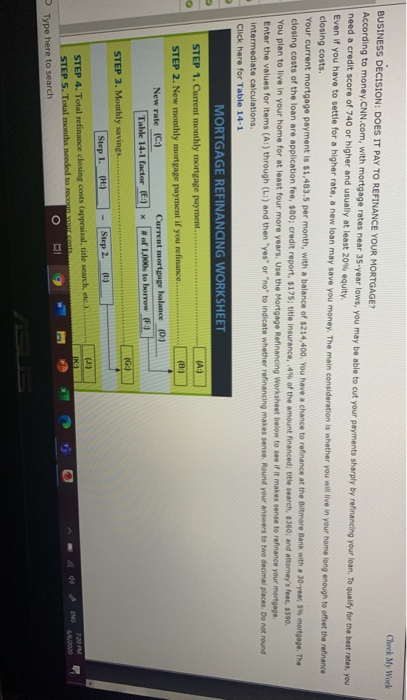

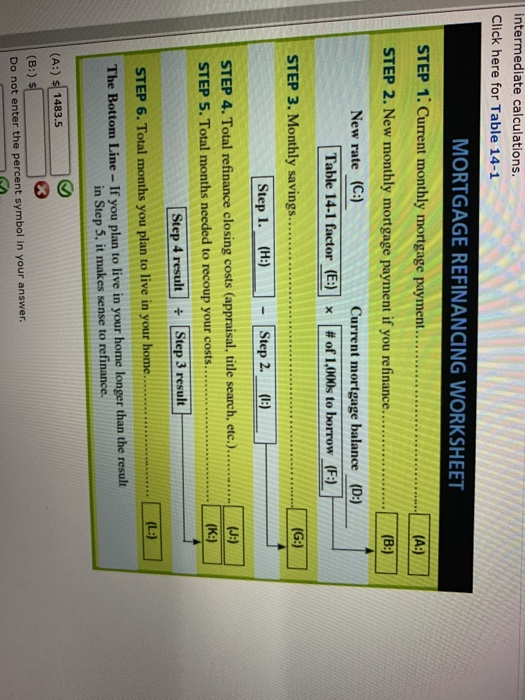

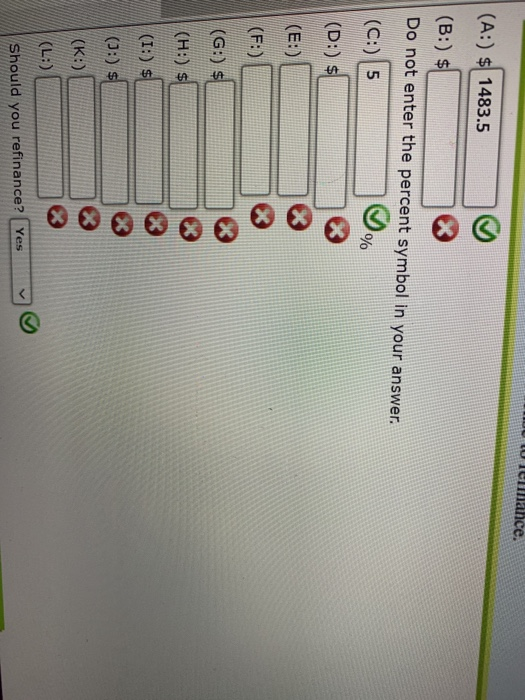

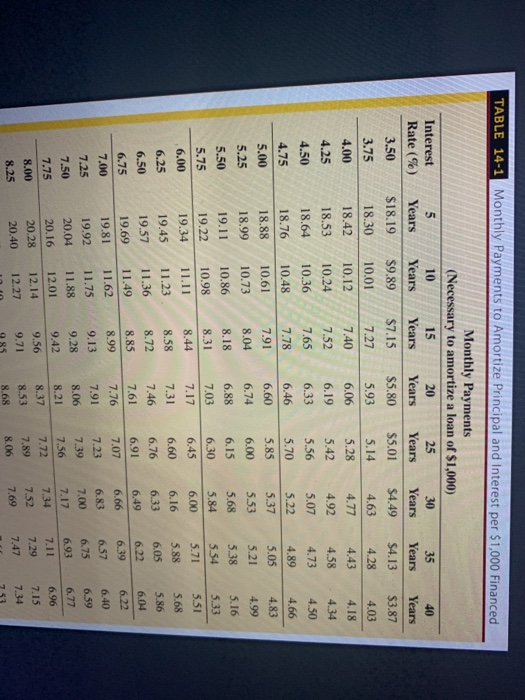

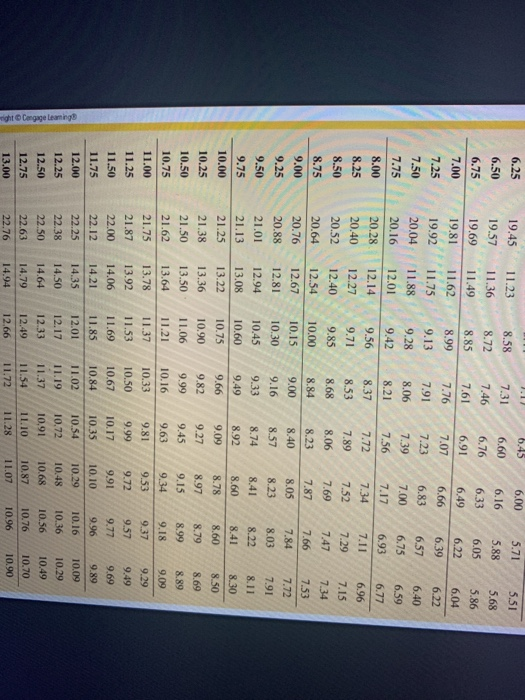

BUSINESS DECISION: DOES IT PAY TO REFINANCE YOUR MORTGAGE? Check My Work According to money.CNN.com, with mortgage rates near 35-year lows, you may be able to cut your payments sharply by refinancing your loan. To quality for the best rates, you need a credit score of 740 or higher and usually at least 20% equity Even if you have to settle for a higher rate, a new loan may save you money. The main consideration is whether you will live in your home long enough to offset the refinance closing costs Your current mortgage payment is $1,483,5 per month, with a balance of $214,400. You have a chance to refinance at the Bitmore Bank with a 30-year, 5mortgage. The closing costs of the loan are application fee, 500; credit report, $175; title insurance, 4% of the amount financed: title search, 5360; and attorney's fees, 5590. You plan to live in your home for at least four more years. Use the Mortgage Refinancing Worksheet below to see if it makes sense to refinance your mortgage Enter the values for items (AI) through (LI) and then "yes" or "no to indicate whether refinancing makes sense. Round your answers to two decimal places. Do not round intermediate calculations. Click here for Table 14-1 MORTGAGE REFINANCING WORKSHEET STEP 1. Current monthly mortgage payment... (A:) STEP 2. New monthly mortgage payment if you refinance. (8) New rate (C:) Current mortgage balance 10:) Table 14-1 factor (E:) #of 1,000 to borrow (F:) 1G1 STEP 3. Monthly savings... Step I. (H) (1:) :) STEP 4. Total refinance closing costs (appraisal, title search, etc.). 7-2011 STEP 5. Total months needed to recounts 646/2000 BI 9 Type here to search Step 2 ING o intermediate calculations. Click here for Table 14-1 MORTGAGE REFINANCING WORKSHEET STEP 1. Current monthly mortgage payment... (A:) (B:) STEP 2. New monthly mortgage payment if you refinance........ New rate (C:) Current mortgage balance (D:) Table 14-1 factor (E:) # of 1,000s to borrow (F:) STEP 3. Monthly savings..... (G:) Step 1. (H:) Step 2. (1:) STEP 4. Total refinance closing costs (appraisal, title search, etc.).. STEP 5. Total months needed to recoup your costs.. (K:) Step 4 result Step 3 result (L:) STEP 6. Total months you plan to live in your home. The Bottom Line - If you plan to live in your home longer than the result in Step 5, it makes sense to refinance. (A:) $ 1483.5 (B:) $ Do not enter the percent symbol in your answer. mahce. (A:) $ 1483.5 (B:) $ Do not enter the percent symbol in your answer. (C:) 5 % (D:) $ (E:) (F:) (G:) $ 5 50 (H:) $ 52 (I:) $ (J:) $ (K:) (L: Should you refinance? Yes TABLE 14-1 Monthly Payments to Amortize Principal and Interest per $1,000 Financed 5 Years Interest Rate (%) 3.50 3.75 35 Years $4.13 40 Years $18.19 $3.87 18.30 4.28 4.03 4.00 18.42 4.43 4.18 4.25 4.34 4.58 18.53 18.64 4.73 4.50 4.50 4.89 4.66 4.75 18.76 5.05 5.00 18.88 4.83 4.99 5.21 5.25 Monthly Payments (Necessary to amortize a loan of $1,000) 10 15 20 25 30 Years Years Years Years Years $9.89 $7.15 $5.80 $5.01 $4,49 10.01 7.27 5.93 5.14 4.63 10.12 7.40 6.06 5.28 4.77 10.24 7.52 6.19 5.42 4.92 10.36 7.65 6.33 5.56 5.07 10.48 7.78 6.46 5.70 5.22 10.61 7.91 6.60 5.85 5.37 10.73 8.04 6.74 6.00 5.53 10.86 8.18 6.88 6.15 5.68 10.98 8.31 7.03 6.30 5.84 11.11 8.44 7.17 6.45 6.00 11.23 8.58 7.31 6.60 6.16 11.36 8.72 7.46 6.76 6.33 11.49 8.85 7.61 6.91 6.49 11.62 8.99 7.76 7.07 6.66 11.75 9.13 7.91 7.23 6.83 9.28 11.88 8.06 7.00 7.39 9.42 12.01 8.21 7.17 7.56 9.56 12.14 8.37 7.34 7.72 7.52 7.89 8.53 9.71 12.27 985 8.68 7.69 5.38 5.54 5.71 5.88 5.16 5.33 5.51 18.99 19.11 19.22 19.34 19.45 19.57 19.69 19.81 19.92 20.04 20.16 20.28 20.40 5.50 5.75 6.00 6.25 6.50 6.75 7.00 7.25 6.05 6.22 6.39 5.68 5.86 6.04 6.22 7.50 7.75 6.57 6.75 6.93 7.11 7.29 7.47 6.40 6.59 6.77 6.96 7.15 7.34 8.00 8.25 8.06 2.1 6.45 6.25 6.00 19.45 11.23 5.71 5.51 8.58 7.31 6.60 6.50 19.57 5.88 5.68 6.75 6.76 6.05 11.36 11.49 11.62 6.16 6.33 6.49 5.86 8.72 8.85 8.99 19,69 19.81 7.00 7.46 7.61 7.76 7.91 6.91 7,07 6.22 6.04 7.25 6,66 19.92 6.39 11.75 6.22 9.13 7.23 7.50 6.40 9.28 