Question

BulkWhiz: Negotiating as a Startup Founder in the UAE: Harvard case 9-919-004 CASE STARTS It had been another long day at the office in May

BulkWhiz: Negotiating as a Startup Founder in the

UAE: Harvard case 9-919-004

CASE STARTS

It had been another long day at the office in May 2018 for Amira Rashad (MBA 1998), co-founder and CEO of Bulk Whiz, based in Dubai. As Rashad got into her car and started her journey back home her mind started to wander. She could hardly believe it had already been more than a ear since the beta had gone live for the buy-in-bulk grocery delivery platform. The proposition was the first of its kind in the Middle East, and since its launch in May 2017, 13,000 households in Dubai and Abu Dhabi- the largest two emirates in the United Arab Emirates (UAE -had registered. While Rashad recognized the customer-base was still small, she was extremely pleased with the exponential rate at which the startup had been acquiring customers. The BulkWhiz platform hosted 1,800 SKUs and the team had grown to over 20 employees. She had successfully raised a total of $1.2 million in three rounds of seed funding from angel and venture capital (C) investors in exchange for 27 % of the company's equity. Despite BulkWhiz's early success, Rashad couldn't help but feel that the company was now at a critical juncture. bulkWhiz had only enough funding to last roughly through the end or the year

Surviving, and growing, would require a few key steps. The first had to do with co-founder Yusuf Saber. Currently the chief technology officer (CTO) of BulkWhiz, Saber also had a full-time job at a leading startup in the region, spending his nights and weekends working at BulkWhiz. So far, Saber was not earning a salary at BulkWhiz, but he did have a nominal equity stake that would increase whenever he joined the company full-time. Given the positive customer traction and the rapidly expanding operations, Rashad was keen for Saber to quit his current job and to join BulkWhiz full time. Rashad also needed a plan for expanding her business beyond the UAE, likely into Saudi Arabia.

