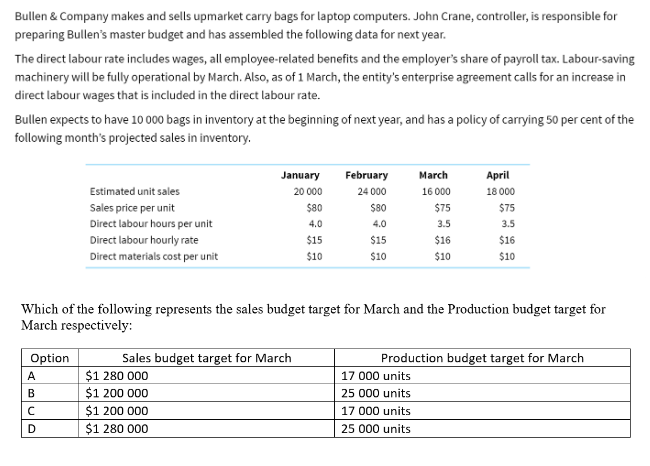

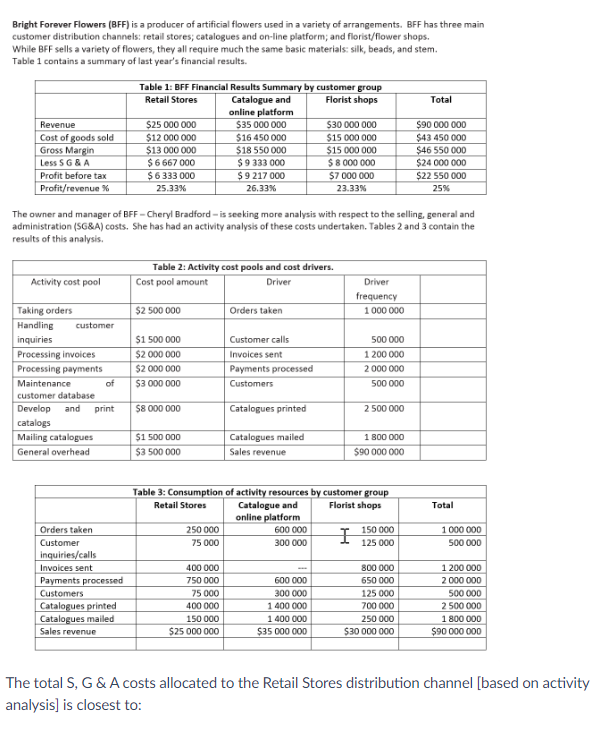

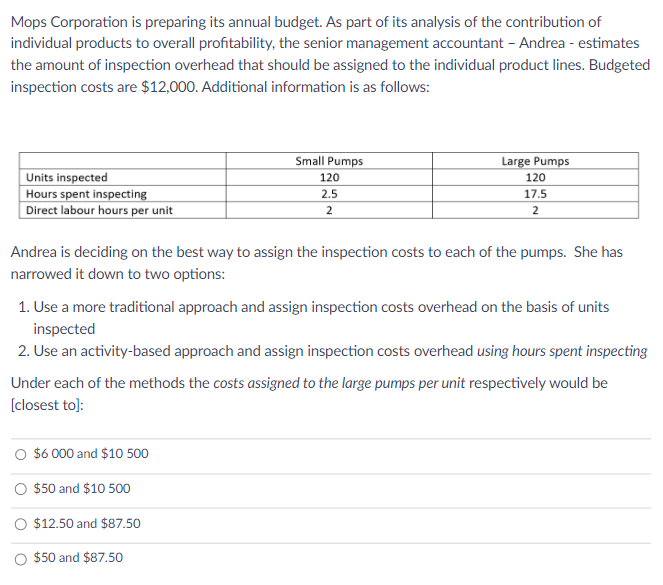

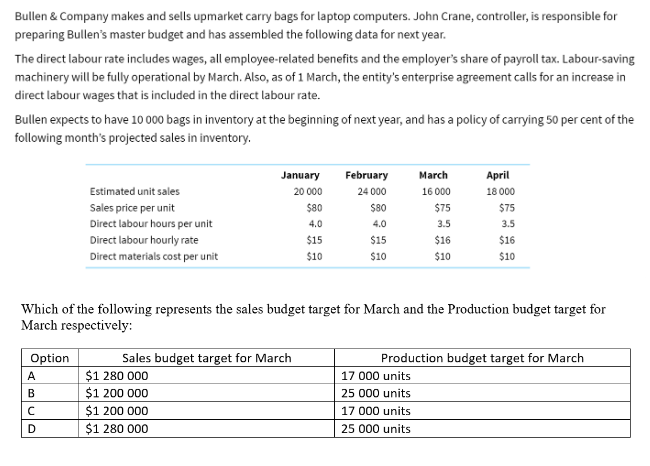

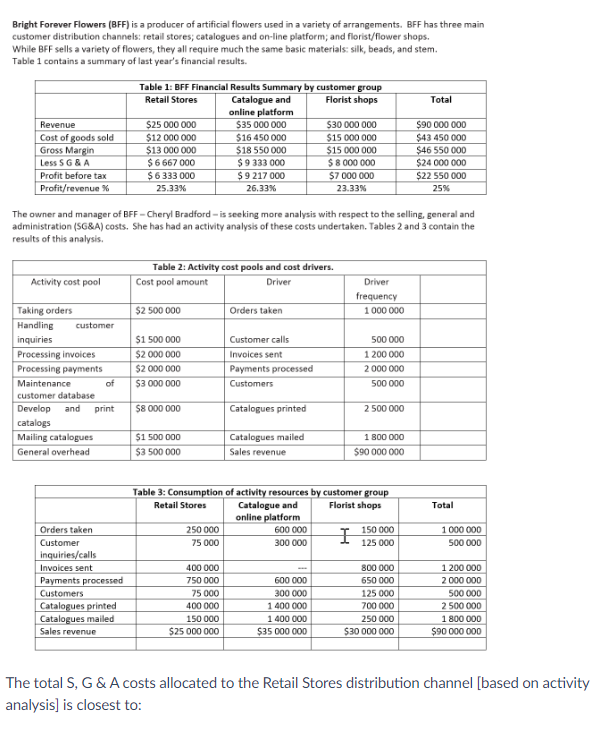

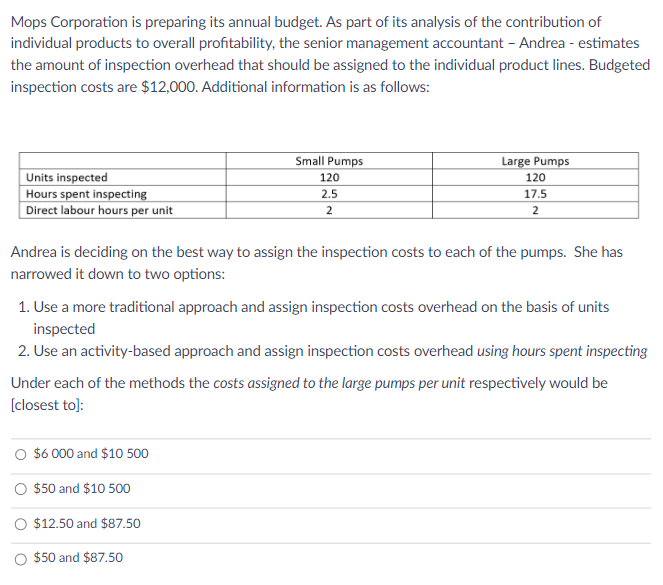

Bullen \& Company makes and sells upmarket carry bags for laptop computers. John Crane, controller, is responsible for preparing Bullen's master budget and has assembled the following data for next year. The direct labour rate includes wages, all employee-related benefits and the employer's share of payroll tax. Labour-saving machinery will be fully operational by March. Also, as of 1 March, the entity's enterprise agreement calls for an increase in direct labour wages that is included in the direct labour rate. Bullen expects to have 10000 bags in inventory at the beginning of next year, and has a policy of carrying 50 per cent of the following month's projected sales in inventory. Which of the following represents the sales budget target for March and the Production budget target for March respectively: Bright Forever Flowers (BFF) is a producer of artificial flowers used in a variety of arrangements. BFF has three main customer distribution channels: retall stores; catalogues and on-line platform; and florist/flower shops. While BFF sells a variety of flowers, they all require much the same basic materials: silk, beads, and stem. Table 1 contains a summary of last year's financial results. The owner and manager of BFF - Cheryl Bradford - is seeking more analysis with respect to the selling, general and administration (SG\&A) costs. She has had an activity analysis of these costs undertaken. Tables 2 and 3 contain the results of this analysis. The total S, G \& A costs allocated to the Retail Stores distribution channel [based on activity analysis] is closest to: Mops Corporation is preparing its annual budget. As part of its analysis of the contribution of individual products to overall profitability, the senior management accountant - Andrea - estimates the amount of inspection overhead that should be assigned to the individual product lines. Budgeted inspection costs are $12,000. Additional information is as follows: Andrea is deciding on the best way to assign the inspection costs to each of the pumps. She has narrowed it down to two options: 1. Use a more traditional approach and assign inspection costs overhead on the basis of units inspected 2. Use an activity-based approach and assign inspection costs overhead using hours spent inspecting Under each of the methods the costs assigned to