11.88 12.01 8.06 7.39 7.75 6.83 7.00 7.17 6.57 6.75 6.59 9.42 8.21 8.00 6.77 12.14 20.04 20.16 20.28 20.40 20.52 20.64 9.56 8.37 7,34 6.96 7.56 7.72 7.89 8.06 9.71 8.53 8.25 8.50 8.75 7.52 6.93 7.11 7.29 7.47 12.27 12.40 12.54 12.67 9.85 7.69 8.68 8.84 8.23 10.00 10.15 9.00 9.25 7.15 7.34 7.53 7.72 7,91 9.00 7.87 8.05 8.23 7.66 7.84 8.03 10.30 9.16 8.40 8.57 8.74 20.76 20.88 21.01 21.13 21.25 12.81 12.94 9.33 9.50 9.75 10.00 8.11 10.45 10.60 10.75 13.08 13.22 8.92 9.49 9.66 8.41 8.60 8.78 8.22 8.41 8.60 8.30 8.50 10.25 21.38 9.09 9.27 10.90 9.82 9.99 10.50 13.36 13.50 13.64 21.50 21.62 11.06 8.97 9.15 9.34 8.79 8.99 9.18 8.69 8.89 9.09 10.75 11.00 10.16 10.33 9.45 9.63 9.81 9.99 9.37 13.78 13.92 11.21 11.37 11.53 11.69 21.75 21.87 22.00 22.12 10.50 10.67 9.57 9.77 14.06 9.53 9.72 9.91 10.10 10.29 14.21 9.96 10.84 11.02 11.25 11.50 11.75 12.00 12.25 12.50 12.75 13.00 9.29 9.49 9.69 9.89 10.09 10.29 10.49 10.70 10.17 10.35 10.54 10.72 10,91 10.48 weight Cargage learning 22.25 22.38 22.50 22.63 22.76 11.85 12.01 12.17 12.33 12.49 12.66 14.35 14.50 14.64 14.79 14.94 11.19 11.37 11.54 11.72 10.16 10.36 10.56 10.76 10.96 10.68 10.87 11.07 11.10 11.28 10.90 BUSINESS DECISION: DOES IT PAY TO REFINANCE YOUR MORTGAGE? Check My Work According to money.CNN.com, with mortgage rates near 35-year lows, you may be able to cut your payments sharply by refinancing your loan. To quality for the best rates, you need a credit score of 740 or higher and usually at least 20% equity Even if you have to settle for a higher rate, a new loan may save you money. The main consideration is whether you will live in your home long enough to offset the refinance closing costs Your current mortgage payment is $1,483,5 per month, with a balance of $214,400. You have a chance to refinance at the Bitmore Bank with a 30-year, 5mortgage. The closing costs of the loan are application fee, 500; credit report, $175; title insurance, 4% of the amount financed: title search, 5360; and attorney's fees, 5590. You plan to live in your home for at least four more years. Use the Mortgage Refinancing Worksheet below to see if it makes sense