Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Buscar Labs is planning to invest $150,000,000 in a technology to produce a new vaccine. The vaccine will reduce significantly the amount of risk

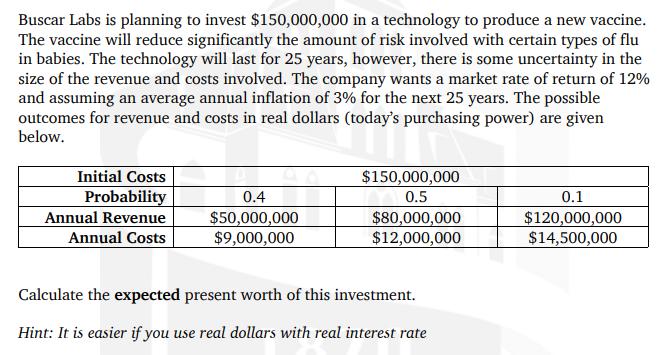

Buscar Labs is planning to invest $150,000,000 in a technology to produce a new vaccine. The vaccine will reduce significantly the amount of risk involved with certain types of flu in babies. The technology will last for 25 years, however, there is some uncertainty in the size of the revenue and costs involved. The company wants a market rate of return of 12% and assuming an average annual inflation of 3% for the next 25 years. The possible outcomes for revenue and costs in real dollars (today's purchasing power) are given below. Initial Costs $150,000,000 0.5 0.1 Probability Annual Revenue 0.4 $50,000,000 $80,000,000 $120,000,000 Annual Costs $9,000,000 $12,000,000 $14,500,000 Calculate the expected present worth of this investment. Hint: It is easier if you use real dollars with real interest rate

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 2 A B E Annual Revenue Annual Costs Probability 04 05 500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started