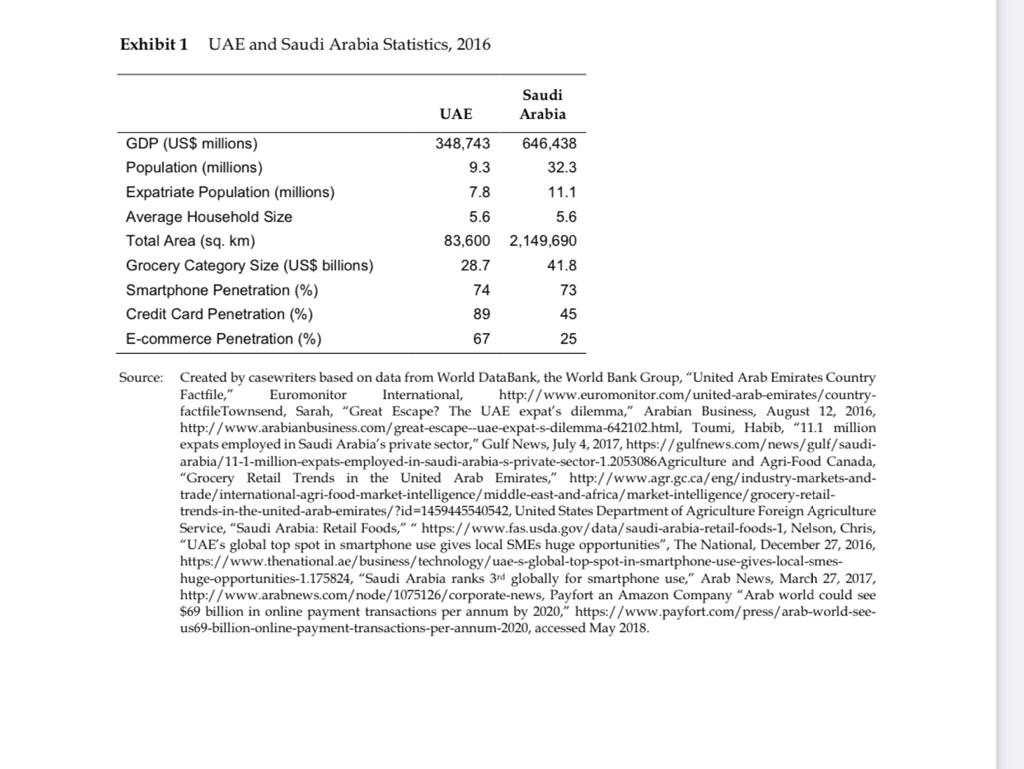

Saudi Arabia was a much larger and more complex market than the UAE - succeeding there would be far from be easy (see Exhibit 1 tor UAE and Saudi Arabia statistics). Une key challenge Would be the operational logistics: the retail landscape was fragmented, suppliers were unreliable, and there was no household address system - people relied on landmarks and directions to find their way around. All of these factors would make it difficult to scale a quality delivery service In addition. while the environment for foreigners and women in the entrepreneurship space was starting to improve in Saudi Arabia, Rashad recognized that there would likely be additional cultural challenges to entering this market. Of course, both of these important steps would likely be fruitless if Rashad couldn't manage to raise more money. She was hoping to close a series A round of fundraising by the end of the tall. The funds would give her the ability to expand her team, further develop the platform technology, and help with the expansion into Saudi Arabia. Rashad wanted to minimize her dilution as much as possible and find investors that could add value that was over and above the financing. At the same time, she was aware that there was on v a handful of V firms in the Middle east.

The Origins of BulkWhiz

Rashad grew up in Tanzania and Kuwait, and then completed her undergraduate degree INeconomics at the American University of Cairo, Egypt in 1989. She then moved to the U.K. to do a master's degree in science at the University of Salford in Manchester. In 1992, Rashad started her first job as a marketing manager at PepsiCo in Cairo, where she spent four years in various marketing roles Rashad then moved to the U.S. to do her MBA and graduated from Harvard Business School in 1998

Over the next decade, worked as a management consultant at Booz Allen Hamilton and The Valen Group, and held senior strategy positions in information management firms Dun & Bradsheet and Spears Business Solutions. In the summer of 201l, Rashad's husband was offered the position of Head of Merrill Lynch for the Middle East and North Africa, based in Dubai. She and her husband decided it was an opportunity worth pursuing, so along with their two young sons, they made the move to Dubai. Rashad accepted a leadership role at Yahoo! as she and her family were settling into their new lite in the UAE. The company had been in the Middle East since 2009, following its $164 million acquisition of Maktoob , and Rashad was brought in as the head of audience and media for the Middle

East,Africa, and Turkey. Then, in early 20s. Rashad joined Dubai Facebook office as the head of

brand for the Middle East and Africa. She was tasked with working with large multinational consumer product companies such as Proctor & Gamble (L&G) and Unilever, helping them use the Facebook platform to scale their respective businesses During her time at Yahoo! and Facebook, Rashad was struck by some of the interesting dynamics in Middle East e-commerce, particularly in the grocer industry. Despite its massive size - nearly $175 billion - and the fact that the region had high smartphone and internet penetration rates, the grocery industry represented less than two percent of e-commerce. Instead, the e-commerce space was mostlyfocused on fashion and electronics. As Rashad saw it, "Existing platforms were not conducive grocery shopping. Searching for items was tedious, and there was no concept of saving shopping lists so for each purchase cycle, customers had to search for each item from scratch. In the whole process was very painful And. while there were very tew e-commerce grocery retailers, Rashad recognized that many large multinational consumer product companies, like Procter & Gamble, were beginning to mandate that more marketing dollars be spent in the e-commerce space

Rashad also recognized that family structure in the region, where large households were the norm made purchasing in bulk an attractive option from a cost perspective. And yet, there were few bulk retailers. Most retail establishments were local, mom-and-pop style shops; there were no Costcos or Walmarts in the region. The larger scale retailers that did exist weren't located on the outskirts or the city, as in many other markets, but instead occupied high-value real estate, often as anchors of malls Because of that, they tended to focus on fast-moving products that generated high returns on

investment, rather than bulky items that would take up a lot of shelf space. Even if one could find good bulk options, the climate presented its own challenges. As Kashad saw it, Who would want to lug around bulky items in the scorching heat?

