Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Burger King is a US-based fast food restaurant chain. Burger King advertises, develops new foods, and procures ingredients, but it owns almost none of

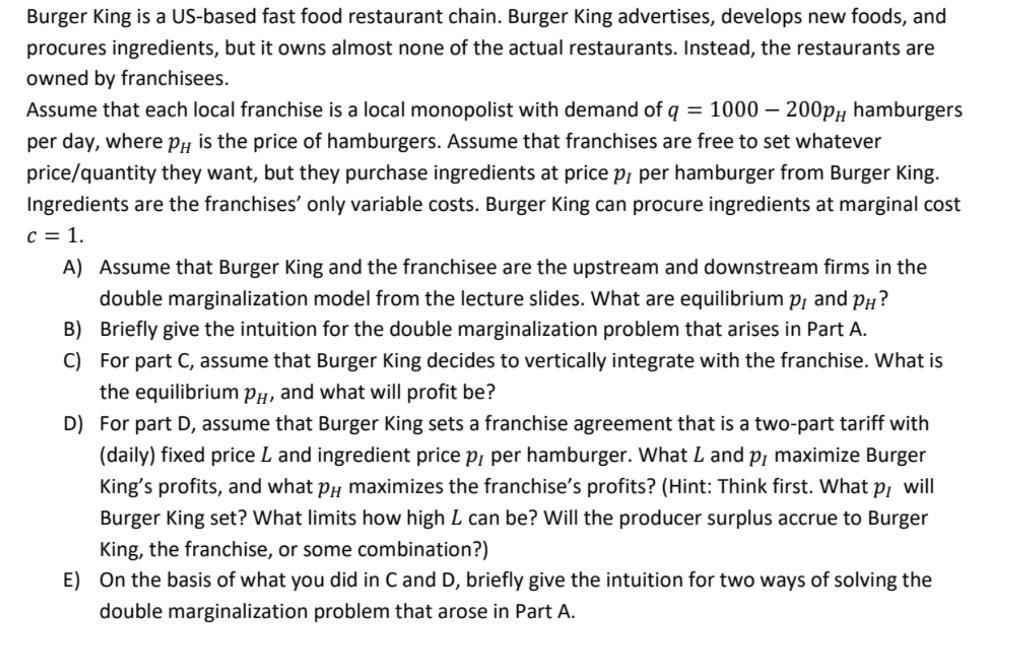

Burger King is a US-based fast food restaurant chain. Burger King advertises, develops new foods, and procures ingredients, but it owns almost none of the actual restaurants. Instead, the restaurants are owned by franchisees. Assume that each local franchise is a local monopolist with demand of q = 1000 - 200p, hamburgers per day, where pH is the price of hamburgers. Assume that franchises are free to set whatever price/quantity they want, but they purchase ingredients at price p, per hamburger from Burger King. Ingredients are the franchises' only variable costs. Burger King can procure ingredients at marginal cost c = 1. A) Assume that Burger King and the franchisee are the upstream and downstream firms in the double marginalization model from the lecture slides. What are equilibrium p, and p? Briefly give the intuition for the double marginalization problem that arises in Part A. B) C) For part C, assume that Burger King decides to vertically integrate with the franchise. What is the equilibrium pH, and what will profit be? D) For part D, assume that Burger King sets a franchise agreement that is a two-part tariff with (daily) fixed price L and ingredient price p, per hamburger. What L and p, maximize Burger King's profits, and what pH maximizes the franchise's profits? (Hint: Think first. What p, will Burger King set? What limits how high L can be? Will the producer surplus accrue to Burger King, the franchise, or some combination?) E) On the basis of what you did in C and D, briefly give the intuition for two ways of solving the double marginalization problem that arose in Part A.

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

In a twopart tariff model the monopolist sets the usage cost here ingr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started