Answered step by step

Verified Expert Solution

Question

1 Approved Answer

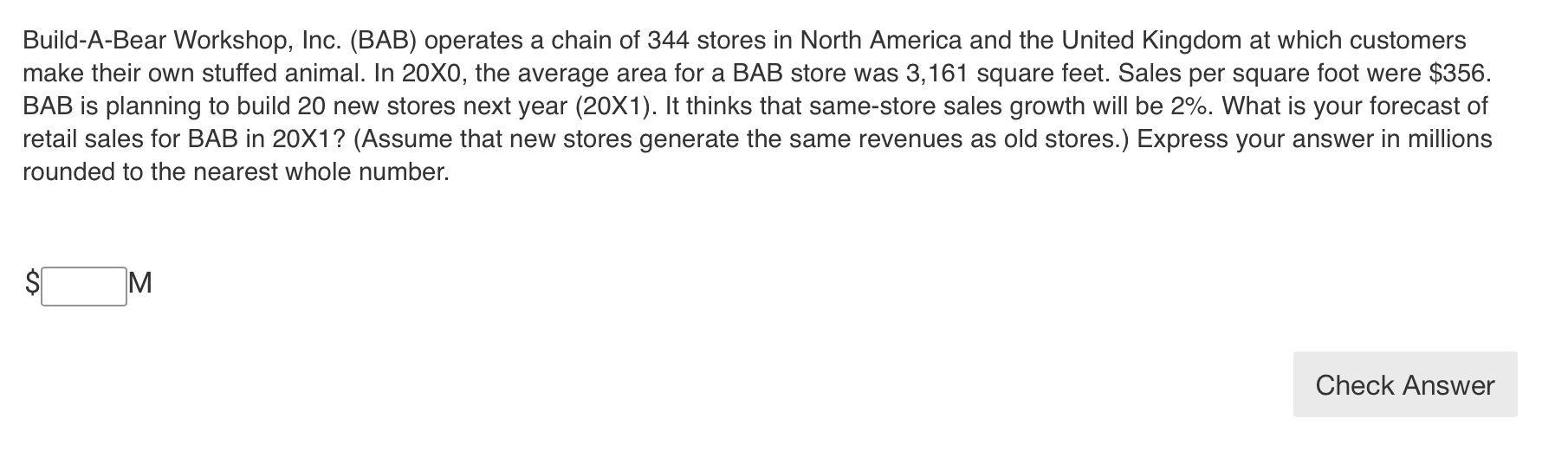

Build-A-Bear Workshop, Inc. (BAB) operates a chain of 344 stores in North America and the United Kingdom at which customers make their own stuffed