When Rashad looked at all the dynamics holistically in mid-2015, she believed that a buy-in-bulk grocery delivery platform could be a valuable proposition. Because e-commerce was still in its infancy. Rashad felt that the success would depend on ensuring a simple and easy-to-use interface. As her expertise was on the commercial side though, she was not yet sure what shape or form the technology would take, but she was certain technology would be the mechanism that would differentiate the platform from other sites

Securing the First Round of Seed Fundraising

By June 2016, Rashad was starting to mention her idea in casual conversations with friends andacquaintances. Because of her husband's work in wealth management, many of these conversations happened to be with principals of major businesses and experienced investors. She explained, "I wasn't pitching to anyone. It wasn't me taking people through a presentation. It was more about sharing my idea and asking their opinion about it - and maybe exploring ideas for how they might approach it.

two things immediately struck Kashad from these conversations. The first was how easily everyone understood the concept and the opportunity. The second was their underlying belief that she could take this on as an entrepreneur. Rashad elaborated,

in my mind. the opportunity had so many scenarios - maybe a partnership with one of them, perhaps my leading the initiative for a conglomerate that wanted to pursue it. I honestly wasn't thinking that this could be a startup. But over and over again was asked

Why don't you do this? Then one day I came home and asked my husband, 'Do you think

I can be an entrepreneur? His reply was, "Yeah, why not?'

Rashad and her family spent the summer of 2016 in Palo Alto, California, where Rashad's husband focused on founding his own, unrelated startup while Rashad spent time modeling a varietyscenarios tor her business idea. She prepared tour or five different options and, in each case, despite being quite conservative, the numbers looked promising. She expected to grow annual revenues from roughly >25U, W in the first year to over 920 million by the fifth year, driven by assumptions or a gradual growth in grocery e-commerce, a steady increase in her company's market share,

and geographic expansion within the Middle East. Through a bottom-up approach, Rashad calculated that she would require an investment of $750,000, which she would ideally raise via two or three stages so as to minimize her equity dilution

With this investment sum in the back of her mind, she decided to go back to the people who hadencouraged her to pursue this, this time to show them the numbers to convince them it could actually work. However, this time around, when they saw that she was pitching a business idea and asking for money, the nature of the conversations changed. Kashad started getting questions about the ideas implementation; they were confident in her ability to lead the initiative, but they questioned whether she would be able to put together a team to make it happen. The biggest question was about the technology: where it was going to come from and how it was going to work. Rashad had not yet found a suitable CTO. At this point it was just her, the concept, and the market opportunity. Others were uncertain about her level of commitment: "Your husband is doing very well, right? You don't reallyneed this to succeed.

." Another asked how old her kids were and how much time they would require. Recognizing that she needed to be smart about how she continued to converse with potential investors in her network and how she would approach others, Rashad decided to devise a few strategies. She also took advantage of the fact that entrepreneurs often lack transparent and diligent reporting on performance. Rashad recognized that her prior professional experience was serving her well in terms of working with numbers and generating robust reports, so she proactively offered to provide reports, believing that this openness would give investors a significant degree of comfort. She also found that many of the investors were generally confident about what she was doing, but they tended to question how she would actually get things done. Describing the challenge, Rashad said,"You have to do certain things to set up shop here. You have to get a license from the government. You have to negotiate with suppliers, many of whom operate through distributors. And there is a big 'boys' club' dynamic. It is all about networks. Even though I had lived in the region for several years, I wasn't in those networks." Rather than try to convince investors she was plugged in to those clubs, she decided to seek out co-founders with their own broad networks, and whose skill sets would complement her own. She assured investors she would soon have these partners on board. Finally, she strategically targeted investors whose existing interests might work in her favor:

