Question

BUSI 106 Final Review Summer 2018 Instructions: Following are several questions related to specific chapters (6, 7, 8, 9, 11, 12, and 13) from your

BUSI 106 Final Review

BUSI 106 Final Review

Summer 2018

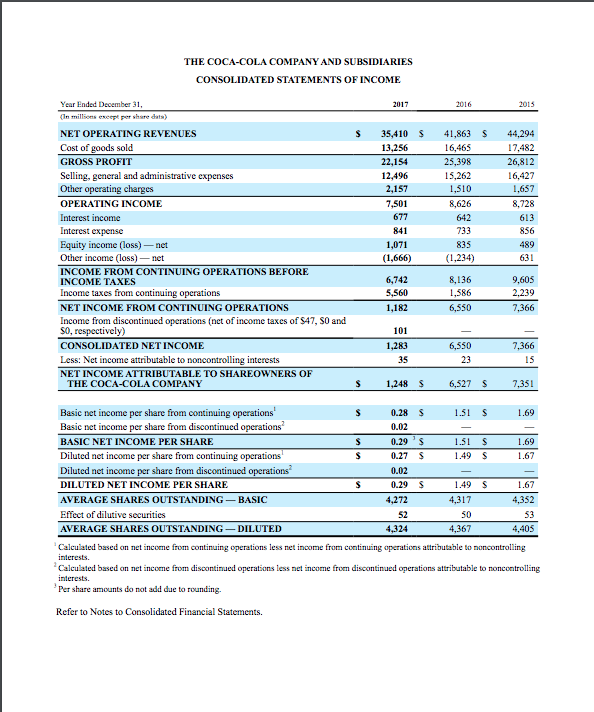

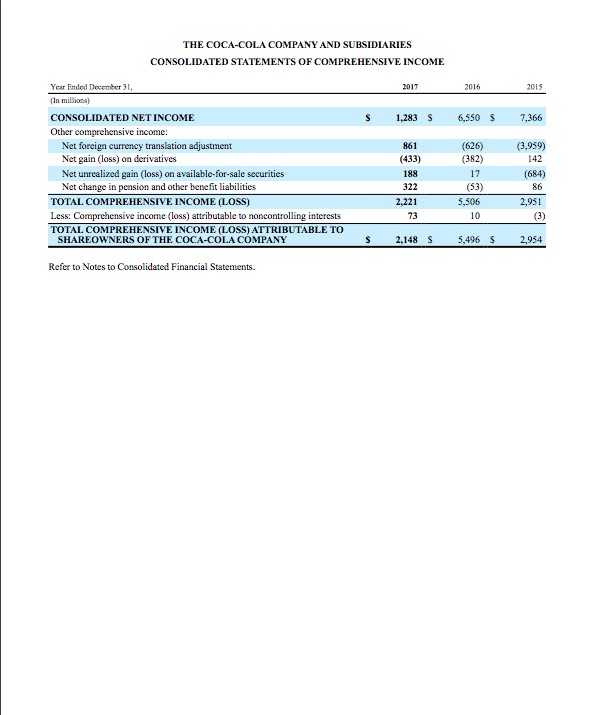

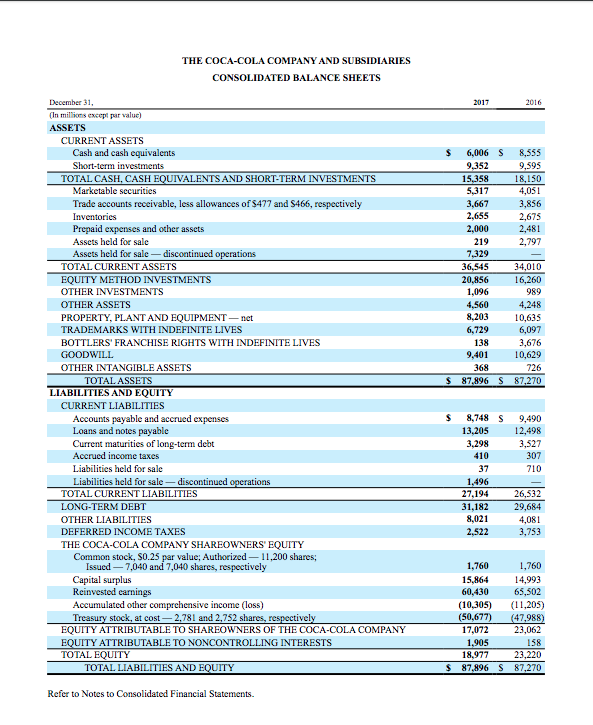

Instructions: Following are several questions related to specific chapters (6, 7, 8, 9, 11, 12, and 13) from your textbook. You will use the 2017 Coca Cola Company Financial Statements. All answers you will need are provided within the companys 10-K. You are advised to use the financial statements (Balance Sheet, Income Statement, Statement of Cash Flows) as well as the Footnotes provided in the 10-K, where applicable. You must provide the answer AND indicate where you found this information.

Questions related to Chapter 6:

How much cash and cash equivalents does the company report at the end of 2017?

What was the change in trade receivables from 2016 to 2017 and how would it affect the net cash provided by operating activities in 2016? (Please note Trade Receivables is not a separate line item on Coca Colas Statement of Cash Flows, but aggregated into Other.)

Which types of customers account for a most of the companys accounts receivable? Did bad debt expense increase or decrease from 2016 to 2017? How did you know?

What items are subtracted from Gross Revenue to get to Net Operating Revenue?

Questions related to Chapter 7:

How much inventory does Coca-Cola hold at the end of 2017? Please refer to the Footnotes and provide the amounts of inventory allocation.