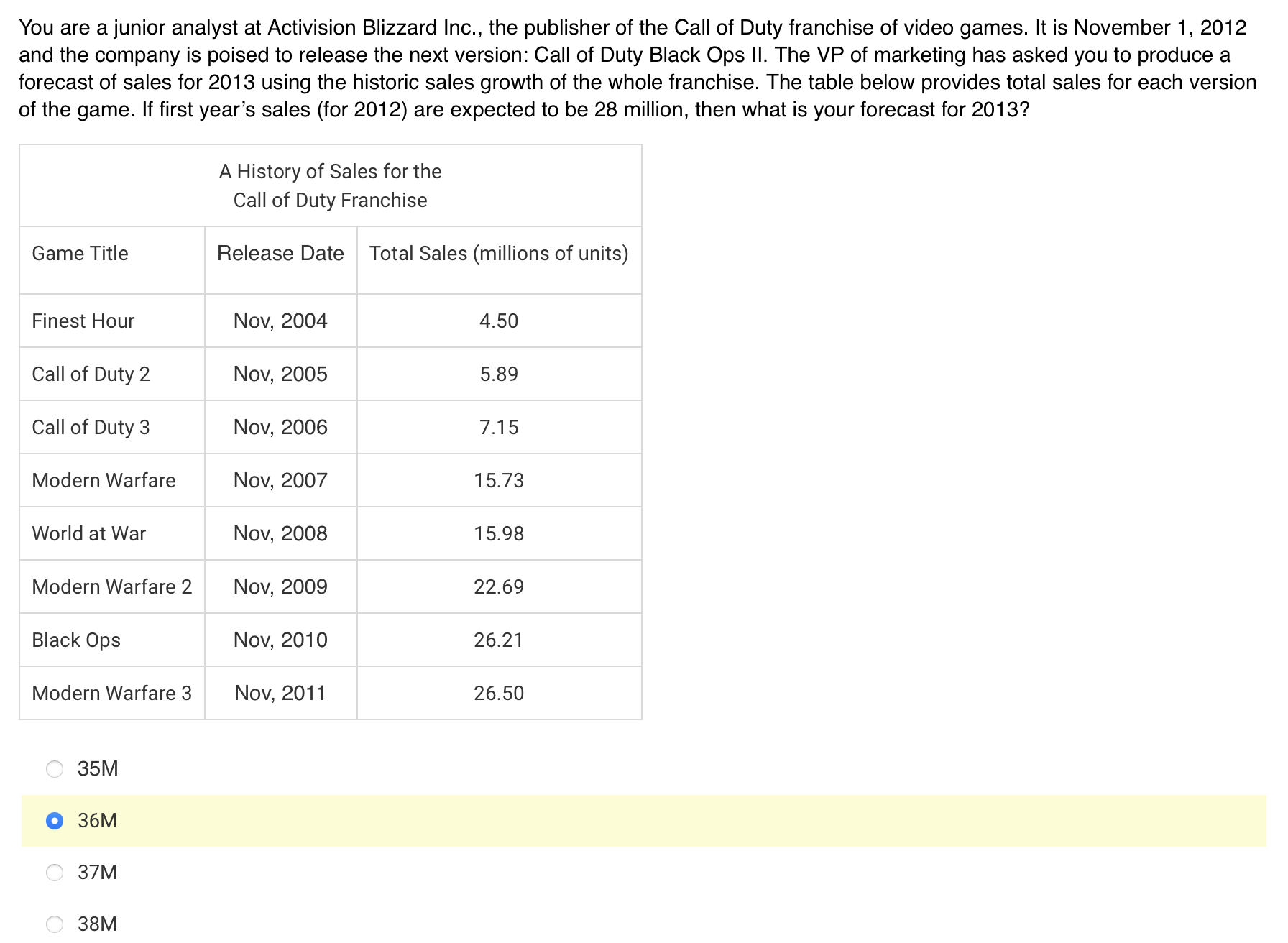

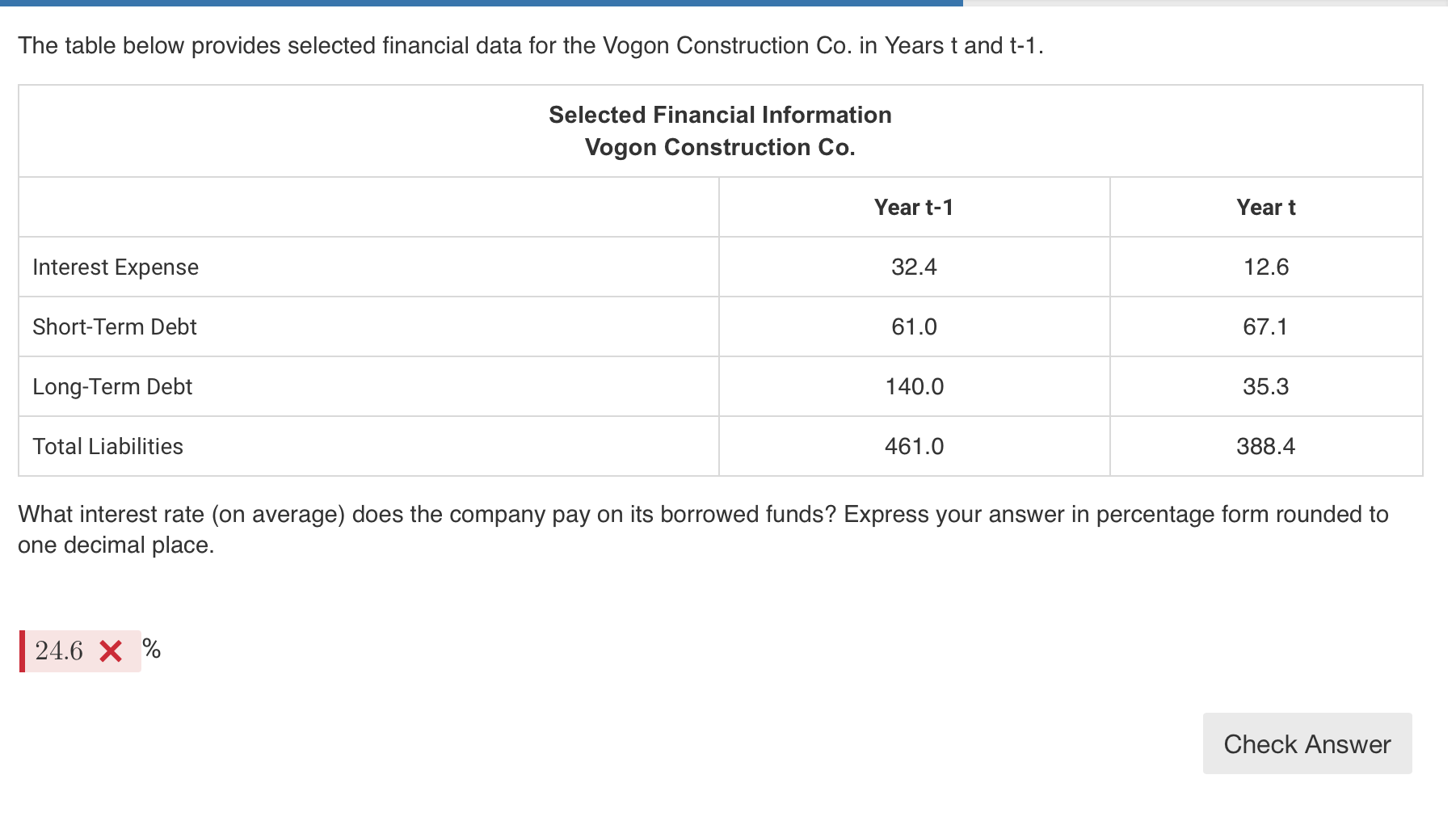

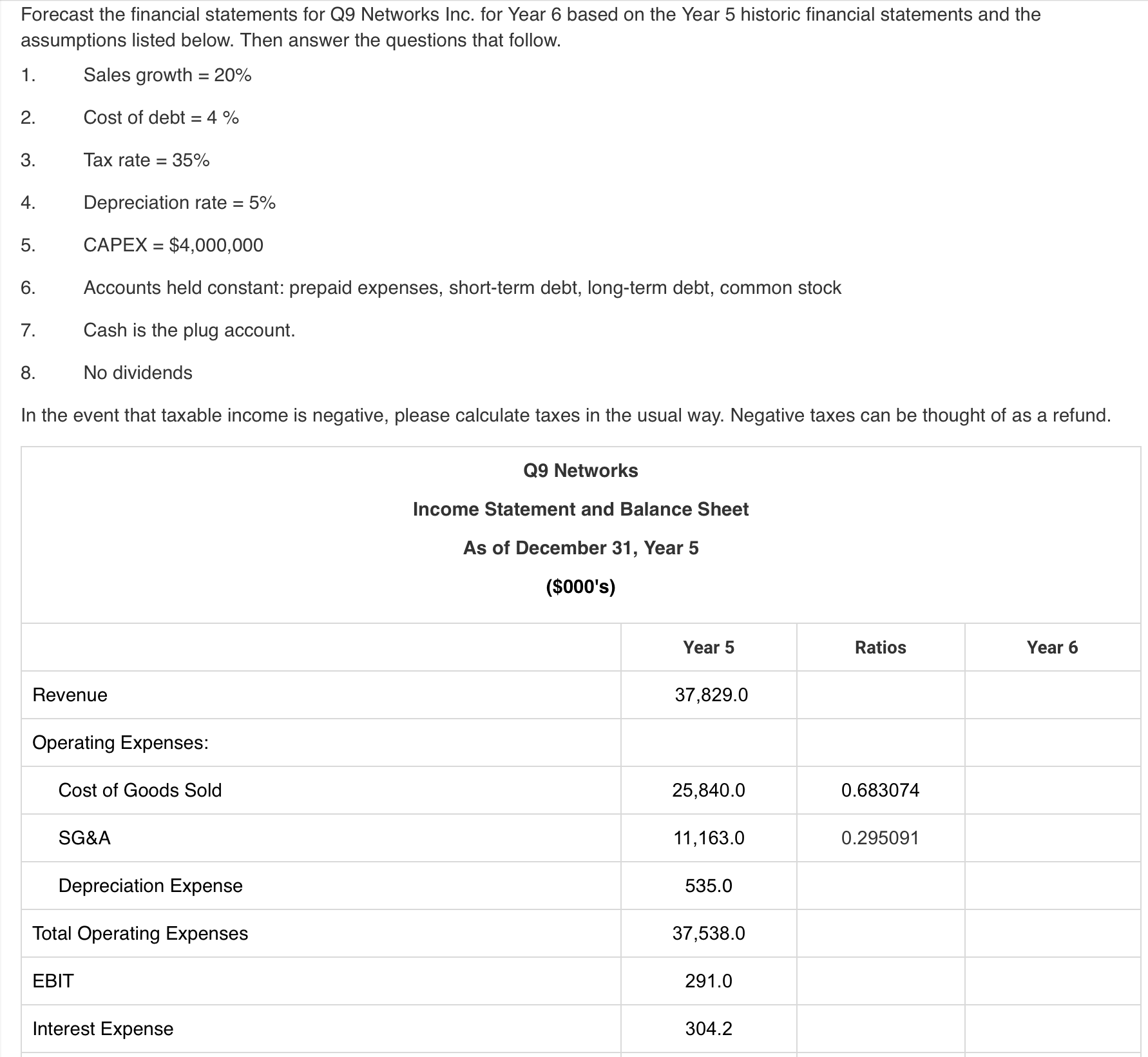

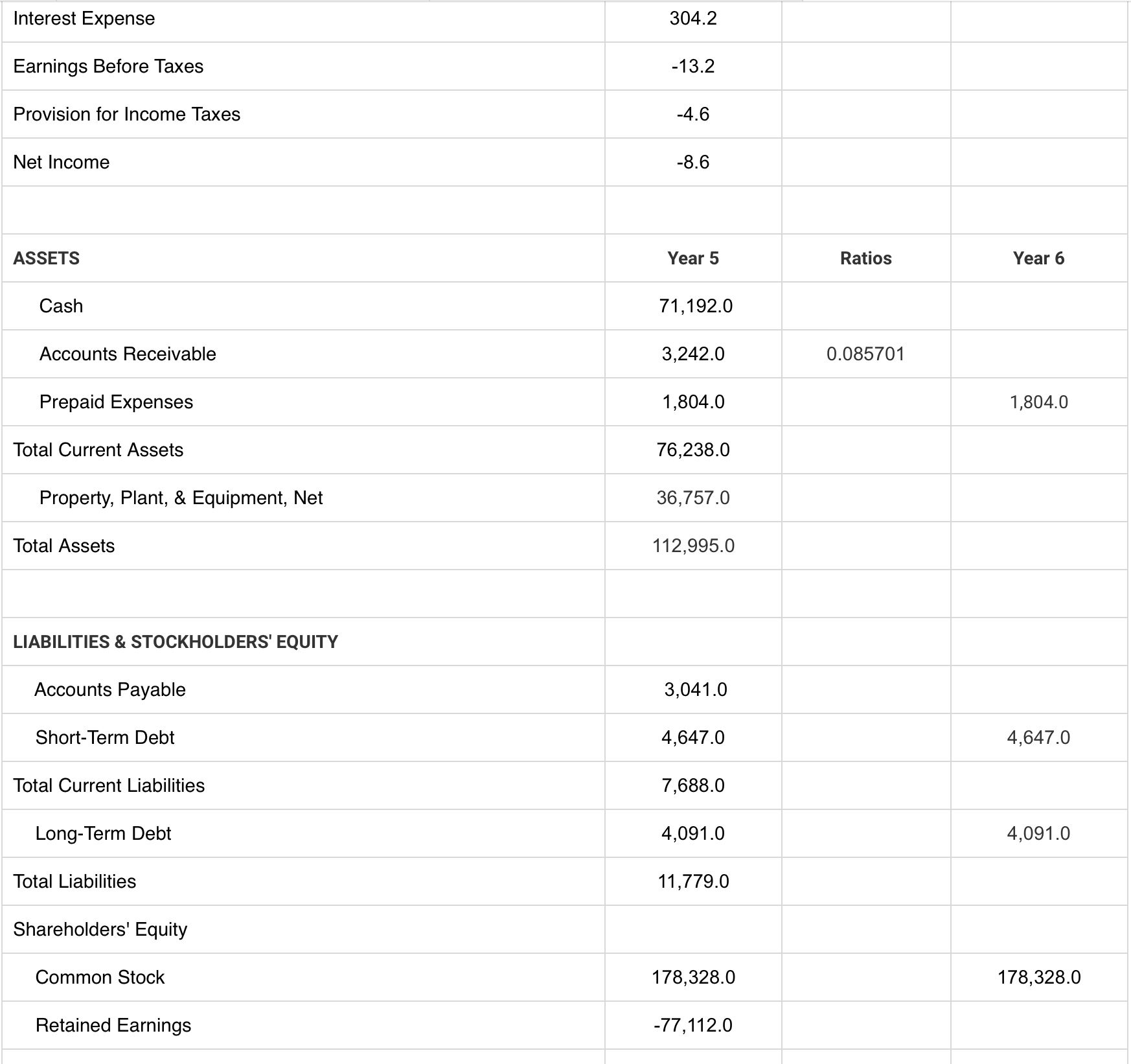

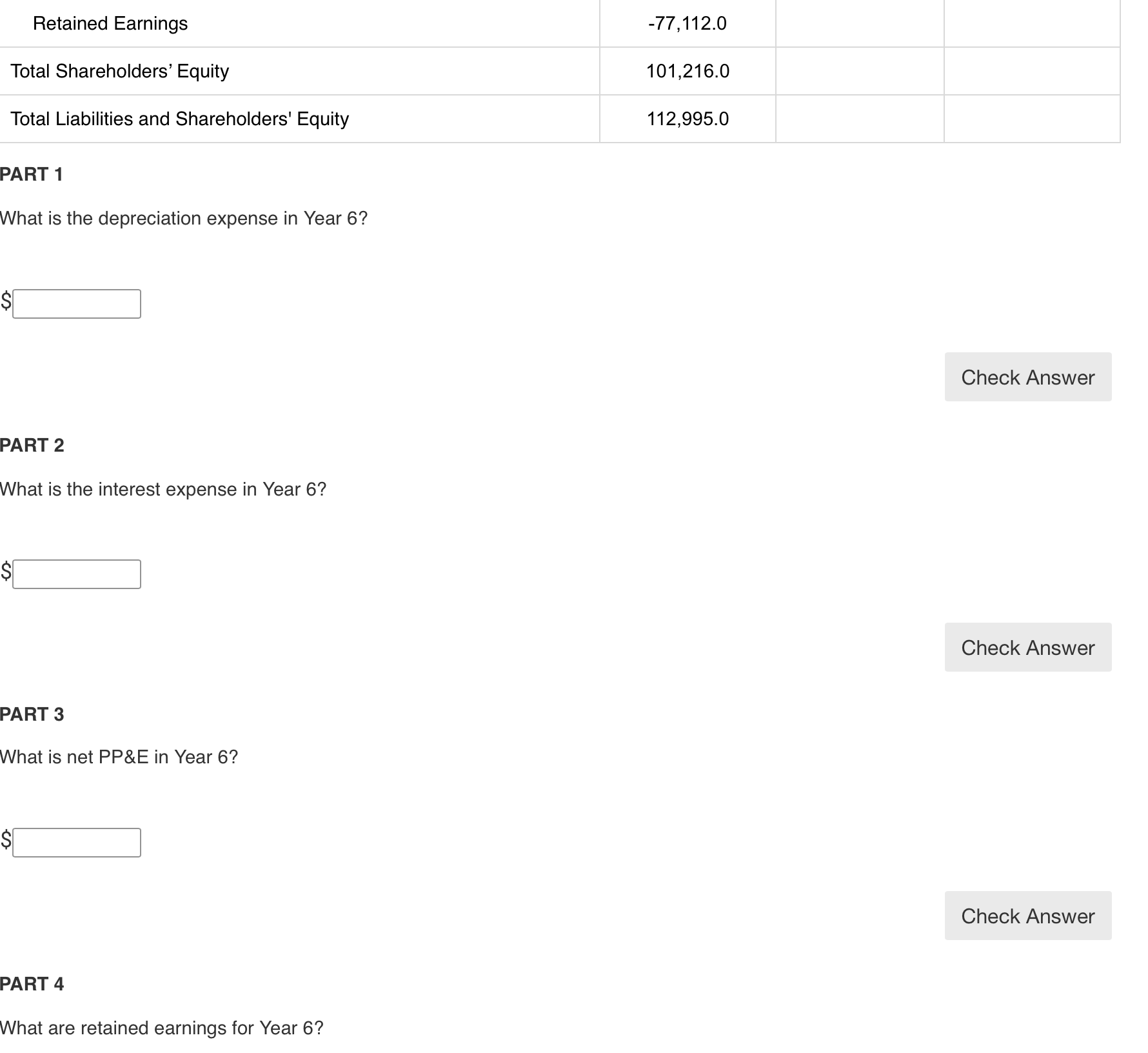

Build-A-Bear Workshop, Inc. (BAB) operates a chain of 344 stores in North America and the United Kingdom at which customers make their own stuffed animal. In 20X0, the average area for a BAB store was 3,161 square feet. Sales per square foot were $356. BAB is planning to build 20 new stores next year (20X1). It thinks that same-store sales growth will be 2%. What is your forecast of retail sales for BAB in 20X1? (Assume that new stores generate the same revenues as old stores.) Express your answer in millions rounded to the nearest whole number. $ M Check Answer You are a junior analyst at