Builders builds townhomes in a new subdivision just outside of . Land and labour are cheap, and competition among developers is fierce. The homes in the subdivision are identical to one another, but buyers can upgrade features by paying the difference. Builders' cost per developed sublot are as follows: LOADING... (Click the icon to view the costs.) Builders would like to earn a profit of % of the variable cost of each home sale. Similar homes offered by competing builders sell for each. RequirementsLOADING... Requirement 1. Which approach to pricing should Builders emphasize? Why? will need to emphasize a cost-plus target-costing approach to pricing. Because the townhomes are not unique and face unique and do not face stiff competition, will have a lot of not have much control over pricing. Requirement 2. Will Builders be able to achieve its target profit levels? Show your computations. Complete the following table to show whether Builders will be able to achieve the target profit level. (Use parentheses or a minus sign to indicate a profit shortfall.)

i dont want the answer in excle

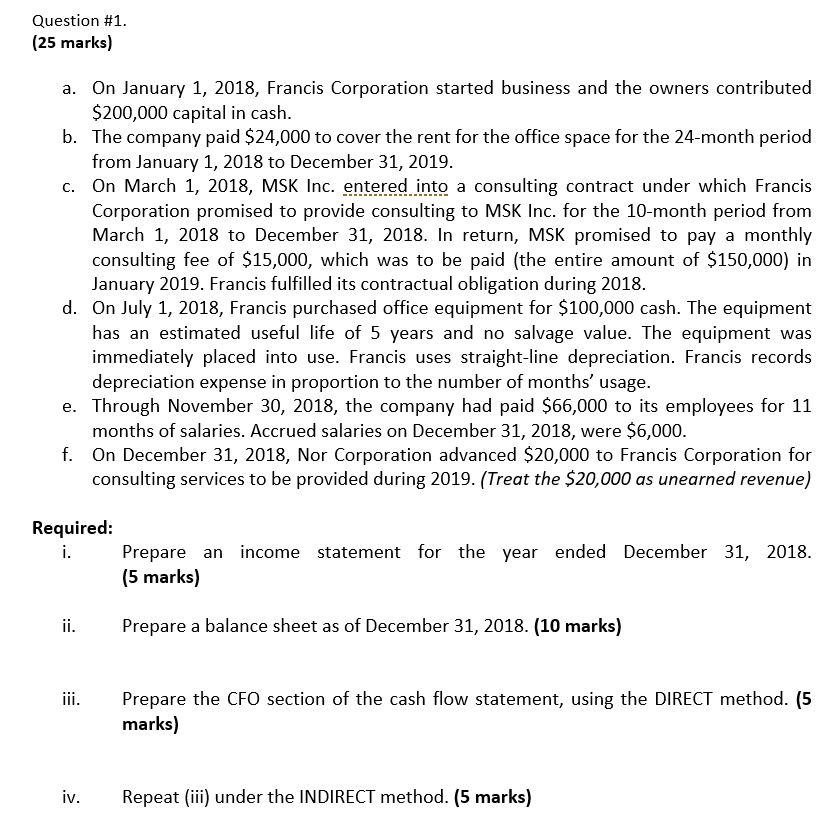

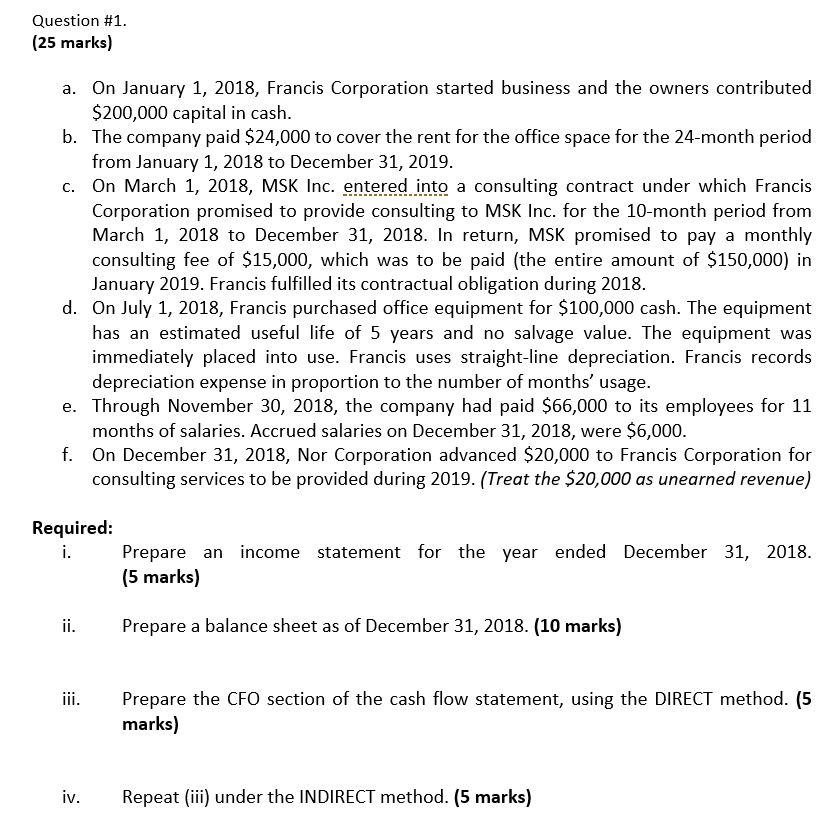

Question #1. (25 marks) a. On January 1, 2018, Francis Corporation started business and the owners contributed $200,000 capital in cash. b. The company paid $24,000 to cover the rent for the office space for the 24-month period from January 1, 2018 to December 31, 2019. c. On March 1, 2018, MSK Inc. entered into a consulting contract under which Francis Corporation promised to provide consulting to MSK Inc. for the 10-month period from March 1, 2018 to December 31, 2018. In return, MSK promised to pay a monthly consulting fee of $15,000, which was to be paid (the entire amount of $150,000) in January 2019. Francis fulfilled its contractual obligation during 2018. d. On July 1, 2018, Francis purchased office equipment for $100,000 cash. The equipment has an estimated useful life of 5 years and no salvage value. The equipment was immediately placed into use. Francis uses straight-line depreciation. Francis records depreciation expense in proportion to the number of months' usage. e. Through November 30, 