Answered step by step

Verified Expert Solution

Question

1 Approved Answer

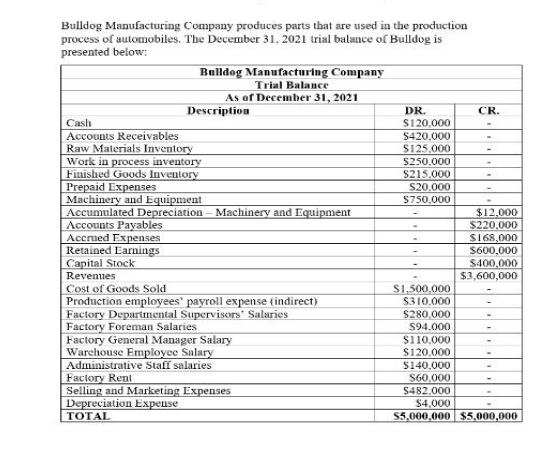

Bulldog Manufacturing Company produces parts that are used in the production process of automobiles. The December 31, 2021 trial balance of Bulldog is presented

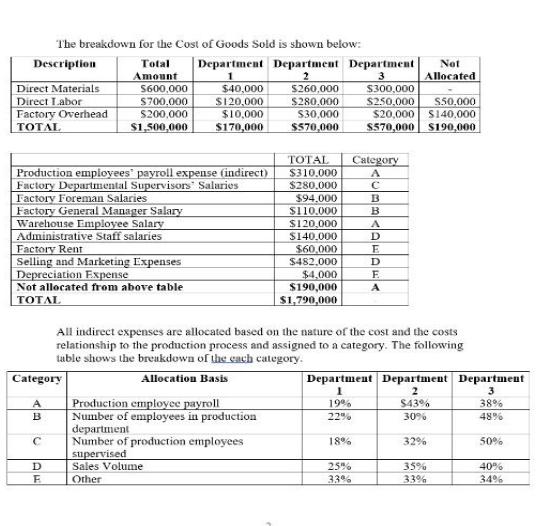

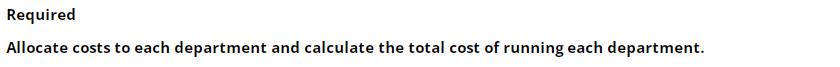

Bulldog Manufacturing Company produces parts that are used in the production process of automobiles. The December 31, 2021 trial balance of Bulldog is presented below: Bulldog Manufacturing Company Trial Balance As of December 31, 2021 Accounts Payables Accrued Expenses Retained Earnings Capital Stock Revenues Description Cash Accounts Receivables Raw Materials Inventory Work in process inventory Finished Goods Inventory Prepaid Expenses Machinery and Equipment Accumulated Depreciation - Machinery and Equipment Cost of Goods Sold Production employees' payroll expense (indirect) Factory Departmental Supervisors Salaries Factory Foreman Salaries Factory General Manager Salary Warehouse Employee Salary Administrative Staff salaries Factory Rent Selling and Marketing Expenses Depreciation Expense TOTAL DR. $120,000 $420,000 $125,000 $250,000 $215,000 $20,000 $750,000 $1,500,000 $310,000 $280,000 $94.000 $110.000 $120,000 CR. $12,000 $220,000 $168,000 $600,000 $400,000 $3,600,000 $140,000 $60,000 $482.000 $4,000 $5,000,000 $5,000,000 The breakdown for the Cost of Goods Sold is shown below: Description Direct Materials Direct Labor Factory Overhead TOTAL Category A B C Total Amount DE $600,000 $700.000 $200,000 $1,500,000 Production employees' payroll expense (indirect) Factory Departmental Supervisors Salaries Factory Foreman Salaries Factory General Manager Salary Warehouse Employee Salary Administrative Staff salaries Factory Rent Selling and Marketing Expenses Depreciation Expense Not allocated from above table TOTAL Department Department Department 2 3 $40,000 $120,000 $10,000 $170,000 Sales Volume Other Production employee payroll Number of employees in production department Number of production employees supervised $260,000 $280.000 $30,000 $570,000 TOTAL Category A C B B A D $310,000 $280,000 $94.000 $110.000 $120,000 $140.000 $60,000 $482,000 $4,000 $190,000 $1,790,000 All indirect expenses are allocated based on the nature of the cost and the costs relationship to the production process and assigned to a category. The following table shows the breakdown of the cach category. Allocation Basis $300,000 $250,000 $50,000 $20,000 $140,000 $570,000 $190,000 18% Not Allocated E D E A 25% 33% Department Department 1 2 19% $43% 22% 30% 32% 35% 33% Department 3 38% 48% 50% 40% 34% Required Allocate costs to each department and calculate the total cost of running each department. Bulldog Manufacturing Company produces parts that are used in the production process of automobiles. The December 31, 2021 trial balance of Bulldog is presented below: Bulldog Manufacturing Company Trial Balance As of December 31, 2021 Accounts Payables Accrued Expenses Retained Earnings Capital Stock Revenues Description Cash Accounts Receivables Raw Materials Inventory Work in process inventory Finished Goods Inventory Prepaid Expenses Machinery and Equipment Accumulated Depreciation - Machinery and Equipment Cost of Goods Sold Production employees' payroll expense (indirect) Factory Departmental Supervisors Salaries Factory Foreman Salaries Factory General Manager Salary Warehouse Employee Salary Administrative Staff salaries Factory Rent Selling and Marketing Expenses Depreciation Expense TOTAL DR. $120,000 $420,000 $125,000 $250,000 $215,000 $20,000 $750,000 $1,500,000 $310,000 $280,000 $94.000 $110.000 $120,000 CR. $12,000 $220,000 $168,000 $600,000 $400,000 $3,600,000 $140,000 $60,000 $482.000 $4,000 $5,000,000 $5,000,000 The breakdown for the Cost of Goods Sold is shown below: Description Direct Materials Direct Labor Factory Overhead TOTAL Category A B C Total Amount DE $600,000 $700.000 $200,000 $1,500,000 Production employees' payroll expense (indirect) Factory Departmental Supervisors Salaries Factory Foreman Salaries Factory General Manager Salary Warehouse Employee Salary Administrative Staff salaries Factory Rent Selling and Marketing Expenses Depreciation Expense Not allocated from above table TOTAL Department Department Department 2 3 $40,000 $120,000 $10,000 $170,000 Sales Volume Other Production employee payroll Number of employees in production department Number of production employees supervised $260,000 $280.000 $30,000 $570,000 TOTAL Category A C B B A D $310,000 $280,000 $94.000 $110.000 $120,000 $140.000 $60,000 $482,000 $4,000 $190,000 $1,790,000 All indirect expenses are allocated based on the nature of the cost and the costs relationship to the production process and assigned to a category. The following table shows the breakdown of the cach category. Allocation Basis $300,000 $250,000 $50,000 $20,000 $140,000 $570,000 $190,000 18% Not Allocated E D E A 25% 33% Department Department 1 2 19% $43% 22% 30% 32% 35% 33% Department 3 38% 48% 50% 40% 34% Required Allocate costs to each department and calculate the total cost of running each department.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started