1,722,386 5,046,792 6,936,792 $ 500,000 1,716,574 5,040,980 7,028,980 2017 2,500,000 780,000 1,720,000 INCOME STATEMENT Year Ended December 31 2019 2018 Operating Revenues Sales, net $ 3,911,365 $ 2,280,000 Cost of goods sold 2,088,650 850,000 Gross Profit 1,822,715 1,430,000 Operating Expenses Wages expense 1,010,000 565,000 Utility expense 66,000 37,050 Insurance expense 119,556 23,905 Rent Expense 55,883 18,009 Fuel Expense 3,500 2,900 Office supplies expense 27,000 6,000 Advertising expense 146,667 23,000 Bad debt expense 303,968 60,750 Amortization Expense 6,875 Depreciation expense 536,500 500,000 Total expenses 2,275,949 1,236,614 Operating Income (453,233) 193,386 Other Items Interest income 71,875 23,676 Interest expense (68,688) (56,250) Bond Interest Expense (19,000) Loss on sale (215,000) Gain on sale 300,000 Unrealized holding gain (loss) 12,000 Net Income $ (372,046) $ 160,812 785,000 37,500 21,097 17,080 1,400 5,000 25,000 45,000 500,000 1,437,077 282,923 21,574 (56,250) (34,900) 120,000 $ 333,347