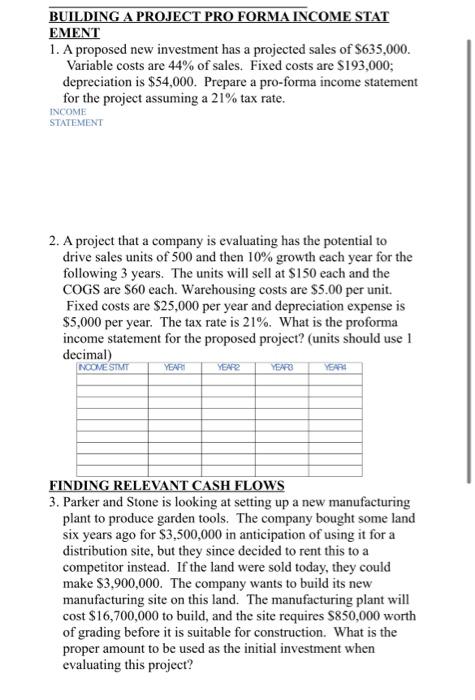

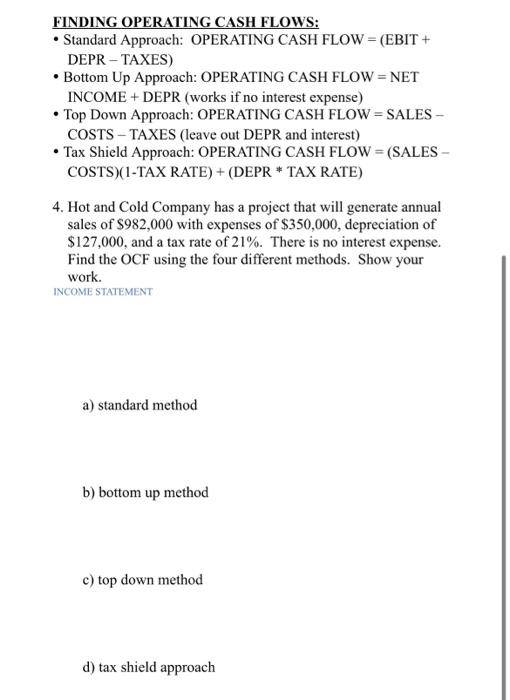

BUILDING A PROJECT PRO FORMA INCOME STAT EMENT 1. A proposed new investment has a projected sales of $635,000. Variable costs are 44% of sales. Fixed costs are $193,000; depreciation is $54,000. Prepare a pro-forma income statement for the project assuming a 21% tax rate. INCOME STATEMENT 2. A project that a company is evaluating has the potential to drive sales units of 500 and then 10% growth each year for the following 3 years. The units will sell at $150 each and the COGS are $60 each. Warehousing costs are $5.00 per unit. Fixed costs are $25,000 per year and depreciation expense is $5,000 per year. The tax rate is 21%. What is the proforma income statement for the proposed project? (units should use 1 decimal) FINDING RELEVANT CASH FLOWS 3. Parker and Stone is looking at setting up a new manufacturing plant to produce garden tools. The company bought some land six years ago for $3,500,000 in anticipation of using it for a distribution site, but they since decided to rent this to a competitor instead. If the land were sold today, they could make $3,900,000. The company wants to build its new manufacturing site on this land. The manufacturing plant will cost $16,700,000 to build, and the site requires $850,000 worth of grading before it is suitable for construction. What is the proper amount to be used as the initial investment when evaluating this project? FINDING OPERATING CASH FLOWS: - Standard Approach: OPERATING CASH FLOW =( EBIT + DEPR - TAXES) - Bottom Up Approach: OPERATING CASH FLOW = NET INCOME + DEPR (works if no interest expense) - Top Down Approach: OPERATING CASH FLOW = SALES COSTS - TAXES (leave out DEPR and interest) - Tax Shield Approach: OPERATING CASH FLOW =( SALES COSTS )(1 TAX RATE )+( DEPR * TAX RATE ) 4. Hot and Cold Company has a project that will generate annual sales of $982,000 with expenses of $350,000, depreciation of $127,000, and a tax rate of 21%. There is no interest expense. Find the OCF using the four different methods. Show your work. INCOME STATEMENT a) standard method b) bottom up method c) top down method d) tax shield approach