the large pumps per unit respectively would be [closest to]: $6000 and $10500 $50 and $10500 $12.50 and $87.50 $50 and $87.50 Bullen \& Company makes and sells upmarket carry bags for laptop computers. John Crane, controller, is responsible for preparing Bullen's master budget and has assembled the following data for next year. The direct labour rate includes wages, all employee-related benefits and the employer's share of payroll tax. Labour-saving machinery will be fully operational by March. Also, as of 1 March, the entity's enterprise agreement calls for an increase in direct labour wages that is included in the direct labour rate. Bullen expects to have 10000 bags in inventory at the beginning of next year, and has a policy of carrying 50 per cent of the following month's projected sales in inventory. Which of the following represents the sales budget target for March and the Production budget target for March respectively: Bright Forever Flowers (BFF) is a producer of artificial flowers used in a variety of arrangements. BFF has three main customer distribution channels: retall stores; catalogues and on-line platform; and florist/flower shops. While BFF sells a variety of flowers, they all require much the same basic materials: silk, beads, and stem. Table 1 contains a summary of last year's financial results. The owner and manager of BFF - Cheryl Bradford - is seeking more analysis with respect to the selling, general and administration (SG\&A) costs. She has had an activity analysis of these costs undertaken. Tables 2 and 3 contain the results of this analysis. The total S, G \& A costs allocated to the Retail Stores distribution channel [based on activity analysis] is closest to: Mops Corporation is preparing its annual budget. As part of its analysis of the contribution of individual products to overall profitability, the senior management accountant - Andrea - estimates the amount of inspection overhead that should be assigned to the individual product lines. Budgeted inspection costs are $12,000. Additional information is as follows: Andrea is deciding on the best way to assign the inspection costs to each of the pumps. She has narrowed it down to two options: 1. Use a more traditional approach and assign inspection costs overhead on the basis of units inspected 2. Use an activity-based approach and assign inspection costs overhead using hours spent inspecting Under each of the methods the costs assigned to the large pumps per unit respectively would be [closest to]: $6000 and $10500 $50 and $10500 $12.50 and $87.50 $50 and $87.50