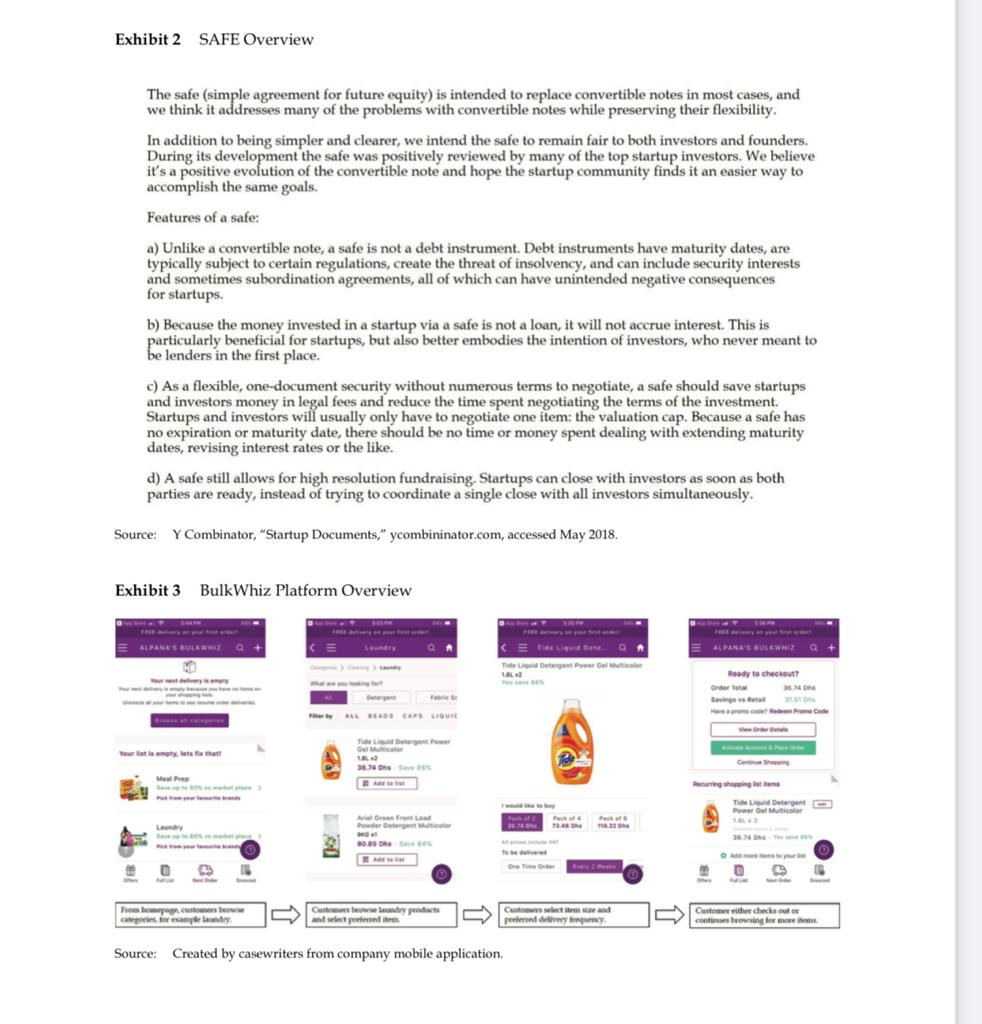

"One of my husband's clients who worked in private equity was looking to get into the VC space, so I was able to capitalize on that." By September 2016, Rashad was able to secure a total of $250,000 from two angel investors. All of the investments were administered through a standard simple agreement for future equity (SAFE), capped at a $2.5 million valuation (see Exhibit 2 for the SAFE overview). Everyone got the same standard term sheets. It was at this point that Rashad left Facebook to focus on her search for a CTO

Building Her Team

Rashad had anticipated that investors would question her about the platform technology, so she

started her CTO search in mid-2016. She spoke with CTOs of several existing e-commerce companies

in the region, but none stood out as an ideal partner. Rashad described the interview experience:

I met four or five CTOs. Honestly, they seemed quite bored, and it's pretty clear why. When you are the CTO of a business that calls itself a tech business and it really isn't, and you have aspirations to actually do things, but you are instead being asked to do things like install software on someone's computer, it's frustrating. They were really frustrated. So when I started to talk to them about a true tech-first business where things would be built from scratch, all in- house, and that we could potentially sell our capabilities to others, their eyes lit up. They were excited, but I felt they just didn't have the experience to do it. They didn't have the teams and so on. And nobody was talking about artificial intelligence (AI). Nobody.

By September 2016, Rashad was starting to wonder if the right candidate was out there. She was at a technology conference chatting with a VC industry delegate about her idea for BulkWhiz when he said he knew of someone she might be interested in meeting. A few days later, he introduced her to Saber, and the two met for lunch and chatted for hours about the opportunity. Rashad made it clear that she was not looking to create an e-commerce company that depended on technology; rather, she wanted to build a technology company that operated in the e-commerce space. Saber was in his early 30s and had a bachelor's degree from the German University in Cairo and two master's degrees, one in data science from Harvard University and another in machine learning from ETH Zurich, in Switzerland. He had founded a couple of startups, one of which had been bought by IBM. Rashad recounted, "He was soft-spoken, my polar opposite, but we got along really well. He had a broad approach, asking questions about everything from operations to customer service. I liked that he interested in how technology could make these things work better." Rashad was encouraged by their chemistry and that they shared a similar thought process. She went on to explain, "I wanted to have a culture that was based on a zero-ego approach. It was important that the person who was going to lead the technology side of the business did not have an ego. They really needed to be grounded by a test. and-learn approach.

