Question

BUS201 (Multiple Choice) 1) The Jones Family has a net worth of $1,000. Their monthly mortgage payment is $840. Utilities are another $280. They have

BUS201 (Multiple Choice)

1) The Jones Family has a net worth of $1,000. Their monthly mortgage payment is $840. Utilities are another $280. They have $25,000 in credit card debt and $3,000 in their savings account as an emergency fund. They have $29,000 equity in their home. They have not been contributing to 401(k) plans at work. What is their #1 financial priority?

A. Contribute the maximum to their 401(k)

B. Obtain a second mortgage line of credit

C. Pay off credit card debt

D. Purchase mortgage insurance

2) Selecting, buying and selling stocks, bonds, and other financial instruments are important to personal financial planning. The Wilson Family has been investing $2,000 annually in an IRA for the past 6 years, which is invested in a portfolio of a mutual fund. The average return on stocks since 1926 has been about 10%. How much will the IRA be worth in 7.2 years?

A. $16,974

B. $33,949

C. $53,439

D. None of the above.

3) Assume that the overall stock market decreases by 13% and that EFG stock has a beta of 1.8. How much do you expect EFG's stock price to change?

A. 13%

B. 23%

C. -13%

D. -23%

4) The primary value of an annuity is to ensure your retirement income. Therefore, you should purchase annuities before investing in IRA, 401(k), or Keogh.

A. True

B. False

5) You realize that, even though you have been contributing the maximum to your 401(k), you will not have enough money to ensure you have a comfortable retirement. What can you do?

A. Choose a higher risk investment portfolio.

B. Contribute to a Roth IRA in addition to your 401(k)

C. Purchase an annuity

D. All of the above may be worthwhile.

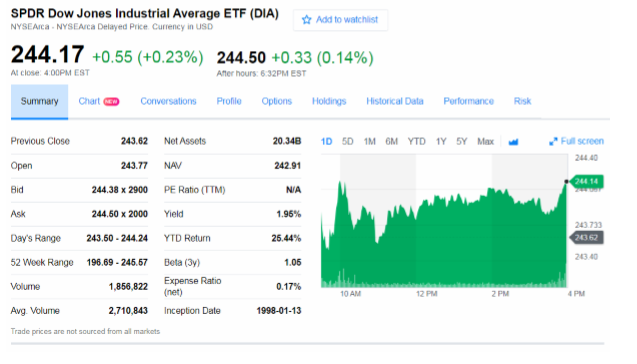

6) The Dow Jones Industrial average has shown steady growth for nearly a century. A special type of stock traded under the symbol DIA is available that tracks the performance of the DJIA. An snapshot of its performance is shown in the following figure:

A. DIA has a low expense ratio.

B. DIA is very risky because its beta is greater than 1.0.

C. DIA has had a year-to-date return on investment of 1.95%.

D. DIA is not diversified.

7) With investments earning 9%, and inflation at 2%, a reasonable approximation of an opportunity cost of carrying credit card debt at 18% APR is:

A. 18%

B. 29% (18 + 9 + 2)

C. 7% (18 - 9 - 2)

D. The future value of the investment you could have made instead.

8) As an investor, you decide your goal is a balanced portfolio. Which of the following asset allocation strategies is the best fit with your goal?

A. 20% stocks, 80% bonds

B. 40% stocks, 60% bonds

C. 70% stocks, 30% bonds

D. All of the above.

9) Assuming you earn $35,000 salary. The Easy Method of estimating your life insurance shown in the textbook indicates you should have life insurance worth:

A. $122,500

B. $171,500

C. $175,000

D. $245,000

SPDR Dow Jones Industrial Average ETF (DIA) NYSEArca NYSEArca Delayed Price Currency in USD Add to watchlist 244.17 +0.55 (+0.23%) 244.50 +0.33(0.14%) Al close 4.00PM EST After hours: 6:32PM EST Summary Chart CED Conversations Proile Options Holdings Historical DataPerformance Risk Previous Close Open Bid Ask Day's Range 243.50-244.24 YTD Return 52 Wook Range 196.69-245.67 Beta (3y) Volurme Avg. Volume Trade 243.62 Net Assets 20.348 1D 5D 1M GM YTD 1Y 5Y Max Full screen 244 40 242.91 N/A 1.96% 25.44% 1.06 0.17% 1998-01-13 243.77 NAV 244.38 x 2900 PE Ratio (TTM) 244.50 x 2000 Yield 243 733 243.40 1,856,822 Expense Ratio (net) 10 AM 12 PM 2 PM PM 2,710,843 Inception Date prices are not sourced from all marketsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started