to refinance your mortgage Enter the values for items (AI) through (LI) and then "yes" or "no to indicate whether refinancing makes sense. Round your answers to two decimal places. Do not round intermediate calculations. Click here for Table 14-1 MORTGAGE REFINANCING WORKSHEET STEP 1. Current monthly mortgage payment... (A:) STEP 2. New monthly mortgage payment if you refinance. (8) New rate (C:) Current mortgage balance 10:) Table 14-1 factor (E:) #of 1,000 to borrow (F:) 1G1 STEP 3. Monthly savings... Step I. (H) (1:) :) STEP 4. Total refinance closing costs (appraisal, title search, etc.). 7-2011 STEP 5. Total months needed to recounts 646/2000 BI 9 Type here to search Step 2 ING o intermediate calculations. Click here for Table 14-1 MORTGAGE REFINANCING WORKSHEET STEP 1. Current monthly mortgage payment... (A:) (B:) STEP 2. New monthly mortgage payment if you refinance........ New rate (C:) Current mortgage balance (D:) Table 14-1 factor (E:) # of 1,000s to borrow (F:) STEP 3. Monthly savings..... (G:) Step 1. (H:) Step 2. (1:) STEP 4. Total refinance closing costs (appraisal, title search, etc.).. STEP 5. Total months needed to recoup your costs.. (K:) Step 4 result Step 3 result (L:) STEP 6. Total months you plan to live in your home. The Bottom Line - If you plan to live in your home longer than the result in Step 5, it makes sense to refinance. (A:) $ 1483.5 (B:) $ Do not enter the percent symbol in your answer. mahce. (A:) $ 1483.5 (B:) $ Do not enter the percent symbol in your answer. (C:) 5 % (D:) $ (E:) (F:) (G:) $ 5 50 (H:) $ 52 (I:) $ (J:) $ (K:) (L: Should you refinance? Yes TABLE 14-1 Monthly Payments to Amortize Principal and Interest per $1,000 Financed 5 Years Interest Rate (%) 3.50 3.75 35 Years $4.13 40 Years $18.19 $3.87 18.30 4.28 4.03 4.00 18.42 4.43 4.18 4.25 4.34 4.58 18.53 18.64 4.73 4.50 4.50 4.89 4.66 4.75 18.76 5.05 5.00 18.88 4.83 4.99 5.21 5.25 Monthly Payments (Necessary to amortize a loan of $1,000) 10 15 20 25 30 Years Years Years Years Years $9.89 $7.15 $5.80 $5.01 $4,49 10.01 7.27 5.93 5.14 4.63 10.12 7.40 6.06 5.28 4.77 10.24 7.52 6.19 5.42 4.92 10.36 