Saber was interested in the opportunity and saw that he and Rashad complemented each other; she had the idea of bulk delivery and he had the idea of how they could use Al to automate the business However, he also had reservations, which he candidly voiced to Rashad: "I have been in startups that failed, not because of the technology, but because the people I partnered with could not commercialize the ideas. I felt like I did my very best, but they were either unable to raise the funds or unable to create " Saber had been approached several times by people who wanted to build something simply to tick things off their list but who were not actually serious about what they were doing. Would this be different? After the first meeting, each decided to give it some more thought.

Asking around, Rashad heard only positive things about Saber's performance at his existing job. In particular, she repeatedly heard that he embodied two qualities that were typically rare to find in the same individual: intellectual brilliance and emotional intelligence. So, by their second meeting, she was keen to bring him on board immediately. In fact, Rashad told him, "The only way this is going to work is it you quit your job and join me." However, this did not sit well with Saber. He responded that he was earning a good salary at his current job and that he had financial responsibilities, as he had young family to support. At the same time, he admitted that he viewed his current role as "just a job' and that he had a desire to create something from scratch. Rashad agreed to sideline the need to bring .I board full time for now. They continued to meet tor a tew hours each week to expand on the idea and try to find a workable arrangement for Saber.

After a few more meetings, they finally found a solution for Saber's work arrangement: he would Temporarily continue at his current job while committing nights and weekends to working Rashad. His work would be unpaid, but it would provide an equity stake that would vest after four ears, with the opportunity to increase it should he join Rashad full-time. Perhaps the key to the deal was that Saber was given control over hiring a few developers to support him. Rashad's initial concerns were that they might command a salary they were not able to afford and perhaps equity as well, but Saber reassured her he would be able to find talented engineers in Cairo, his hometown, at a traction of the cost of those in the UAE. To ease concerns about whether he could be a full partner while working only part-time, they agreed that he would attend all management meetings and ensure that Key

performance indicators (KPIs) such as timely product and feature release dates were met While Rashad was working out the arrangement with Saber, she finalized two other co-founded positions. The first was her brother, Mahmoud Sayed ahmed, a consultant who had over 2U years of marketing experience with major multinationals. He would serve as the chief marketing officer and would focus on monetizing the platform. The second was Reda Bouraoui, whom Rashad had met at PepsiCo. Reda had over 15 years of experience working at PepsiCo in various sales and general management roles. His brief would be securing the suppliers or products tor bulKWhiz In February 2017, with the founding team in place, Rashad started hiring and formally incorporated the company in Dubai under the name BulkWhiz. "We wanted to emphasize the concept of buying in bulk because this was new in the region," Rashad explained. "We also wanted customers to think of us as the smart option for their household needs, given the Al angle. We searched for words that could mean smart: 'whiz' was an obvious choice." Their first employee was a finance manager who doubled as office administrator. Rashad was able to keep down costs by hiring two interns from Europe who were sponsored by their government and who were looking to get work experience in Dubai. In April, they hired their first "customer whiz, a person who would be tasked with delivery and specialized customer service. Meanwhile, Saber set the vision for the minimal viable product (MVP) and, along with the handful of developers in Egypt, started working on the technology.

Closing the Second Round of Seed Fundraising

While Rashad had only raised funds from individual investors, she recognized that there were

couple of institutional investors she could approach. Then, as luck might have it, one of Rashad's long time contacts decided to leave Google Ventures to become a partner at the Dubai office of a global venture capital seed fund and accelerator called 500 Startups. Rashad officially pitched her idea and business plan to 500 Startups, and in March 2017 she secured an investment.

