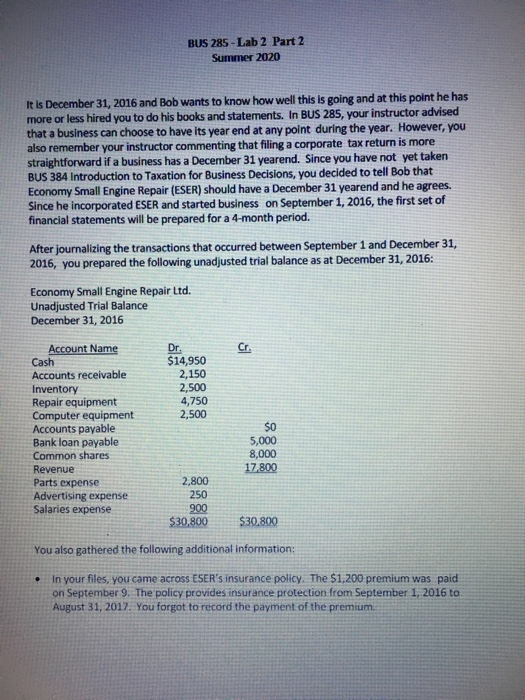

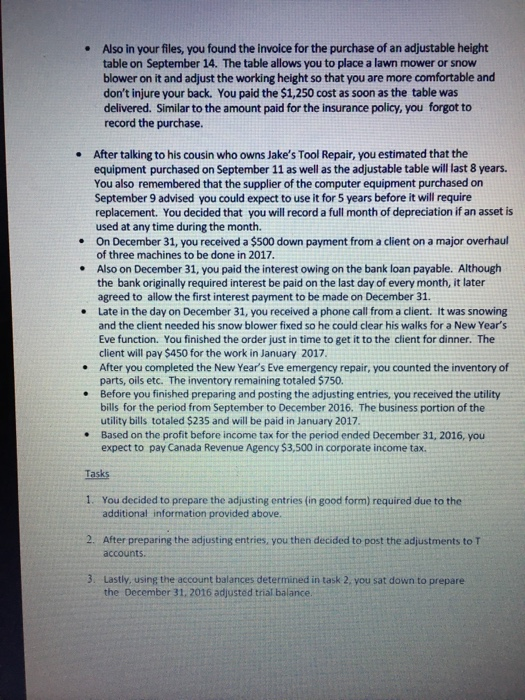

BUS 285 - Lab 2 Part 2 Summer 2020 It is December 31, 2016 and Bob wants to know how well this is going and at this point he has more or less hired you to do his books and statements. In BUS 285, your instructor advised that a business can choose to have its year end at any point during the year. However, you also remember your instructor commenting that filing a corporate tax return is more straightforward if a business has a December 31 yearend. Since you have not yet taken BUS 384 Introduction to Taxation for Business Decisions, you decided to tell Bob that Economy Small Engine Repair (ESER) should have a December 31 yearend and he agrees. Since he incorporated ESER and started business on September 1, 2016, the first set of financial statements will be prepared for a 4-month period. After journalizing the transactions that occurred between September 1 and December 31, 2016, you prepared the following unadjusted trial balance as at December 31, 2016: Economy Small Engine Repair Ltd. Unadjusted Trial Balance December 31, 2016 Cr. Dr. $14,950 2,150 2,500 4,750 2,500 Account Name Cash Accounts receivable Inventory Repair equipment Computer equipment Accounts payable Bank loan payable Common shares Revenue Parts expense Advertising expense Salaries expense $0 5,000 8,000 17 800 2,800 250 900 $30,800 $30.800 You also gathered the following additional information: . In your files, you came across ESER's insurance policy. The $1,200 premium was paid on September 9. The policy provides insurance protection from September 1, 2016 to August 31, 2017. You forgot to record the payment of the premium. Also in your files, you found the invoice for the purchase of an adjustable height table on September 14. The table allows you to place a lawn mower or snow blower on it and adjust the working height so that you are more comfortable and don't injure your back. You paid the $1,250 cost as soon as the table was delivered. Similar to the amount paid for the insurance policy, you forgot to record the purchase. After talking to his cousin who owns Jake's Tool Repair, you estimated that the equipment purchased on September 11 as well as the adjustable table will last 8 years. You also remembered that the supplier of the computer equipment purchased on September 9 advised you could expect to use it for 5 years before it will require replacement. You decided that you will record a full month of depreciation if an asset is used at any time during the month. On December 31, you received a $500 down payment from a client on a major overhaul of three machines to be done in 2017. Also on December 31, you paid the interest owing on the bank loan payable. Although the bank originally required interest be paid on the last day of every month, it later agreed to allow the first interest payment to be made on December 31. late in the day on December 31, you received a phone call from a client. It was snowing and the client needed his snow blower fixed so he could clear his walks for a New Year's Eve function. You finished the order just in time to get it to the client for dinner. The client will pay $450 for the work in January 2017 After you completed the New Year's Eve emergency repair, you counted the inventory of parts, oils etc. The inventory remaining totaled $750. Before you finished preparing and posting the adjusting entries, you received the utility bills for the period from September to December 2016. The business portion of the utility bills totaled $235 and will be paid in January 2017 Based on the profit before income tax for the period ended December 31, 2016, you expect to pay Canada Revenue Agency $3,500 in corporate income tax. Tasks 1. You decided to prepare the adjusting entries (in good form) required due to the additional information provided above. 2. After preparing the adjusting entries, you then decided to post the adjustments to T accounts 3. Lastly, using the account balances determined in task 2. you sat down to prepare the December 31, 2016 adjusted trial balance