Answered step by step

Verified Expert Solution

Question

1 Approved Answer

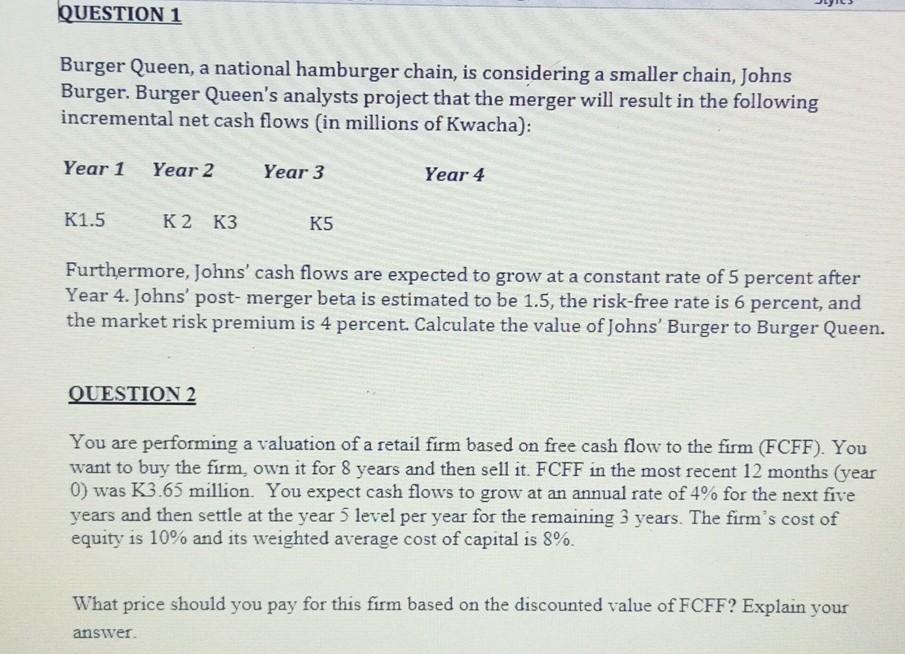

Burger Queen, a national hamburger chain, is considering a smaller chain, Johns Burger. Burger Queen's analysts project that the merger will result in the following

Burger Queen, a national hamburger chain, is considering a smaller chain, Johns Burger. Burger Queen's analysts project that the merger will result in the following incremental net cash flows (in millions of Kwacha): Furthermore, Johns' cash flows are expected to grow at a constant rate of 5 percent after Year 4. Johns' post-merger beta is estimated to be 1.5 , the risk-free rate is 6 percent, and the market risk premium is 4 percent. Calculate the value of Johns' Burger to Burger Queen. QUESTION 2 You are performing a valuation of a retail firm based on free cash flow to the firm (FCFF). You want to buy the firm, own it for 8 years and then sell it. FCFF in the most recent 12 months (year 0) was K3.65 million. You expect cash flows to grow at an annual rate of \4 for the next five years and then settle at the year 5 level per year for the remaining 3 years. The firm's cost of equity is \10 and its weighted average cost of capital is \8. What price should you pay for this firm based on the discounted value of FCFF? Explain your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started