She also received an investment from the Women's Angel Investor Network (WAIN), a UAE-based female network that invests in projects led by female entrepreneurs in the Middle Last and North Africa. Rashad recognized that WAIN was not a big investor, but she knew they could offer value beyond the funding; members could serve as customers, tor example, and thus provide critical feedback on the product and customer experience With the investments from 500 Startups and WAIN, BulkWhiz's total funds as of Tune 2017 were $500,000. Like her previous investments, these were also done through a standard SAFE, this time with a cap of $3.5 million. But while Rashad experienced success with some investor groups, she faced challenges with others. At the Dubai Angel Investors (DAl) group, soon atter Rashad started her pitch, explaining the target market and the demographics of the region, a member interrupted,

"We know all of this already.

Tell us about your tech. Can we hear from your CIO? Rashad was taken aback; she

had planned to talk about the tech, and had even brought Saber with her to the event, but she didn't want to let the investor derail her whole pitch. She pushed back before eventually ceding the floor to Saber to explain the technology piece, drawing on his background in machine learning ana data science. The group ultimately decided not to invest

Going Live with the Beta

In May 2017, BulkWhiz went live with the beta version of its platform. It offered products from 40 suppliers in three main categories: beverages, baby, and cleaning. Customers were invited to create anaccount and sign in. The interface was simple to navigate, allowing easy browsing by product category

Next to each product, customers could see the percentage or savings they were achieving as a result of buying in bulk. Once customers selected an item, they could choose whether to buy on a one-time basis or set up a regular purchase (see Exhibit 3 for the BulkWhiz platform overview). Then customers could select a day and time tor delivery. Those who chose a regular purchase and delivery time had the option of "snoozing." If they were going to be out of town, for example, they could modify quantities and add or remove items from the list. Each customer s shopping list was stored on his or her homepage, for easy future access.

Over the following months, customer sales took off, growing at a rate of 30% month on month. By August, BulkWhiz's monthly revenue was approaching $100,00O. Rashad and Saber closely monitored performance, leveraging the data and Al to further optimize the platform. For example, they introduced a feature that identified customers who demonstrated favorable purchasing behavior and directed special offers to them to encourage further spending. On the operations side, they used Al to help with their just-in-time supply chain management.

Closing the Final Round of Seed Fundraising

Having demonstrated positive traction and unit economics, Rashad was able to close her final set

of investors at a $5 million valuation cap: BECO Capital, Enabling Future, Savour and a few angel investors. Amir Farha, managing partner at BECO Capital, Rashad's biggest investor, described his interactions with Rashad and why the fund chose to We met a while back, when Amira first had the idea for BulkWhiz. At that stage, it was too early for us bECO Capital to get involved, but we stayed in touch. With regard to her idea about selling groceries in bulk, Amazon's Souq.com was leading in the e-commerce space, and their platform included grocery items. Perhaps there was some bias in my not being a target consumer, but I needed to see traction and understand how she would secure stock efficiently.

Fast forward to a year later: she had set up the company. gotten traction. and was delivering

positive unit economics. She also had an impressive CIO. She clearly demonstrated strong

execution capabilities in building the business and growing her team, so we decided to offer a

$375,000 investment.

Decisions Ahead

Rashad was extremely pleased with bulk Whiz's performance to date but she had bigger aspirations for where It could go next. but, expanding would require a tew key steps. The first Important issue to work out was how to bring Saber on board full-time. While their current arrangement had worked well, now with the fast-approaching expansion and series A fundraising, Rashad needed her CTO full-time. Saber and Rashad were aiming at his being full-time at BulkWhiz in July, but the details of the transition and his compensation package were yet to be finalized. She believed that a CTO of Saber's caliber would typically be earning $200,000 to $250,000 a year and receiving an equity compensation of five to ten percent. She was aware that his company shares at his existing job would vest by the end Of June. She was unsure What Saber had in mind, ether in terms of pay or equity.

There was also the question of timing. Could she incentivize Saber to come on board earlier? What if he ultimately balked?

The second issue focused on the expansion of the business into other parts of the region. Rashad

was thinking carefully about whether bulkWhiz's existing model Would Work in Saudi Arabia, where the landscape, demographics and adoption of e-commerce was quite different from that in the UAE (see Exhibit 1). The biggest obstacle Rashad anticipated was customer delivery. First of all, Saudi Arabia was a much larger geography and second, most homes and offices, unlike in the WAF. had no formal street addresses. Drivers had to rely on landmarks, but it was easy to get lost, and they gotten had to phone the intended recipient for directions, making it a frustrating process for both parties.