Activision Blizzard Inc., the publisher of the Call of Duty franchise of video games. It is November 1, 2012 and the company is poised to release the next version: Call of Duty Black Ops II. The VP of marketing has asked you to produce a forecast of sales for 2013 using the historic sales growth of the whole franchise. The table below provides total sales for each version of the game. If first year's sales (for 2012) are expected to be 28 million, then what is your forecast for 2013? A History of Sales for the Call of Duty Franchise Game Title Release Date Total Sales (millions of units) Finest Hour Nov, 2004 4.50 Call of Duty 2 Nov, 2005 5.89 Call of Duty 3 Nov, 2006 7.15 Modern Warfare Nov, 2007 15.73 World at War Nov, 2008 15.98 Modern Warfare 2 Nov, 2009 22.69 Black Ops Nov, 2010 26.21 Modern Warfare 3 Nov, 2011 26.50 35M 36M 37M 38M The table below provides selected financial data for the Vogon Construction Co. in Years t and t-1. Interest Expense Short-Term Debt Selected Financial Information Vogon Construction Co. Year t-1 Year t 32.4 12.6 61.0 67.1 140.0 35.3 461.0 388.4 Long-Term Debt Total Liabilities What interest rate (on average) does the company pay on its borrowed funds? Express your answer in percentage form rounded to one decimal place. 24.6% Check Answer Forecast the financial statements for Q9 Networks Inc. for Year 6 based on the Year 5 historic financial statements and the assumptions listed below. Then answer the questions that follow. Sales growth = 20% 1. 2. Cost of debt = 4% 3. Tax rate = 35% 4. Depreciation rate = 5% 5. CAPEX = $4,000,000 6. Accounts held constant: prepaid expenses, short-term debt, long-term debt, common stock 7. Cash is the plug account. 