Estimate the amount of raw material inventory the company purchased during 2017. (Hint: Use the cost of goods sold equation and use the total beginning and ending inventory amounts in your calculations.)

What method does the company use to determine the cost of its inventory?

Compute the inventory turnover ratio for 2017. What does an inventory turnover ratio tell you?

Questions related to Chapter 8:

How much cash did the company spend on property, plant and equipment in fiscal 2017?

What is the amount of accumulated depreciation at the end of 2017?

For depreciation purposes, what is the estimated useful life for buildings and improvements?

What was the amount of depreciation and amortization reported as an expense for 2017?

What is the companys fixed asset turnover ratio for fiscal year ended 2017? Use Net Operating Revenue and average net fixed assets for this calculation.

Questions related to Chapter 9:

What is the amount of accrued compensation at the end of 2017? The amount of Sales, payroll, and other taxes at the end of 2017?

What was the change in trade accounts payable from 2016 to 2017 and would it affect the net cash provided by operating activities in 2017? (Please note Trade Accounts Payable is not a separate line item on Coca Colas Statement of Cash Flows, but aggregated into Other.)

What is the total amount of long-term liabilities at the end of 2017?

Questions related to Chapter 11:

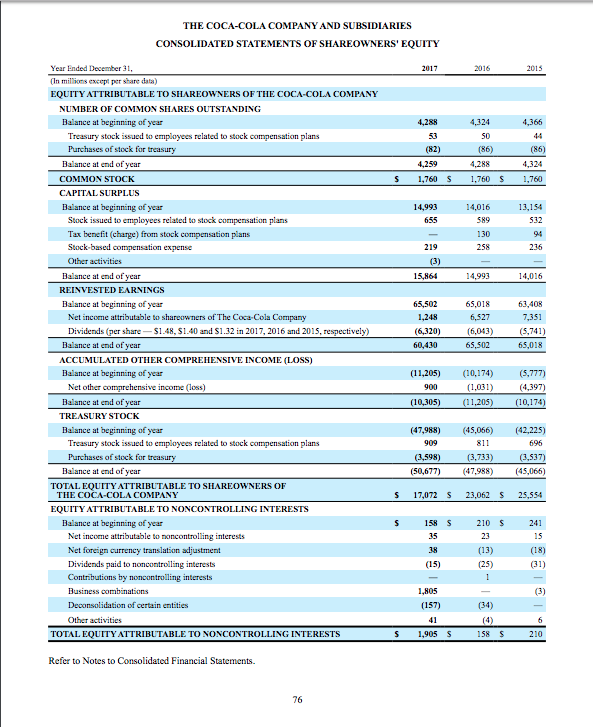

Does the company have treasury stock? If so, how many shares, and what is the dollar amount?