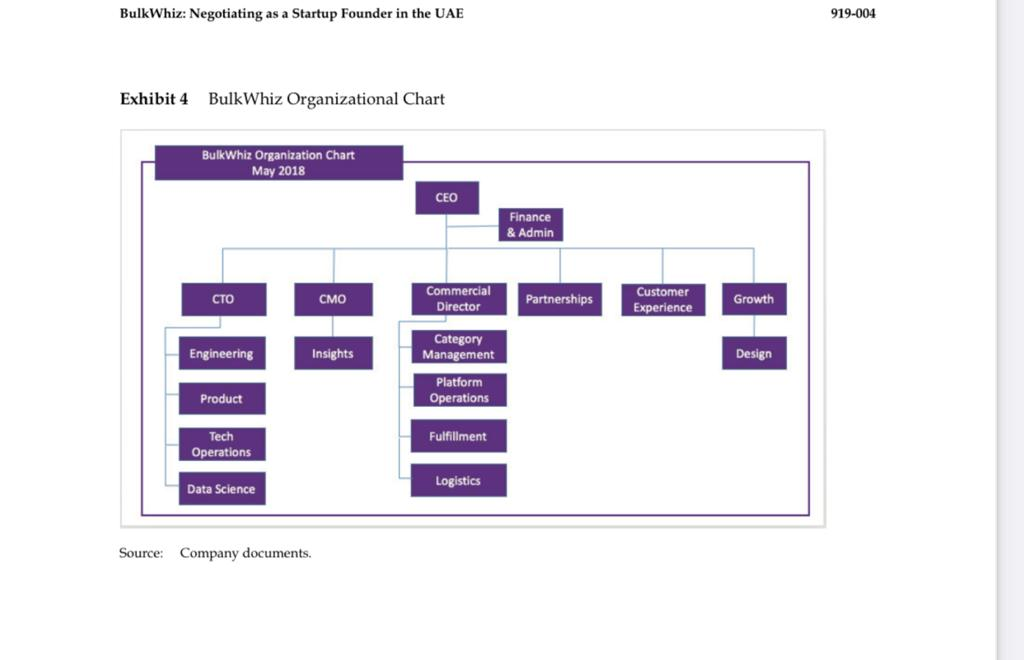

What was the best way for her to enter this market! She had spoken with other entrepreneurs in Saudi to get their thoughts, including Rashed Al Rashed, an experienced investor and entrepreneur whose family owned a major conglomerate in Saudi Arabia. He had recently launched a successful startup called Matic, an online marketplace for home cleaning services in the Gulf. Al Rashed shed light on potential hurdles to the expansion: "BulkWhiz entails a lot of logistic work and negotiations, and most of the suppliers she will be dealing with on a day-to-day basis will be men. So it might be challenging on the ground. It always helps to know people at the top who can influence decisions within the organization Finally, Rashad had to start preparing for her conversations with investors about her upcoming series A fundraising. She was aiming to raise $5 million at a pre-money valuation of $20 million. She anticipated that a majority of the money would go towards people, with the rest going toward further developing the technology and expanding operations. Rashad believed their existing team was extremely lean and that she to add resources across the board. most importantly in the commercial department (see Exhibit 4 tor company organizational chart).

In discussions With her advisory board, which included Farha, the initial reaction was that it might be too early for Rashad to pursue a series A round and that a $2 million bridge round might be a better approach. Farha had seen many entrepreneurs who had gotten a large investment sum too early and then were unable to spend it efficiently or on the right things. In his view, if Rashad decided to take less money now, she could focus on the key problems, and then aim for a higher valuation in the next round. Rashad had no intentions of pursuing the bridge round. Noting that she had already given out 27% of her equity for $1.2 million and that investors would not "bite into anything less than 15-20% in her next round, Rashad believed that a bridge round would dilute her company too much. It would result in her to giving away nearly halt of her company tor >3.2 million, while the A series would result in her giving away a similar amount of equity but tor S6.2 million As Rashad pulled into the driveway of her home and turned off the car's engine, she looked at her reflection in the rear-view mirror and sighed. It was the end of the day, but it was also the start of a long journey ahead. She looked forward to getting a good night's rest so that she could start the next day preparing for all the critical conversations that stood before him.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started