8. No dividends In the event that taxable income is negative, please calculate taxes in the usual way. Negative taxes can be thought of as a refund. Q9 Networks Income Statement and Balance Sheet As of December 31, Year 5 ($000's) Year 5 Ratios Year 6 37,829.0 Revenue Operating Expenses: Cost of Goods Sold SG&A 25,840.0 0.683074 11,163.0 0.295091 Depreciation Expense 535.0 Total Operating Expenses 37,538.0 EBIT 291.0 Interest Expense 304.2 Interest Expense 304.2 Earnings Before Taxes -13.2 Provision for Income Taxes -4.6 Net Income -8.6 ASSETS Cash Accounts Receivable Prepaid Expenses Year 5 Ratios Year 6 71,192.0 3,242.0 0.085701 1,804.0 1,804.0 Total Current Assets 76,238.0 Property, Plant, & Equipment, Net 36,757.0 Total Assets 112,995.0 LIABILITIES & STOCKHOLDERS' EQUITY Accounts Payable 3,041.0 Short-Term Debt Total Current Liabilities 4,647.0 4,647.0 7,688.0 Long-Term Debt 4,091.0 4,091.0 Total Liabilities 11,779.0 Shareholders' Equity Common Stock 178,328.0 178,328.0 Retained Earnings -77,112.0 Retained Earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity PART 1 What is the depreciation expense in Year 6? es $ PART 2 What is the interest expense in Year 6? $ PART 3 What is net PP&E in Year 6? $ PART 4 What are retained earnings for Year 6? -77,112.0 101,216.0 112,995.0 Check Answer Check Answer Check Answer PART 4 What are retained earnings for Year 6? $ PART 5 What is the total for the plug variable in Year 6? $ Check Answer Check Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started