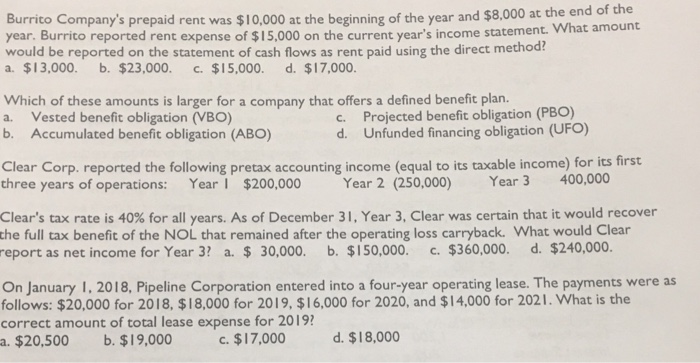

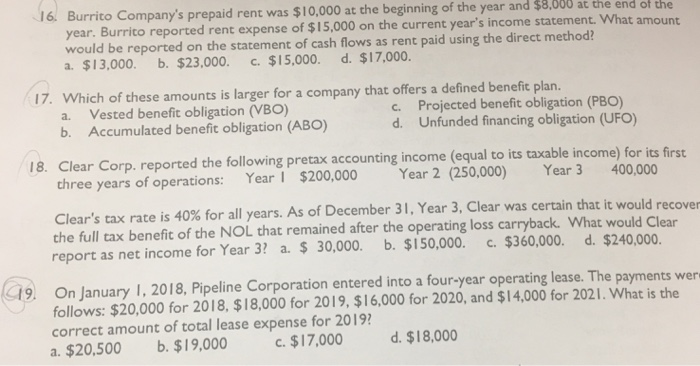

Burrito Company's prepaid rent was $10,000 at the beginning of the year year. Burrito reported rent expense of $15,000 on the current year's income statement would be reported on the statement of cash flows as rent paid using the direct method a. $13,000. b. $23,000. c. $15,000. d. $17,000. and $8,000 at the end of the What amount Which of these amounts is larger for a company that offers a defined benefit plan. a. Vested benefit obligation (VBO) b. Accumulated benefit obligation (ABO) c. Projected benefit obligation (PB) d. Unfunded financing obligation (UFO) Clear Corp. reported the following pretax accounting income (equal to its taxable income) for its first chree years of operations: Year | $200,000 Year 2 (250,000) Year 3 400,000 Clear's tax rate is 40% for all years. As of December 31, Year 3, Clear was certain that it would recover the full tax benefit of the NOL that remained after the operating loss carryback. What would Clear report as net income for Year 3? a. 30,000. b. $150,000. c. $360,000. d. $240,000. On January I, 2018, Pipeline Corporation entered into a four-year operating lease. The payments were as follows: $20,000 for 2018, $18,000 for 2019, $16,000 for 2020, and $14,000 for 2021. What is the correct amount of total lease expense for 2019 a. $20,500 b. $19,000 C$17,000 d. $18,000 6. Burrito Company's prepaid rent was $10,000 at the beginning of the year and $8,000 at the end of th year. Burrito reported rent expense of $15,000 on the current year's income statement. What would be reported on the statement of cash flows as rent paid using the direct method? a. $13,000. b. $23,000. $15,000. d. $17,000. amount 17. Which of these amounts is larger for a company that offers a defined benefit plan. Vested benefit obligation (VBO) Accumulated benefit obligation (ABo) Projected benefit obligation (PBo) c. d. a. b. Unfunded financing obligation (UFO) 18. Clear Corp. reported the following pretax accounting income (equal to its taxable income) for its first Year | $200,000 Year 2 (250,000) three years of operations: Year 3 400,000 Clear's tax rate is 40% for all years. As of December 31, Year 3, Clear was certain that it would recover the full tax benefit of the NOL that remained after the operating loss carryback. What would Clear report as net income for Year 3? a. $ 30,000. b. $150,000. c. $360,000. d. $240,000. 19 On January I, 2018, Pipeline Corporation entered into a four-year operating lease. The payments wer follows: $20,000 for 2018, $18,000 for 2019, $16,000 for 2020, and $14,000 for 2021. What is the correct amount of total lease expense for 2019 a. $20,500 b. $19,000 . $17,000 d. $18,000