Does the company pay dividends? If so, how much per share?

Did the company buy treasury stock from the public during 2017?

What is the par value of the common stock?

Questions related to Chapter 12:

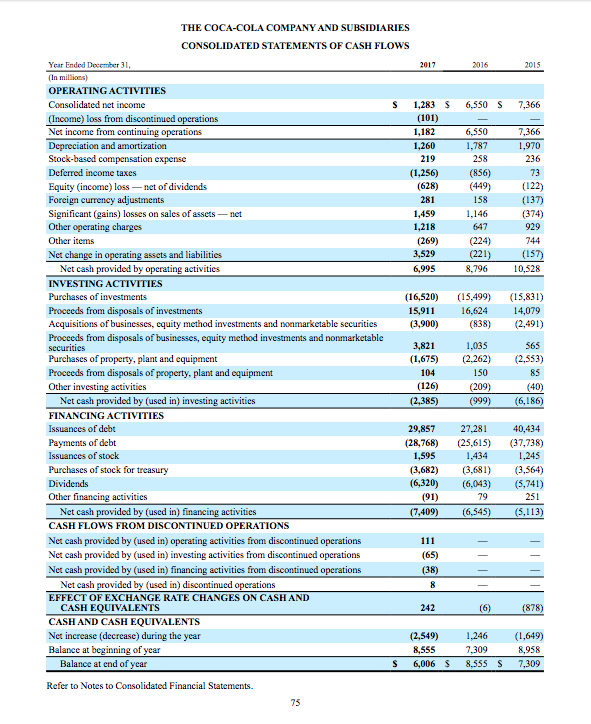

On the statement of cash flows, what was the largest item (absolute value) listed in the Operating Section? Is this added or subtracted from Net Income? Explain why.

Does Coca-Cola use the direct or indirect method to report cash flows from operations?

Examine the investing and financing activities. List the three largest uses of cash during 2017.

What was free cash flow for the year ended 2017?

Questions related to Chapter 13:

Compute the following ratios using Coca-Colas 2017 financial statements and a stock price of $45.88.

Return on Equity (use Net Income attributable to Shareowners of Coca-Cola and Equity attributable to the Shareowners)

Basic Net Income per share

Profit margin

Current ratio

Debt/Equity ratio

Price/Earnings ratio

Dividend yield

THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME Year Ended December 31, 2017 2016 2015 n millions exeept per share dats) NET OPERATING REVENUES Cost of goods sold GROSS PROFTT Selling, general and administrative expenses Other operating charges OPERATING INCOME Interest income Interest expense Equity income (loss)- net Other income (loss)-net INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Income taxes from continuing operations NET INCOME FROM CONTINUING OPERATIONS Income from discontinued operations (net of income taxes of $47, S0 and $0, respectively) CONSOLIDATED NET INCOME Less: Net income attributable to noncontrolling interests NET INCOME ATTRIBUTABLE TO SHAREOWNERS OF S 35,410 S41,863 44,294 17,482 26,812 16,427 1,657 8,728 613 856 13,256 22,154 12,496 2,157 7,501 16,465 15,262 1,510 8,626 642 733 835 (1,234) 841 1,071 (1,666) 6,742 5,560 1,182 631 8,136 1,586 9,605 2,239 ,366 101 1,283 35 ,366 15 23 THE COCA-COLA COMPANY S 1,248 S 6,527S7,35 Basic net income per share from continuing operations Basic net income per share from discontinued operations BASIC NET INCOME PER SHARE Diluted net income per share from continuing operations Diluted net income per share from discontinued DILUTED NET INCOME PER SHARE AVERAGE SHARES OUTSTANDING -BASIC Effect of dilutive securities AVERAGE SHARES OUTSTANDING DILUTED 0.28 S 0.02 0.29 S 0.27 S 0.02 0.29 S 1.51 S 1.69 1.51 $ 1.49 S .69 1.67 1.49 S 1.67 4,272 52 4,324 4,317 50 4,367 53 4,405 Calcu ated based on net income from continuing operations less net income from continuing operations attributable to noncontrolling alcu ated based on net income run discontinued operations ess net income rom discontinued?erations attributable o noncontrolling Per share amounts do not add due to rounding. Refer to Notes to Consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started