7.65 6.33 5.56 5.07 10.48 7.78 6.46 5.70 5.22 10.61 7.91 6.60 5.85 5.37 10.73 8.04 6.74 6.00 5.53 10.86 8.18 6.88 6.15 5.68 10.98 8.31 7.03 6.30 5.84 11.11 8.44 7.17 6.45 6.00 11.23 8.58 7.31 6.60 6.16 11.36 8.72 7.46 6.76 6.33 11.49 8.85 7.61 6.91 6.49 11.62 8.99 7.76 7.07 6.66 11.75 9.13 7.91 7.23 6.83 9.28 11.88 8.06 7.00 7.39 9.42 12.01 8.21 7.17 7.56 9.56 12.14 8.37 7.34 7.72 7.52 7.89 8.53 9.71 12.27 985 8.68 7.69 5.38 5.54 5.71 5.88 5.16 5.33 5.51 18.99 19.11 19.22 19.34 19.45 19.57 19.69 19.81 19.92 20.04 20.16 20.28 20.40 5.50 5.75 6.00 6.25 6.50 6.75 7.00 7.25 6.05 6.22 6.39 5.68 5.86 6.04 6.22 7.50 7.75 6.57 6.75 6.93 7.11 7.29 7.47 6.40 6.59 6.77 6.96 7.15 7.34 8.00 8.25 8.06 2.1 6.45 6.25 6.00 19.45 11.23 5.71 5.51 8.58 7.31 6.60 6.50 19.57 5.88 5.68 6.75 6.76 6.05 11.36 11.49 11.62 6.16 6.33 6.49 5.86 8.72 8.85 8.99 19,69 19.81 7.00 7.46 7.61 7.76 7.91 6.91 7,07 6.22 6.04 7.25 6,66 19.92 6.39 11.75 6.22 9.13 7.23 7.50 6.40 9.28 11.88 12.01 8.06 7.39 7.75 6.83 7.00 7.17 6.57 6.75 6.59 9.42 8.21 8.00 6.77 12.14 20.04 20.16 20.28 20.40 20.52 20.64 9.56 8.37 7,34 6.96 7.56 7.72 7.89 8.06 9.71 8.53 8.25 8.50 8.75 7.52 6.93 7.11 7.29 7.47 12.27 12.40 12.54 12.67 9.85 7.69 8.68 8.84 8.23 10.00 10.15 9.00 9.25 7.15 7.34 7.53 7.72 7,91 9.00 7.87 8.05 8.23 7.66 7.84 8.03 10.30 9.16 8.40 8.57 8.74 20.76 20.88 21.01 21.13 21.25 12.81 12.94 9.33 9.50 9.75 10.00 8.11 10.45 10.60 10.75 13.08 13.22 8.92 9.49 9.66 8.41 8.60 8.78 8.22 8.41 8.60 8.30 8.50 10.25 21.38 9.09 9.27 10.90 9.82 9.99 10.50 13.36 13.50 13.64 21.50 21.62 11.06 8.97 9.15 9.34 8.79 8.99 9.18 8.69 8.89 9.09 10.75 11.00 10.16 10.33 9.45 9.63 9.81 9.99 9.37 13.78 13.92 11.21 11.37 11.53 11.69 21.75 21.87 22.00 22.12 10.50 10.67 9.57 9.77 14.06 9.53 9.72 9.91 10.10 10.29 14.21 9.96 10.84 11.02 11.25 11.50 11.75 12.00 12.25 12.50 12.75 13.00 9.29 9.49 9.69 9.89 10.09 10.29 10.49 10.70 10.17 10.35 10.54 10.72 10,91 10.48 weight Cargage learning 22.25 22.38 22.50 22.63 22.76 11.85 12.01 12.17 12.33 12.49 12.66 14.35 14.50 14.64 14.79 14.94 11.19 11.37 11.54 11.72 10.16 10.36 10.56 10.76 10.96 10.68 10.87 11.07 11.10 11.28 10.90