2018, the company had paid $66,000 to its employees for 11 months of salaries. Accrued salaries on December 31, 2018, were $6,000. f. On December 31, 2018, Nor Corporation advanced $20,000 to Francis Corporation for consulting services to be provided during 2019. (Treat the $20,000 as unearned revenue) Required: i. Prepare an income statement for the year ended December 31, 2018. (5 marks) ii. Prepare a balance sheet as of December 31, 2018. (10 marks) jii. Prepare the CFO section of the cash flow statement, using the DIRECT method. (5 marks) iv. Repeat (iii) under the INDIRECT method. (5 marks) Question #1. (25 marks) a. On January 1, 2018, Francis Corporation started business and the owners contributed $200,000 capital in cash. b. The company paid $24,000 to cover the rent for the office space for the 24-month period from January 1, 2018 to December 31, 2019. c. On March 1, 2018, MSK Inc. entered into a consulting contract under which Francis Corporation promised to provide consulting to MSK Inc. for the 10-month period from March 1, 2018 to December 31, 2018. In return, MSK promised to pay a monthly consulting fee of $15,000, which was to be paid (the entire amount of $150,000) in January 2019. Francis fulfilled its contractual obligation during 2018. d. On July 1, 2018, Francis purchased office equipment for $100,000 cash. The equipment has an estimated useful life of 5 years and no salvage value. The equipment was immediately placed into use. Francis uses straight-line depreciation. Francis records depreciation expense in proportion to the number of months' usage. e. Through November 30, 2018, the company had paid $66,000 to its employees for 11 months of salaries. Accrued salaries on December 31, 2018, were $6,000. f. On December 31, 2018, Nor Corporation advanced $20,000 to Francis Corporation for consulting services to be provided during 2019. (Treat the $20,000 as unearned revenue) Required: i. Prepare an income statement for the year ended December 31, 2018. (5 marks) ii. Prepare a balance sheet as of December 31, 2018. (10 marks) jii. Prepare the CFO section of the cash flow statement, using the DIRECT method. (5 marks) iv. Repeat (iii) under the INDIRECT method